Lazy Trades Long & Short Trade Setups We are finally seeing some spunk out of this market that has lacked it for the better part of two-plus weeks. That’s saying something as we’ve bounced over 15 points off of the day’s lows this afternoon. Essentially we have seen the buyers finally show back up and

I’m’ not a big fan of these commodity miners – particularly when it comes to silver miners, because usually it is ultra difficult to find a the right setup that offers an ideal risk/reward opportunity. I might have to really rethink that one here though, because, we’ve got two mighty tempting setups here – the

Weirdly we are up on the day. It doesn’t feel like that, i think primariy to the churning we saw early on, and the constant reversals. I think the big picture states that the positive that can be taken from the day is that we managed to finish higher and stop the selling as well

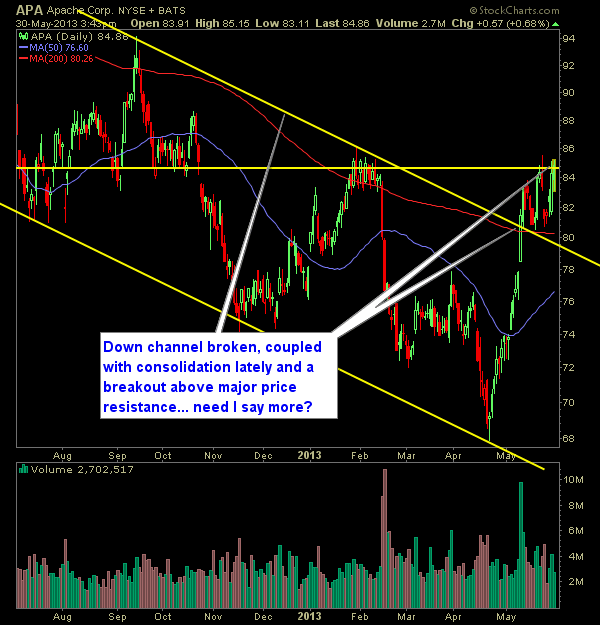

A lot of things going right in Apache (APA). Can’t help but really like what I am seeing in this stock here…. Here’s the chart and setup.

I’m really liking these swing trade setups. The problem is whether this market can bounce back and push higher, or whether we are in a longer-term distribution phase of this market that will ultimately send it lower. I’m not a big fan of making a wild guess, so for now, I’ll simply say that “I

I’ve added all three of these stocks to my watch-list today, as I found the price action very inviting. As with any small cap/low dollar stock there is a lot more risk that is involved in trading them, but with that comes the alluring possibility of out-sized gains that might not otherwise be realized

I like this trade setup quite a bit and has served me well so far with Hornbeck Offshore Services (HOS). I swapped Diamond Offshore Drillers (DO) for HOS and the net gain between the two has been much better had I just stayed in overextended DO. The ascending triangle breakout at the highs is often times

Here’s my only trade today, and it comes in Diamond Offshore Drillers (DO). I love the inverse head and shoulders pattern we are getting here, and I think that it should, at the very least make a push above $75. We have also seen some strength out of other offshore drillers recently, like Hornbeck Offshore

Pre-market update (updated 8am eastern): European markets are trading 0.1% higher. Asian markets traded trading 0.7% higher. US futures are slightly lower. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Producer Price Index (8:30am), Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Industrial Production (9:15am), Housing Market Index (10am), E-Commerce Retail