I posted the chart earlier in our chat-room real-time as I took the trade, and mentioned it in the 7 Stocks Flying Under The Radar post from this morning as well before taking this trade, but I have to say, that Tutor Perini (TPC) is looking like a stud so far. I have no clue as

I don’t know what it is with me and my love/hate relationship I have with Netflix (NFLX). I’ve had some of my best trades come from it, but then there was the chance that I had to add it to my long-term account 5 or 6 years ago when it was in its $20’s

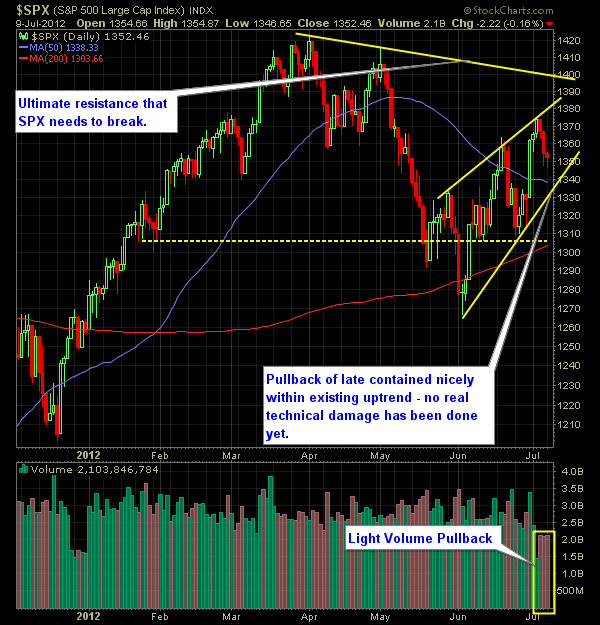

Pre-market update (updated 9:00am eastern): European markets are 0.7% higher. Asian markets sold off an additional -0.4% today. US Markets are slightly higher heading into the open. Economic reports due out (all times are eastern): Consumer Credit (3pm) Technical Outlook (SPX): SPX attempted to sell-off yet again yesterday, but recovered most of its losses before

I’ve actually, while typing out this post, added one of the names on the list (yes these are legitimate setups unlike a lot of websites out there) as the setup looks solid and the market seemed interested in putting in a bottom to today’s action. Nexen (NXY) was added at $16.46 (see chart below) and

I took the trade in Pharmaclyclics (PCYC) this morning – as it appeared in my scan as having higher than normal volume in the AM. Having traded and watched it quite a bit of late, this is one of those trades, where I saw it teste the 10-day moving average like it did previously and

Below are five stocks that I’ve identified as providing excellent risk/reward setups. I’ve already gone long in one of them – Wabco Holdings (WBC) at $53.98. On another front – I got stopped out of WLT this morning, which was a short position that I was using to hedge against this market, and the early

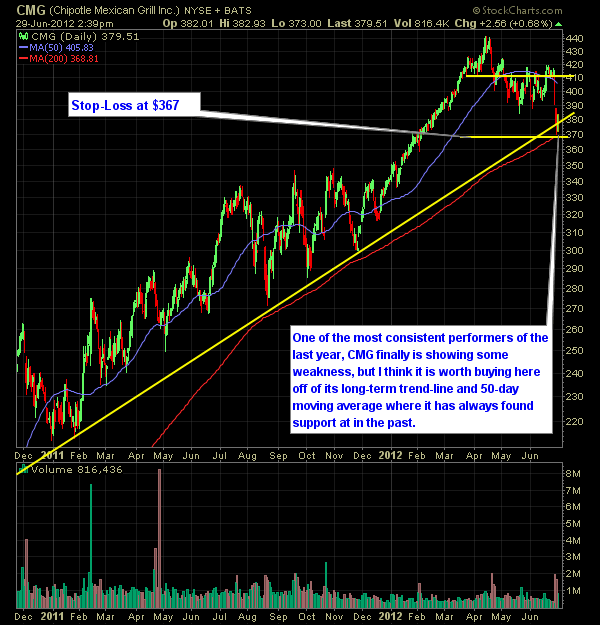

Since the market opened this morning, I’ve been able to post some incredible gains in my long positions in CMG, NFLX, UA and HD. I actually sold a bit early in Netflix (NFLX) at $77.68 from $70 due partly to my incredible distrust of the stock – only to see it march

I've gotta say, that I am somewhat surprised by the fact the market is moving this morning - albeit a little over 5 points, but honestly I thought it would be a total snoozer today. I've taken the opportunity to add Home Depot (HD) at $51.50 and Netflix (NFLX) at $70 flat. What's funny is that

I can’t remember or not if I’ve ever bought Chipotle Mexican Grill (CMG) before (as a stock), but considering my incredible passion for all things burritos, this particular long position that I just got in on is particularly exciting for me. In fact, if the stock can rebound and move higher, I’d rather

Just one new trade for me this morning. I came into the day with WNR and I’m still holding it (though wish I wasn’t stopped out of two longs yesterday). Under Armour has a great looking chart, and one that I think coudl continue to push higher in the days ahead off of the triple