My Trading Plan for each day

Swing-Trading Recap #567

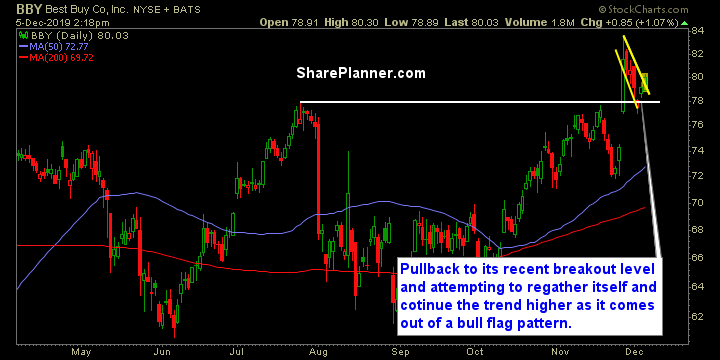

Swing Trade Approach: Nearly three days of extremely dull price action. I don’t have high hopes for that changing tomorrow. Essentially what you have is a market that only pushes higher on the Fed’s “Not QE4”. China trade news, for now is out of the way, and the market is [...]