You’re going to be hard-pressed to find a better trade setup than this one out there right now than the one here in Boeing (BA). Here’s the trade setup:

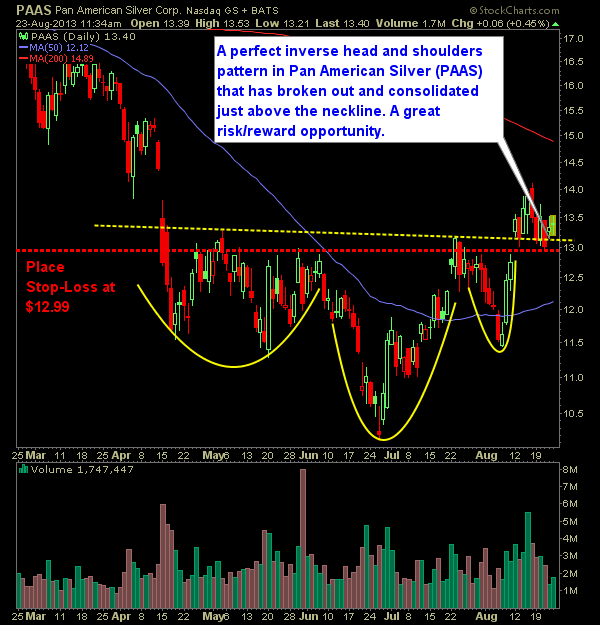

I’ve been bullish on silver for a few weeks now, but haven’t quite found the right silver miner to get long on during that time period. But now I have and its name is Pan American Silver (PAAS). Literally, there’s nothing that’s not to like about this stock. Beautiful inverse head and shoulders pattern, that

Market finally got its bounce today, but it really isn’t that much to get excited about. Getting above the 50-day moving average is critical for this market as it has struggled to do so for the past three trading sessions prior to today. While today might finish in positive territory – what it does from

After the FOMC Minutes came out, and it became evident that the bulls were going to run with the afternoon’s price action I added one additional position to the portfolio in the SharePlanner Splash Zone in the way of URS Corp (URS). My stop-loss is tight so there isn’t too much to worry about

One sluggish maret we have today. Nonetheless, its the cards that we are dealt at the moment. Depending on what direction you lean, consider the two setups below and see if either one works for you and your strategy. Here are today’s lazy swing trades:

One sluggish maret we have today. Nonetheless, its the cards that we are dealt at the moment. Depending on what direction you lean, consider the two setups below and see if either one works for you and your strategy. Here are today’s lazy swing trades:

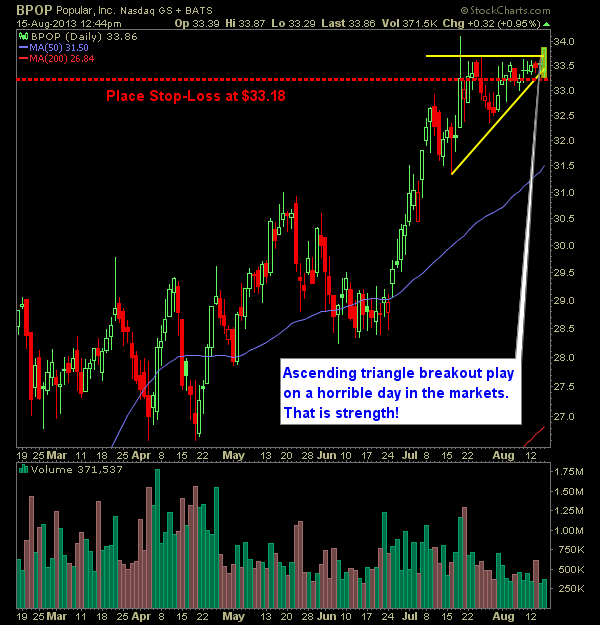

We’ve had a stock market blue moon today – yes, that is where the markets actually drop by more than 1% in a single day. It’s a rarity when you have a Fed Chairman that keeps his boot on the throat of the bears, only to allow them to take a breath of air once

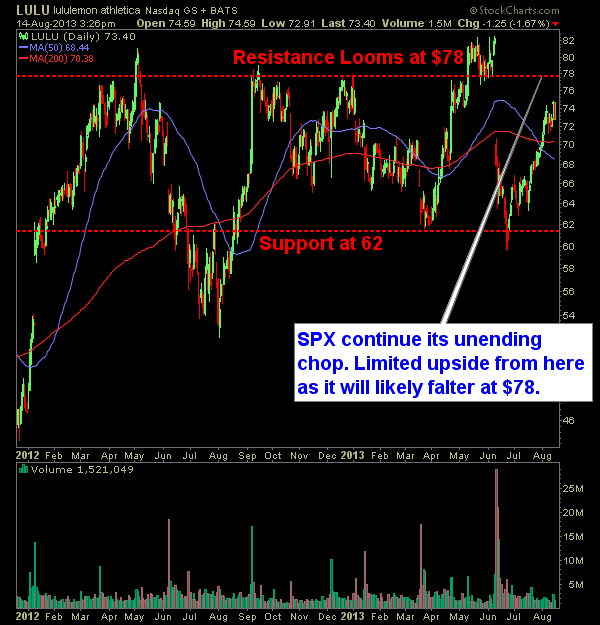

If someone made a bet with you, and you should to lose $12 at the chance to win $4 would you take it? That is the risk-to-reward scenario that Lululemon Athletica (LULU) is offering at this point. Or what I would call an unfavorable 3-to-1 Risk/Reward setup. So while it is in this large scale

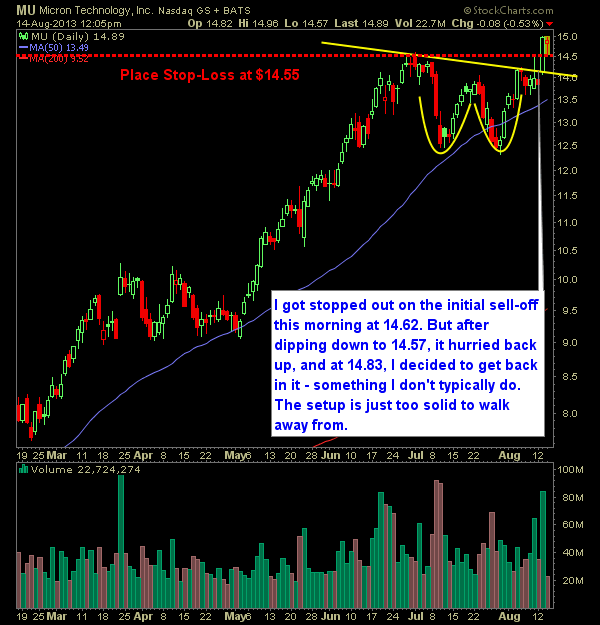

Huge pop in Micron Technology (MU) yesterday that exceeded that of 8%. Of course when that happens, you tighten the stop on that position enough to where you walk out with the majority of the gains. But…of course…there was some profit taking by the masses and I got stopped out at $14.62. That’s

Huge pop in Micron Technology (MU) yesterday that exceeded that of 8%. Of course when that happens, you tighten the stop on that position enough to where you walk out with the majority of the gains. But…of course…there was some profit taking by the masses and I got stopped out at $14.62. That’s