May God bless our precious little children. Quick Glance at the Market Heat Map and Industries Notables: More than $200 off of your highs sees your presence in the tech sector shink quite a bit – $AAPL Banks held up surprisingly well among the bigger names. Steel was rock solid. Be sure to check

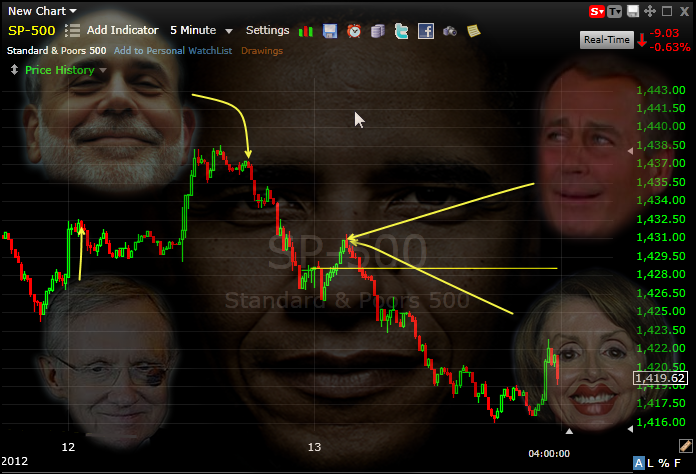

The faces of Wall Street: When they talk the market tanks Quick Glance at the Market Heat Map and Industries Notables: Every sector moved in concert lower today. Apple continues to show much greater weakness than the rest of the market. Be sure to check out my latest swing trades and overall past performance

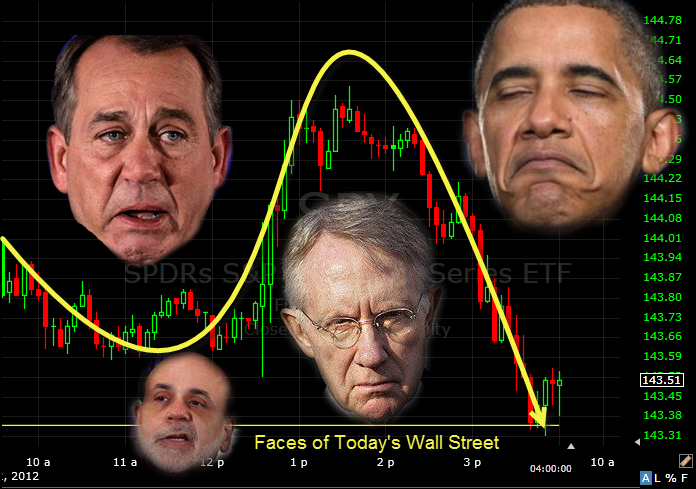

Today’s Wall Street is the represented by these fine men Quick Glance at the Market Heat Map and Industries Notables: Technology led the way lower. Oil and banks held up despite market pressure. Wal-Mart continues to weigh down Services. Be sure to check out my latest swing trades and overall past performance

Inverse head and shoulders pattern in Google (GOOG) might be Santa’s Christmas gift to us Quick Glance at the Market Heat Map and Industries Notables: Technology firing on all cylinders for the first time in a loooooong time. Healthcare took off today. Materials showed moderate strength, while Finance was mixed. Be sure to check

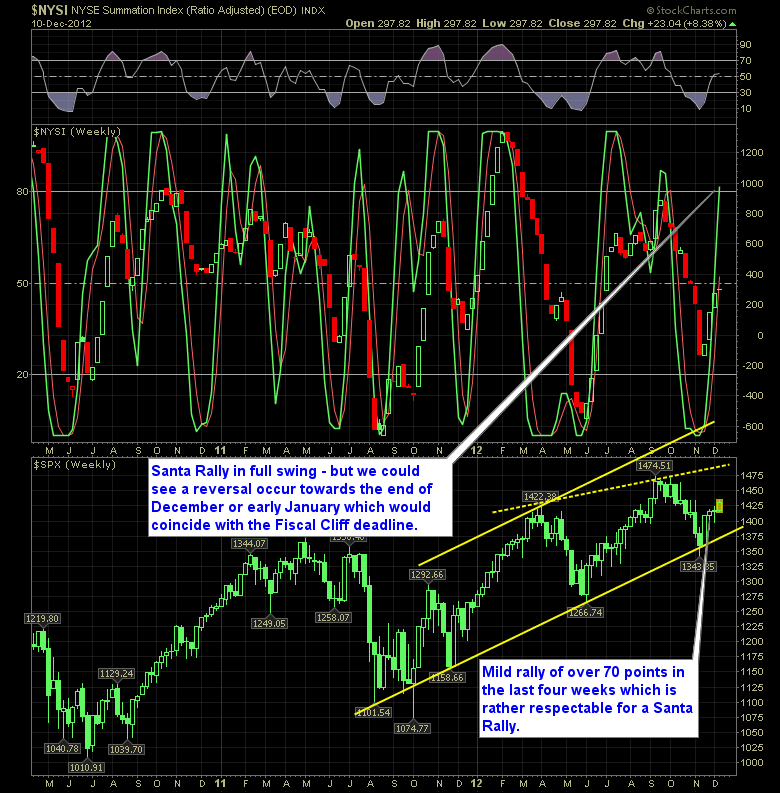

Stock Market Santa Rally In Full Swing for the Reversal Indicator This week's SharePlanner Reversal Indicator shows the Santa Rally in full swing and signs as well that it could be nearing completion in the coming weeks, probably around early January which would coincide nicely with the Fiscal Cliff negotiations deadline. Often times we see

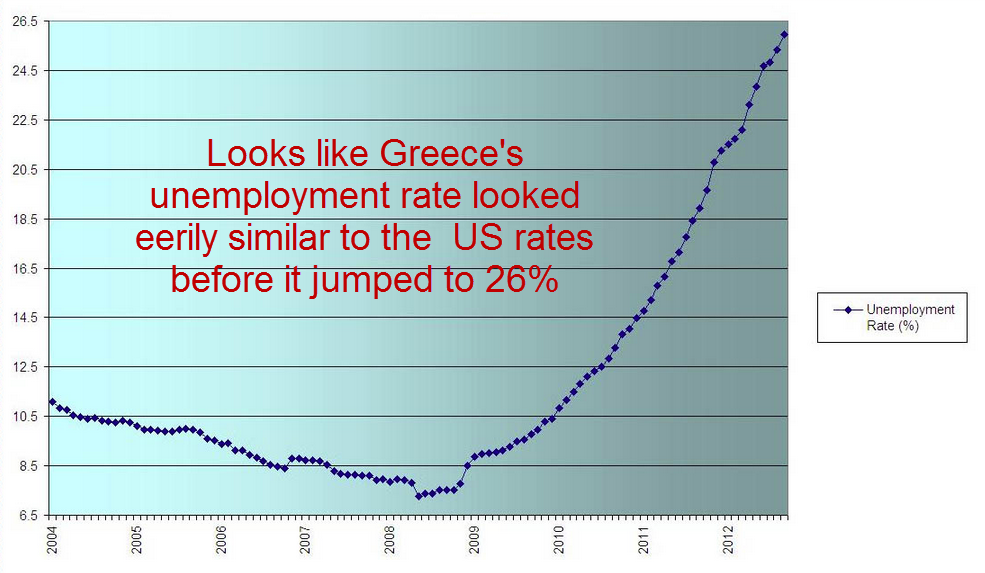

Looks like Greece’s unemployment rate went from 10% down to 7.7%(?) prior to sky rocketing to 26%. Kind of like what we are doing right now. Quick Glance at the Market Heat Map and Industries Notables: Financials and Oil weighted down the market today. If you take Apple out of the picture, Tech had

The Market’s Santa Rally came early for some. If you were in this, just quit trading for the year. You earned it. Quick Glance at the Market Heat Map and Industries Notables: Banks and Materials provided the market support. Apple, GOOG, CSCO weighed down the tech sector. Utilities are back to their old boring

Forget a long thesis explaining the Federal Government – here’s how Uncle Sam really spends your money From SocialTrade.com Quick Glance at the Market Heat Map and Industries Notables: Technology looking better, Apple stopped the bleeding for today. Utilities are looking weak. Materials stabilized Be sure to check out my latest swing trades and

Let’s take a look at the similar charts between the Real Estate Market and Apple (AAPL) during their respective “Bubble Rally” The Real Estate Market before the crash And here you have Apple… eerily similar I should say? If you are a long-term investor in Apple – be afraid…. be very afraid. Quick Glance at

SPX shows the potential for a long-term channel pattern that we are trading inside of. The SharePlanner Investment System did quite well today. Quick Glance at the Market Heat Map and Industries Notables: Blotches of hope in Technology. Signs of a possible bounce for a bottom in this two day pullback Oil getting hammered again