Recently, I had the opportunity to sit down with Timothy Sykes, the founder of TimothySykes.com, Investimonials, and Profit.ly, among other things. He has perhaps one of the most unique trading strategies that I’ve seen, and has been able to teach his strategies to a myriad of others over the years. His passion for teaching traders

Apple (AAPL) has been the market darling for a long time now for investors, especially those who have managed to hold their shares through all the breakthrough innovations from the iPod to the iPhone and to the iPad. However, lately, it has been showing some weakness, beginning with what we saw with their earnings

shareplanner on livestream.com. Broadcast Live Free

Much has been made of the recent 50-day moving average that crossed below the 200-day moving average on the S&P. Among individual stocks, when the 50/200 cross occurs to the downside, many traders take it as a sign to get out of the stock immediately, or to start a new short position. With that being

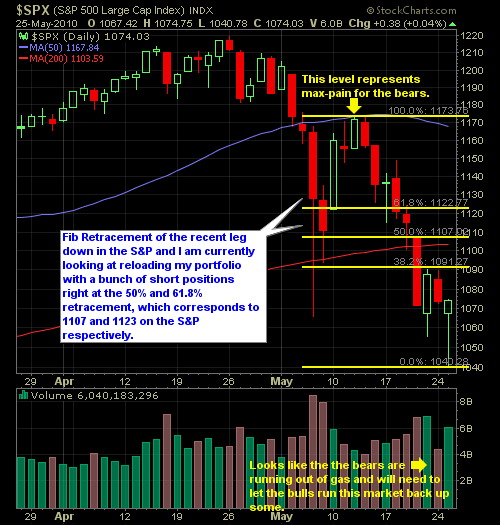

I don’t typically do videos during the middle of the day, but right now, my portfolio is in cruise-control, and can only let my stops and targets play themselves out. I also don’t think that we are going to be seeing a bounce on Monday either so I plan on holding these short positions (93%

Out of nowhere, at 1:20pm EST Live Nation Entertainment (LYV) took an unbelievable plunge. The only thing I can find that gives reason to this is that Michael Rapino, on a live interview on CNBC, said he was willing to take smaller margins on ticket sales in order to help us “little-people” out so that

The one position that has been in my portfolio for about a week now, is the one that I have been relatively quiet about of late. However, if you were near any financial news channel today, you probably heard about gold hitting record highs and when you consider the chart below of the SPDR

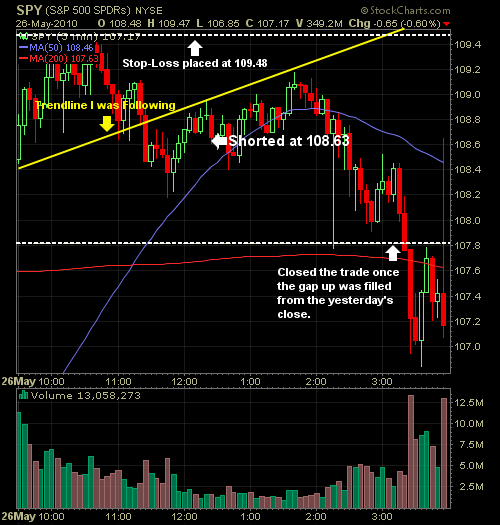

I haven’t dissected a trade of mine in quite some time for everyone. While I give out my trade setups in great detail, I could probably do a better job of giving a post game report on each of them. So, going forward, I’ll try my hardest to do exactly that because, for one, it

While nothing is impossible, if you would have asked me this morning if I thought the bulls would make a mega rally off its lows and rally about 35 points on the S&P to close barely in the green, I would have thought you were delusional. But that is what we got today, and honestly,