The bears are showing some serious 'game' today as they have the S&P 500 down double digits – a rarity these days to say the least. The problem for them though, is that they have become so 'gun-shy' that any kind of weakness they will cover their positions, especially if there isn't a huge catalyst

This never die market keeps pushing…well… higher. Dip buyers are showing themselves strong at the highs for the past three days. With that said, lets look at three swing trade opportunties that you can get long on: Long:Cummins (CMI) Long:Cabela's (CAB) Long:Boeing (BA)

Here's two "lazy trade" setups that I've put together. All mapped out and ready to run with. Remember as it is with all trades - put those stops in (especially you shorts out there). Long: Acadia Pharceuticals (ACAD) Short: Sandisk (SNDK)

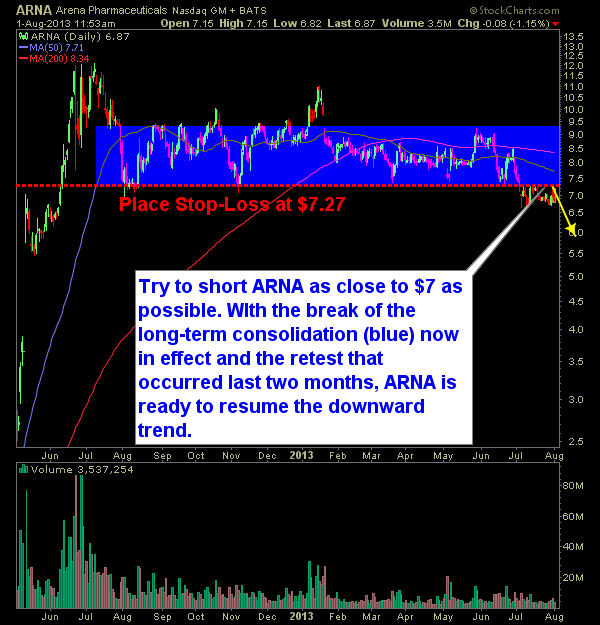

Arena Pharmaceuticals (ARNA) pop this morning provided a great opportunity to get short with minimum risk this morning. I'd say if you can get in close to $6 on this stock, the better off you'll be. But notice how this stock is trading just below the year-long previous consolidation pattern that it had been in.

It appears that the market is just fine with remaining in a holding pattern until Uncle Benny decides what his centralized planning for the economy will be going forward. Until then I wouldn't expect much out of these markets. Considering back in June he really created a mess of everything during his press conference, it

When running my scans this morning I saw that the likes of Intel (INTC), Advanced Micro Devices (AMD) and Sandisk (SNDK) were all looking rather bearish. On all three of these stocks, I would wait for these stocks to bounce. In the charts below I provide that ideal short level, but more importantly is

Sohu.(SOHU) has emerged as one of the best breakout candidates for swing-trading right now. I took a long position a few days ago in the stock, and today we are finally seeing some 'pop' out of the stock itself. As I say all the time that ascending triangle breakouts that consolidates right into the rising trend-line

I’ve had a long history of Mentor Graphics (MENT) as a trader – both on the long and short side fo the trade. Overall it has done me pretty well, which is why I’m happy to be re-uniting myself with this often peculiar stock. There has been a huge rise of late and over the

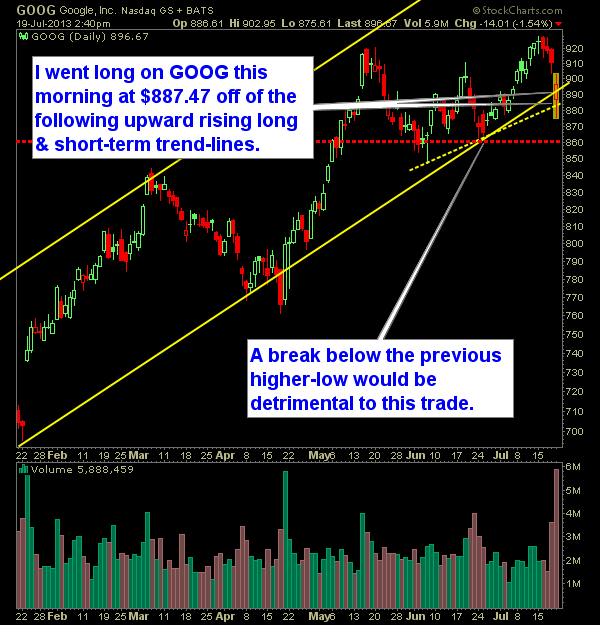

I have to follow up on my Google (GOOG) post from July 12th, when I warned traders to get out of GOOG when it was well over $920. The stock has a history of not performing well in consideration of the price pattern that had matured, the over extension outside of the upper Bollinger

Four swing trades that you should consider getting long on today: Long: Stage Stores (SSI) Long: VimpelCom (VIP)