It's time for another SharePlanner Giveaway - This time around I am raffling off my SharePlanner DVD course on Swing Trading ($100 Value). To enter is easy and free. you simply LIKE the SharePlanner Page on Facebook, follow us on Twitter, or retweet the contest. Better yet you can do all three. So enter, and

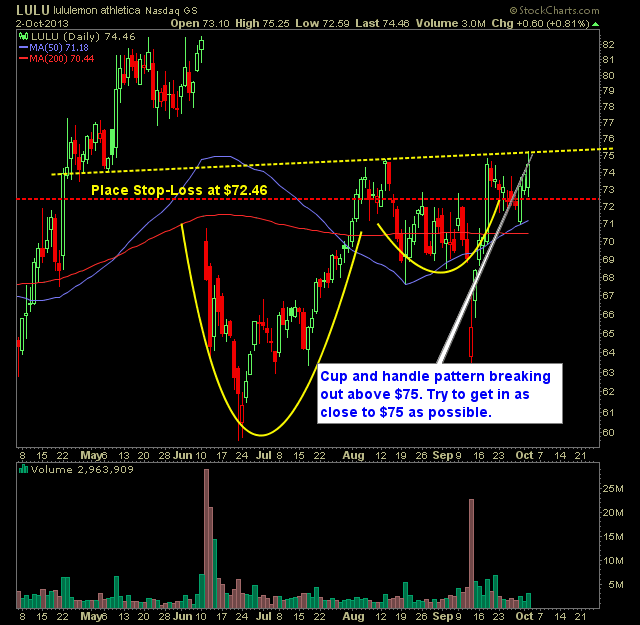

Cup and handle pattern breaking out above $75. Try to get in as close to $75 as possible. I’d place my stop-loss at $72.46. Here’s the trade setup:

Here’s today’s players: 3 long setups and 2 short setups Long Molycorp (MCP):

Here’s today’s plays: 3 longs and 2 short setups: Long Louisiana Pacific (LPX):

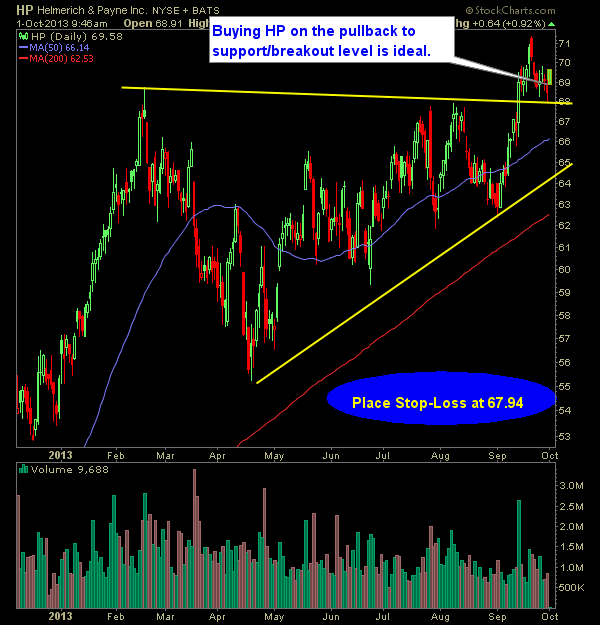

Finally a bounce in this market – lets see whether it can 1) be sustained and 2) can be significant enough to call it a “bounce” Here’s today’s swing-trade hit list, I’ll focus some more on short setups as well starting tomorrow. Long Helmerich and Payne (HP):

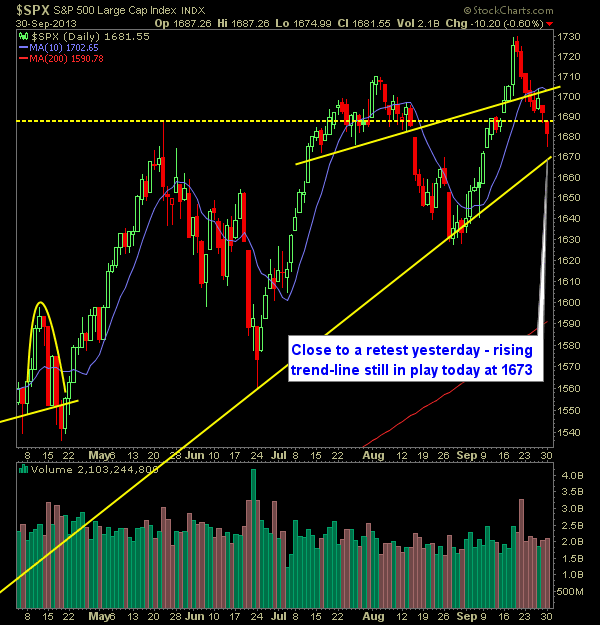

Pre-market update: Asian markets traded -0.5% lower. European markets are trading 0.2% higher. US futures are trading 0.3% higher ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), PMI Manufacturing Index (8:58), ISM Manufacturing Index (10), Construction spending (10) Technical Outlook (SPX): Yesterday’s sell-off

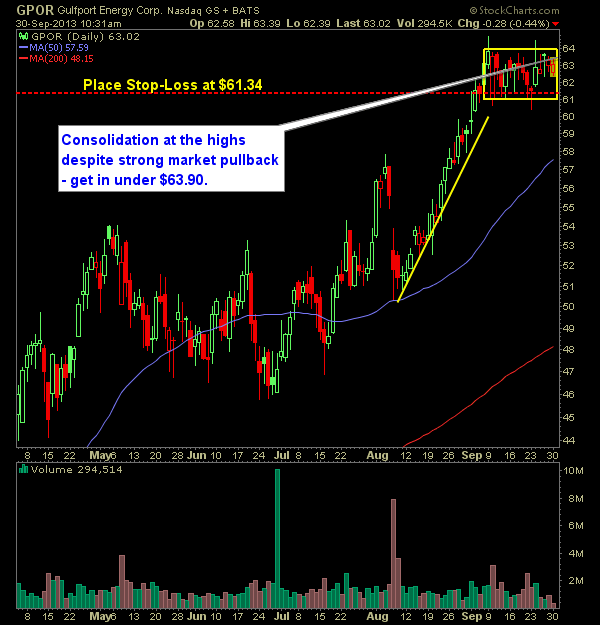

Let’s start this week – I’m expecting a bounce at some point here – might as well have some longs handy for when that time comes: Long Gulfport Energy (GPOP):

Its been a while since I have focused solely on the shorts for my daily setups. So here we go: Short Advanced Micro Devices (AMD):

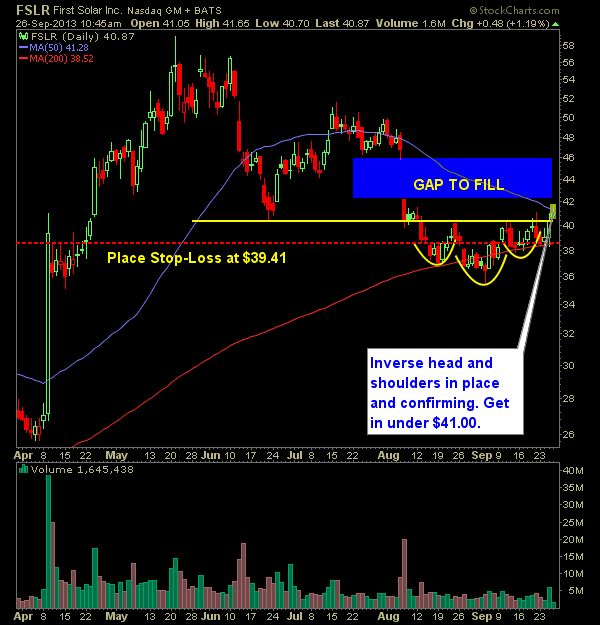

Here are my three long setup and two short setups that I am watching today. My aplogies for just now getting this posted. I had a detenist appointment in the pre-market that went slightly longer than expected. I guess there was more house cleaning than what was expected. Long First Solar (FSLR):

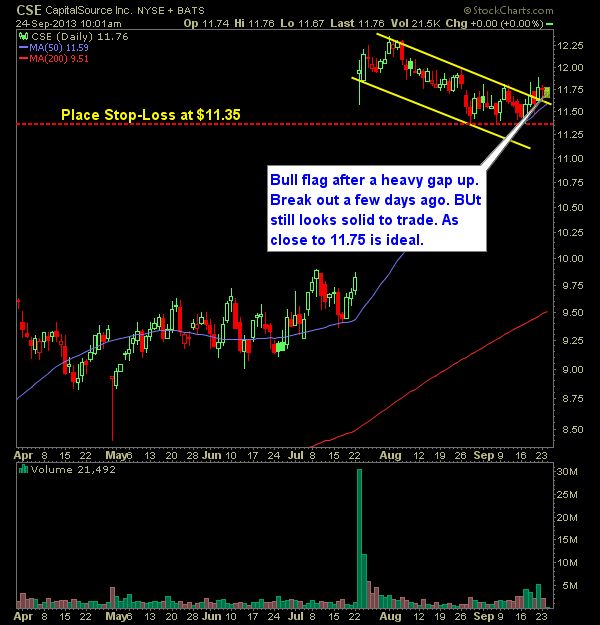

Here are five swing trades that I am watching today: Long: CapitalSource (CSE):