I took on four new trades today – two longs and two shorts. This brings me to a total of four longs and two shorts. I want to hedge myself a little still, because we haven’t broken out and above 1422 yet. I also closed out my trade in CLX for a 0.24% gain. Not

I’ve made four new trades today – two longs and two shorts. Only one of the long positions will I try to hold over the weekend. I’m pleased with the market action so far today – the bounce from the past two days went right into resistance and it seems like…at least for now…the bulls

I’m expecting that we’ll see a bounce in the market tomorrow. We’ve been down four straight days, and if recent history says anything, it says it has a very hard time going down a fifth straight day. I think the bulls will look to try and game this sell-off and see how much damage a

SHORT: Omnicom Group (OMC) – Rising bearish wedge. Provides a great short opportunity once it breaks below support noted below.

When we got the downside reversal signal in the SPRI a month ago, it turned out to be one of the few times since this indicator has been published where the market definantly continued to march higher. Now we are on the verge of another signal to the upside. What I am most curious about

LONG: Rare Element Resources (REE) – Nice ascending triangle ready to breakout at around $6.63. Careful with the declining 200-day moving average, and look to take profits before then.

The biggest thing I’ve seen this morning is that despite a strong ISM Non-Manufacturing reading the market has essentially shrugged off the positive news. At this point, the market is beginning to remind me of that tired, cranky child, who, at the very least, needs a nap, but fights with everything it has to keep

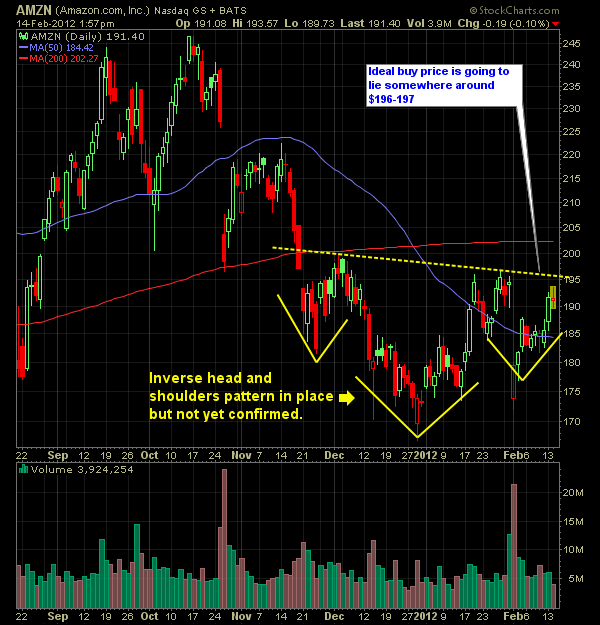

Here’s the nitty-gritty on the stock: Textbook inverse head and shoulders pattern in place but not yet confirmed (Pending Bullish) Consolidation over the last month, that could accumulate enough buying power to push the IH&S pattern (Bullish) Nice support at the 10 & 20 day moving averages (Bullish) Trend-line support holding off of the January

If you’ve followed Amazon.com (AMZN) for any significant amount of time, you’ll know that over the past year or so it has seen some of the most dramatic ups and downs in the stock’s history. Here’s the nitty-gritty on the stock: Text book inverse head and shoulders pattern in place but not yet confirmed

I came across the chart on Wynn Resorts Ltd. (WYNN) and the stock offers a very nice risk/reward setup to take advantage of. Here’s the breakdown on the stock…. Confirmed inverse head and shoulders pattern at $115.81 (Bullish) Well oversold at the moment and coming off of earnings (Bullish) On 1/24/12, broke through the