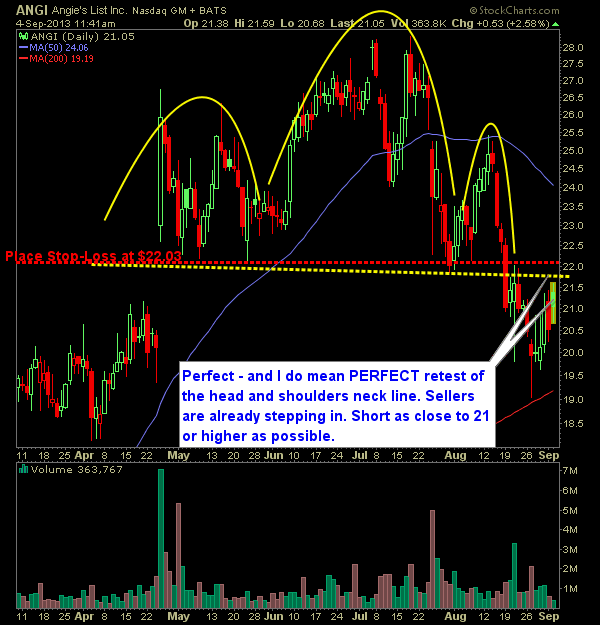

Head and Shoulders…A Retest… A Perfect Short Setup. Need I say more? Here’s the Angie’s List (ANGI) Short Setup:

Schlumbueger (SLB) is the best trade to the long side that I can find out there right now. Starbucks (SBUX) doesn’t look to shabby either. However, the oil plays are the ones that are setting up with the best setups at the moment. SLB is a real possibility for me today. I may

Pre-market update: Asian markets traded 1.4% higher. European markets are trading 0.1% lower. US futures are trading 0.1% higher ahead of the opening bell. Economic reports due out (all times are eastern): PMI Manufacturing Index (8:58), ISM Manufacturing Index (10), Construction Spending (10) Technical Outlook (SPX): Huge gap higher to start the

Perhaps I should pay closer attention to the Russell…perfect sell-off. Quick Glance at the Market Heat Map and Industries Notables: OIl continues to rally in a big way. Financials finally stabilized. Consumer Goods and some of tech weighed down the market. Be sure to check out my latest swing trades and overall past performance

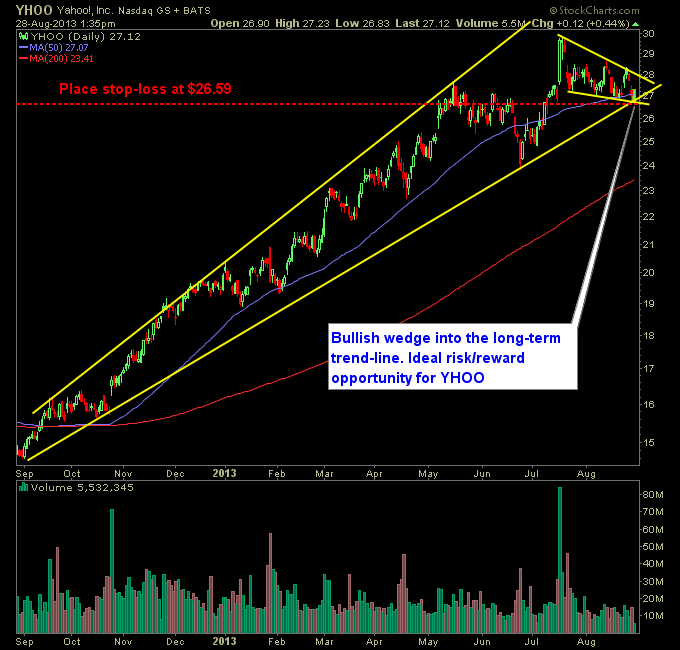

Yahoo (YHOO) tends to be a stock that I avoid at much as possible, so when an unmistakeable trade setup come along that I like, and despite my very best efforts not to like the stock, I still like what I see, well, then I know I am on to something. And that… my friends,

You’re going to be hard-pressed to find a better trade setup than this one out there right now than the one here in Boeing (BA). Here’s the trade setup:

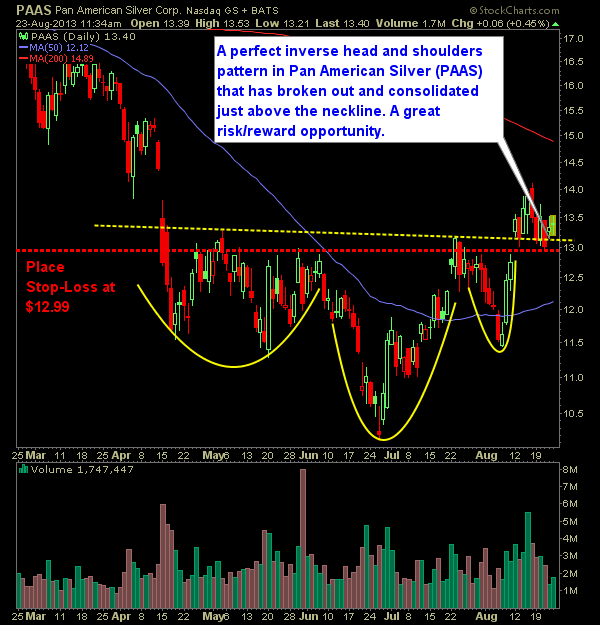

I’ve been bullish on silver for a few weeks now, but haven’t quite found the right silver miner to get long on during that time period. But now I have and its name is Pan American Silver (PAAS). Literally, there’s nothing that’s not to like about this stock. Beautiful inverse head and shoulders pattern, that

Market finally got its bounce today, but it really isn’t that much to get excited about. Getting above the 50-day moving average is critical for this market as it has struggled to do so for the past three trading sessions prior to today. While today might finish in positive territory – what it does from

After the FOMC Minutes came out, and it became evident that the bulls were going to run with the afternoon’s price action I added one additional position to the portfolio in the SharePlanner Splash Zone in the way of URS Corp (URS). My stop-loss is tight so there isn’t too much to worry about

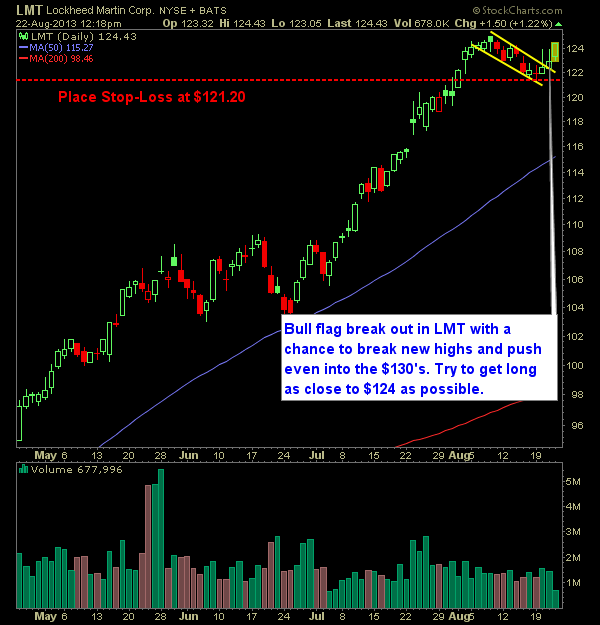

One sluggish maret we have today. Nonetheless, its the cards that we are dealt at the moment. Depending on what direction you lean, consider the two setups below and see if either one works for you and your strategy. Here are today’s lazy swing trades: