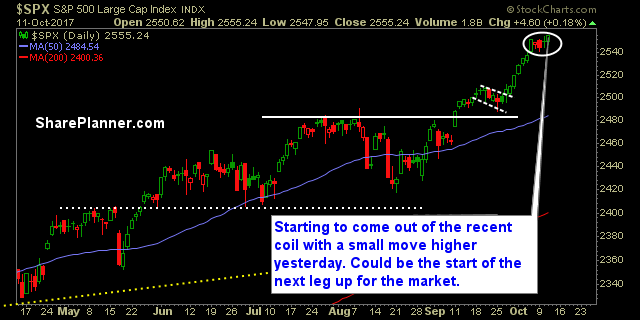

My Swing Trading Approach Again, one or two new swing trades could be added to the portfolio today, assuming a bounce can be sustained at the open. Raise the stop-loss on existing positions where it makes sense. Indicators

My Swing Trading Approach I’ll be looking to add 1-2 new positions today on market strength and ride my current crop of plays as high as they are willing to go, while moving up their stops along the way. Indicators

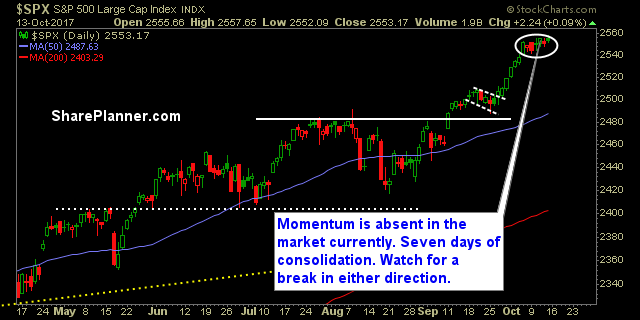

My Swing Trading Approach Still long on the market. I dabbled to the short side some yesterday, it didn’t work. Now that is out of my system, I remain long and will look to add 1-2 new positions today on market strength. Indicators

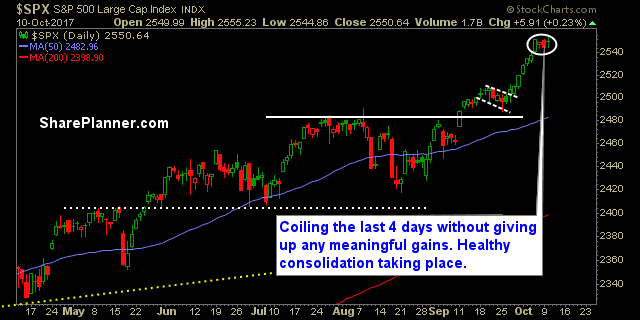

My Swing Trading Approach Raise the stops on existing long positions, and maintain the flexibility to get short as I have done over the past week of trading. Short setups are in play, if the weakness doesn’t immediately get bought up at the open. Indicators

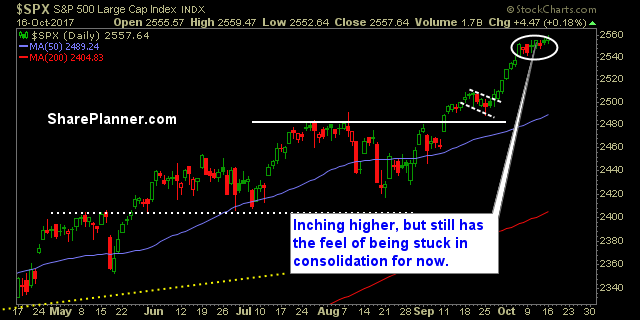

My Swing Trading Approach I have plenty of flexibility to play the market in either direction, depending on what the market ultimately wants to do. Only way I will get short is if the market shows signs of breaking down. Indicators

My Swing Trading Approach I’m looking to add some long exposure today, should the market show enough bullishness to support a move. Still maintaining the ability to get short quickly, should the opportunity arise. Indicators

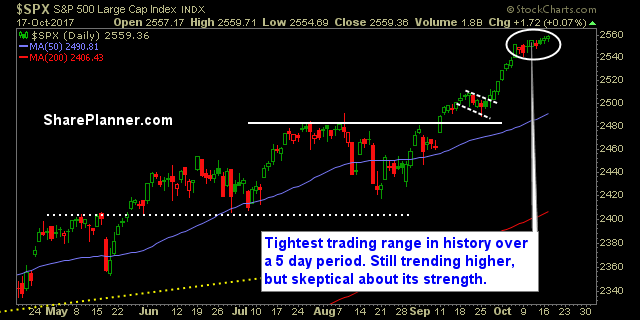

My Swing Trading Approach I would like more price action from this market, but I can’t force that. I have to wait for that to happen, and to place my trades accordingly. Right now, I don’t want to add additional long exposure, until this market can put together a decent breakout to the upside. Indicators

My Swing Trading Approach I’m nearing a point where I want to see price action move out of the recent price coil before getting any more aggressive on this market. As always, I’ll look for opportunities where appropriate, to book profits and move up stop-losses. Indicators

My Swing Trading Approach I won’t rule out adding additional position or two to the portfolio today, but I’m not looking to pile on in this market. Manage the trades that I have, trim the ones that don’t provide a solid reason to keep, and raise the stops on the rest. Indicators

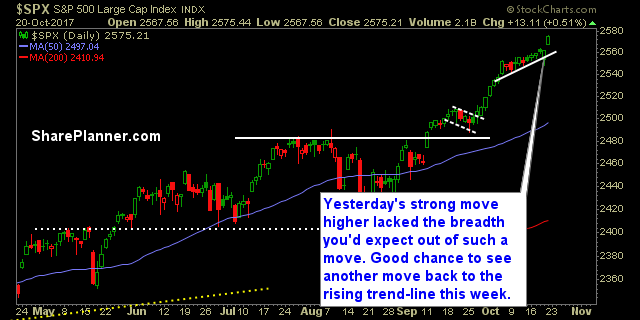

My Swing Trading Approach I trimmed my long exposure quite a bit yesterday. Booked a lot of profits. I added two new positions as well. If the market wants to break out of recent consolidation then I will likely add new positions again today. Indicators