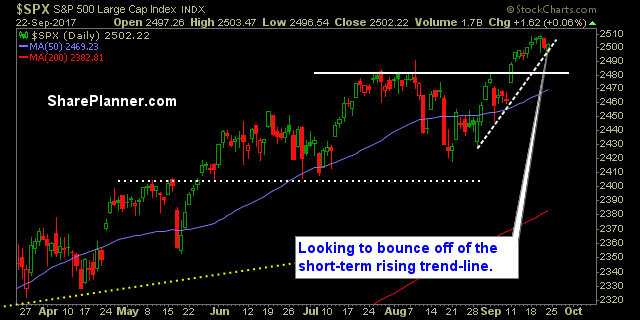

My Swing Trading Approach Yesterday’s intraday bounce off the lows could provide a good launching pad to add a couple of new long positions to the portfolio today – particularly with some of the oversold big-tech stocks. Indicators

My Swing Trading Approach I’m not looking to get 100% long here. While a lot of traders are very comfortable with this market,I realize the risk of a sell-off that takes price down 1-2%. As a result, I want to maintain the flexibility to get net short if need be. Indicators

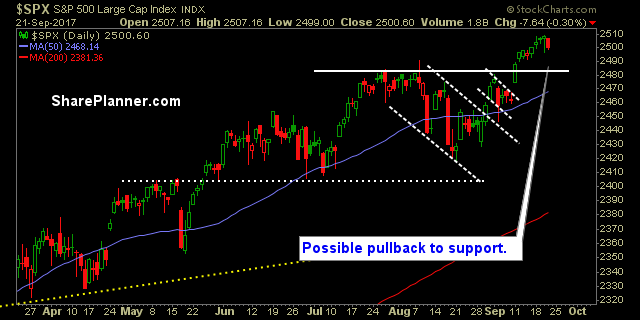

My Swing Trading Approach I’m concerned with the selling yesterday, and whether that could usher in more weakness today and the week ahead. I will be very careful about adding additional long exposure at this point, until I get some clarification from the market. Indicators

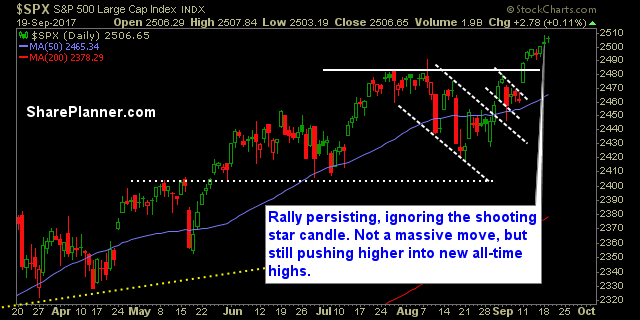

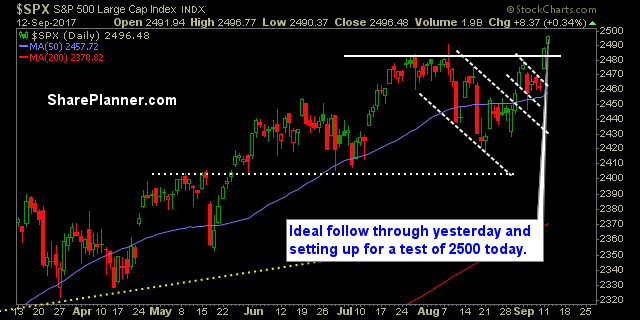

My Swing Trading Approach I’m not opposed to adding new long positions at this point in the rally, but I am cautious about overloading the portfolio with too many long positions at this point, as we are more likely than not to see a 1-2% pullback in the near term (in the coming weeks).

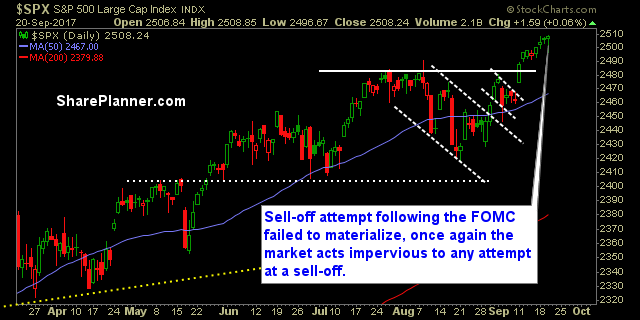

My Swing Trading Approach I don’t expect to make any trades during the morning. I will hold off until after the FOMC meeting to make any new trades to the portfolio. Continue to increase my stop-losses on existing positions. Indicators

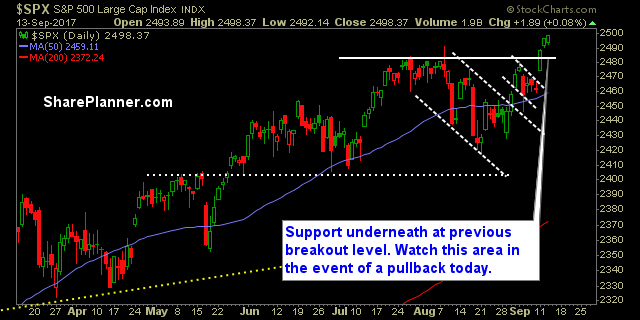

My Swing Trading Approach I want to see early on, whether this market wants to hold the gains from yesterday and the previous four trading sessions. If so, then I will add more long exposure. Otherwise, I will curb risk further. Indicators

My Swing Trading Approach I will continue tightening my stops on existing trades so that the majority of profits are locked in. Also, I want trades with tight risk parameters, so that any new long positions avoid major impacts to the portfolio if the overall market reverses. Indicators

My Swing Trading Approach Tighten the stop-loss on existing swing-trades, book gains on over-extended trades. Will limit how much additional long exposure I add to the portfolio today. Indicators

My Swing Trading Approach Looking to manage the current positions I have, raise the stop-losses, and curb some of my long exposure following the rally that we have seen this week. Indicators

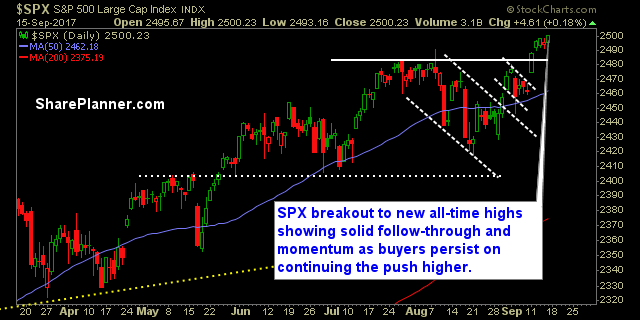

My Swing Trading Approach Looking to ride my current positions. Will look to add a few more positions while increasing my stop-loss along the way. Indicators