. I’m now up to three long positions and just two short positions, though, even as soon as tomorrow, I could see me flipping to the short side more aggressively. I’m essentially watching the daily chart, and looking for a true breakdown below 1306. We get that, and I think this market will indeed see

I know it might seem crazy on the surface to jump in a long position early on, but typically those significant gap downs can be awfully difficult for the markets to hold on to. I’ve been eye-balling Authentec (AUTH) for a while now, and I love the chart setup and the risk/reward. Assuming that the

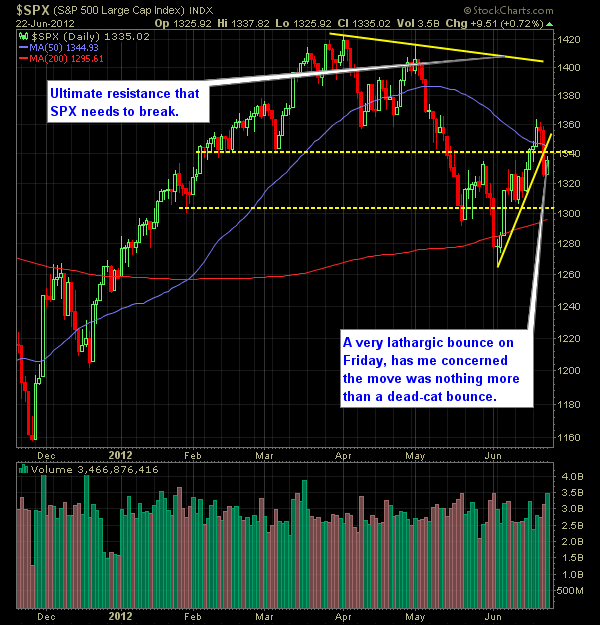

Pre-market Update (Updated 9:00am eastern): US futures are down almost -1% ahead of the open. European markets are trading -1.1% lower. Asian markets are traded -0.6% lower. Economic Reports Due out (Times are EST): Chicago Fed national Activity Index (8:30am), New Home Sales (10am), Dallas Fed Manufacturing Survey (10:30am) Technical Outlook (SPX): SPX manage

I haven’t been actively trading in the market today, mainly because the market is really hard to predict with the massive sell-off yesterday whether we just bounce right back up, or we go further south from here. In particular, today just felt like a massive short covering, so there’s not much to lead me to

I jumped in Accretive Health (AH). Had the stock symbol been “AHHH” I would have been much more suspicious of it. Nonetheless, I got in at $12.50 with stop loss at $11.94 and a target which is really as high as it will take me. Because there is a huge air pocket at 12.50

I’m probably more excited about my pick up in Church & Dwight this morning than any other stock I’ve bought in quite some time. In fact if it goes well… and that’s a big if in the market these days, I wouldn’t mind holding on to this stock for an extended period of time –

I doubt I’ll add any additional long positions (at this point I have 6 swing-trades) but thanks to @TheTradingWife in our chat-room, she spotted Amazon.com (AMZN) and I couldn’t help but take a stab at it myself. That is the benefit of trading with fellow traders because you able to feed off of each

Two Trades I went long in today: LONG: Western Refining (WNR) – Notice the inverse head and shoulders that has formed over a period of months, as well as the range bound ceiling it has been impacted by over the same time period as well. Now we are finally getting a “breakout” to it. Stops

Here’s my latest trade: Pharmacyclics Inc (PCYC) which is breaking out nicely after a short-term bull flag. I’m looking for continuation on this incredible run the stock has been on. It’s imprtant to give stocks like this plenty of room to roam, because often times there is a lot of emotions driving the stock, so