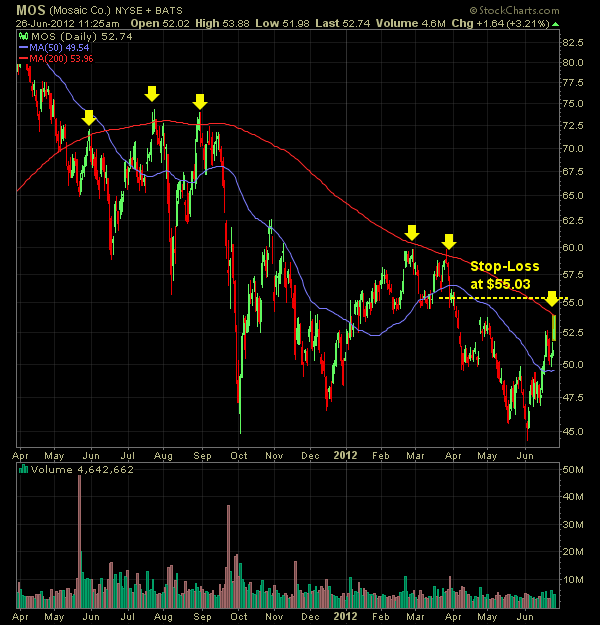

Once the SPX made session lows, bounced, and then sold off again to make fresh session lows, I decided to short Mosaic (MOS) which I had been eye-ballin’ early on. What appeals to me the most here is the inability to break through the 200-day moving average on five separate occasions over the

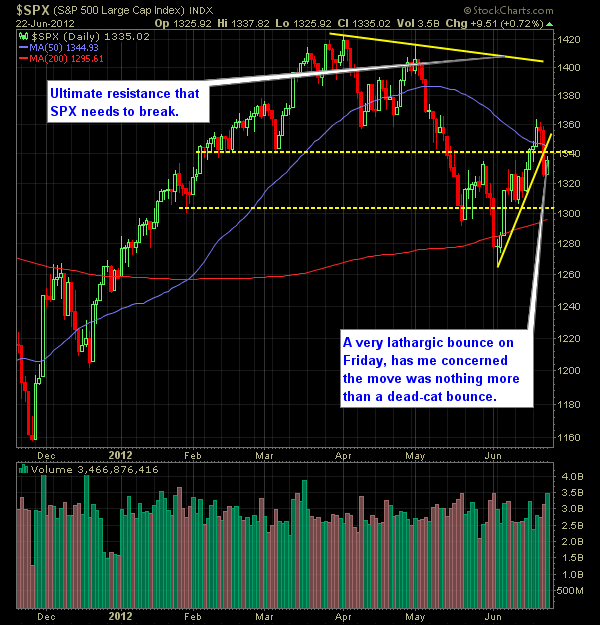

. I’m now up to three long positions and just two short positions, though, even as soon as tomorrow, I could see me flipping to the short side more aggressively. I’m essentially watching the daily chart, and looking for a true breakdown below 1306. We get that, and I think this market will indeed see

I know it might seem crazy on the surface to jump in a long position early on, but typically those significant gap downs can be awfully difficult for the markets to hold on to. I’ve been eye-balling Authentec (AUTH) for a while now, and I love the chart setup and the risk/reward. Assuming that the

Pre-market Update (Updated 9:00am eastern): US futures are down almost -1% ahead of the open. European markets are trading -1.1% lower. Asian markets are traded -0.6% lower. Economic Reports Due out (Times are EST): Chicago Fed national Activity Index (8:30am), New Home Sales (10am), Dallas Fed Manufacturing Survey (10:30am) Technical Outlook (SPX): SPX manage

I haven’t been actively trading in the market today, mainly because the market is really hard to predict with the massive sell-off yesterday whether we just bounce right back up, or we go further south from here. In particular, today just felt like a massive short covering, so there’s not much to lead me to

I jumped in Accretive Health (AH). Had the stock symbol been “AHHH” I would have been much more suspicious of it. Nonetheless, I got in at $12.50 with stop loss at $11.94 and a target which is really as high as it will take me. Because there is a huge air pocket at 12.50

I’m probably more excited about my pick up in Church & Dwight this morning than any other stock I’ve bought in quite some time. In fact if it goes well… and that’s a big if in the market these days, I wouldn’t mind holding on to this stock for an extended period of time –

I doubt I’ll add any additional long positions (at this point I have 6 swing-trades) but thanks to @TheTradingWife in our chat-room, she spotted Amazon.com (AMZN) and I couldn’t help but take a stab at it myself. That is the benefit of trading with fellow traders because you able to feed off of each