Swing Trading Strategy: Tell me more about these ‘limit downs’? So President Trump has a press conference, says some good feeling things, the market rallies, now, what if, and bear with me a second, what if we limit up tomorrow? The market is 20% off of its all-time highs, and you’re telling me you’ll

Swing Trading Strategy: A scary market indeed! These are by far uncertain times for the stock market, bond market, currency markets, let me think, what else? Oh yes, commodities too. Have you seen oil prices crashing tonight? Down -32%! DOWN 32%, I say!!! While Coronavirus has had an impact on oil, this has more to

Swing Trading Strategy: Oh the places the stock market will take you. For those who are just starting out in the stock market for the first time, you are witnessing some of the most volatile trading days that you’ll ever experience. You certainly can learn a lot from market turbulence like this. I’ve done it

Swing Trading Strategy: What a roller coaster – This is what they call the chop. The 10 year treasury yield simply won’t rally and again this morning you are looking at another drop in the rate. That of course has the futures again in a tale-spin. Yesterday, the market, rallied in impressive fashion, taking out

Swing Trading Strategy: Down, Up, Down. Up? Bernie Sanders is faltering big-time tonight, and to be honest, I thought Klobochar and Butt-Edge-Edge dropping out was too little too late, but apparently it was enough to give a boost to Biden and what looked just a couple of weeks ago to be a campaign on the

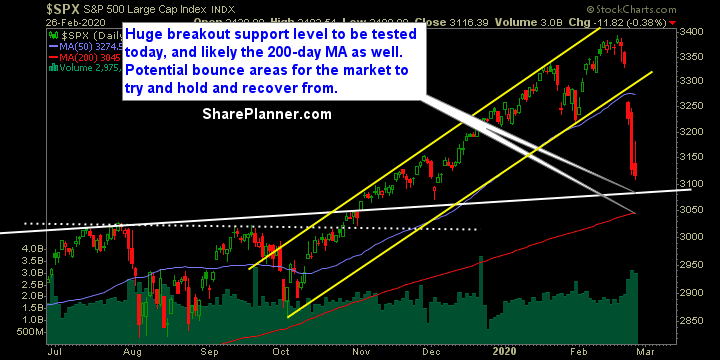

Swing Trading Strategy: Dead cat bounce or Buy the dip? You’re asking that question to yourself right now aren’t you? The price action today embodied that of a possible bottom in the market. I’m not overly confident that the bears are going to kill this market rally right away, but tomorrow will be a key

Swing Trading Strategy: One of the most helpful things that anybody can learn is to give up trying to catch the last eighth or the first. These are the most expensive eighths in the world. ~Jesse Livermore Perfectly timing bottoms or tops is insanely risky business and they usually come with a cost. I’m 100%

Swing Trading Strategy: Are you living to trade another day? I’ve shorted plenty, and I mean plenty of bear markets. Most of the time successfully. Look at my track record for Q4 in 2018 and I did quite well with that, and so far I’m doing pretty well with this one too. I’m profitable so

Swing Trading Strategy: I want to share with you, my notes that I shared with members of the Trading Block this morning, hoping it can be of some use for you as well… Another day where I am not putting any trade setups out there ahead of the market open. In a perfect world, I

Swing Trading Strategy: How am I now 100% cash!?! My two remaining long positions were stopped out – that stunk. Both were contained with AbbieVie (ABBV) being the worst at -6% and the other, Northrop Grumman losing -3%. But Short positions were straight fire – I covered United Parcel Service (UPS) for +10%, Caterpillar