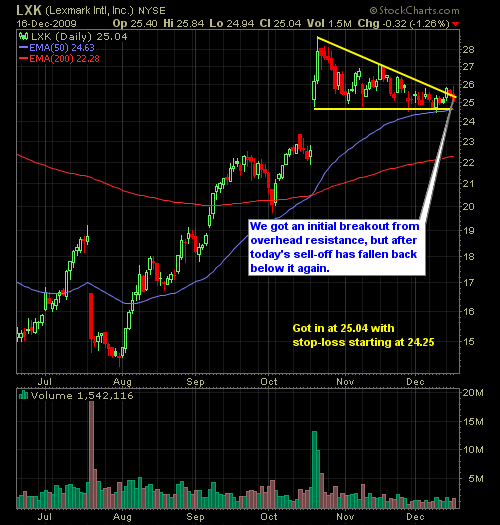

Here is an update and analysis on all five stocks in my portfolio right now. Today was no doubt a good day for the portfolio. I sold 1/2 my position in LXK at $26.68, which was my only trade. I am currently about 50% cash. Any weakness will be an opportunity to add new positions

Here's an update on my 4 of the 5 open positions that I currently have. I provided you last night with an analysis on DDM, the ETF I picked up on Friday so be sure to check out that write-up too. As it currently stands I am profitable in all five positions and three of

Another day where the markets are screwed around with by Uncle Sam! Seriously, why can't the Fed wait until 4:01pm to release their statement, everybody else that has important news does so before or after the bell, why can't the Fed, for pete's sake, do the same thing. In any case, I was seeing some

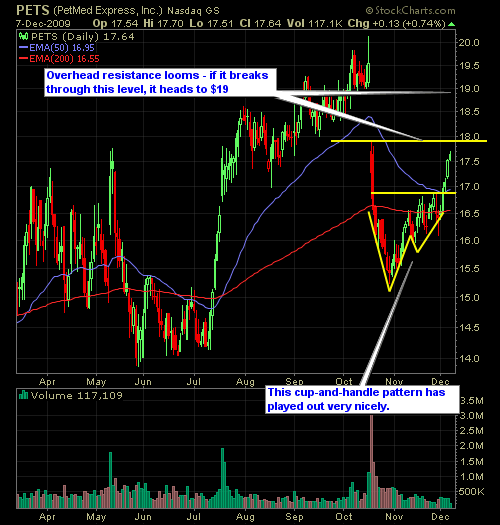

Currently I have four positions – Two of them are profitable, two of them are not. My two profitable positions are running pretty good at the moment – QLD and PETS while, AVP and OSG are languishing after today’s market action. Of the four, I feel like, technically, they are all still holding up strong

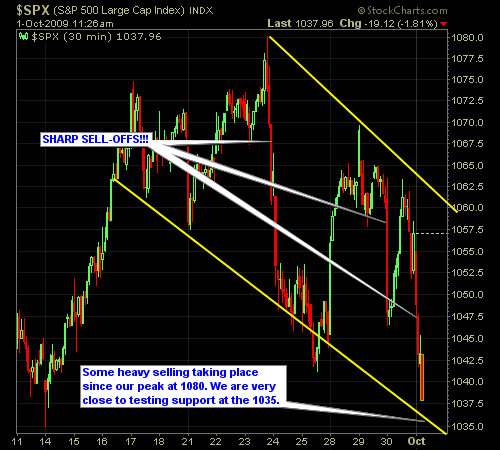

Busy day for me today as I greatly reduced my short positions in my portfolio. I have to say that the past two days have been somewhat disappointing for me that we haven’t got as much action out of the market to the downside as I had hoped for. And both days have had intraday

I was disappointed on two fronts today, the surprising run the bulls showed early on in the morning, and then the inability of the bears to hold the market at or near its lows of the day. So what do we get? A nice doji candle that represents indecision on the market’s behalf on where

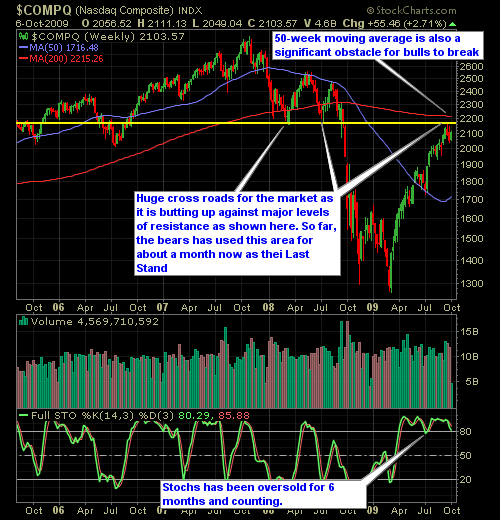

While the run that we have seen in the markets has been historically impressive, there is a major road-block that likes ahead for the NASDAQ simply by looking at the weekly chart. Using weekly charts is very important with technical analysis. It allows you to get a feel for the long term trends that are

Brutal day so far in the market today for the bulls. With all the reports that were released this morning, you could make the argument either way – jobless claims were up and the ISM Manufacturing Index report showed a decline, but home construction, personal spending and income were all up higher then expected. But

Picked up some shares of QLD at 49.75 and sold them at 12:30ish at 50.95 for a nice 2.5% gain. This trade was to take advantage of any type of reflex out of the markets after the mornings sudden and swift sell-off at the open. I got exactly that with the NASDAQ marching back into