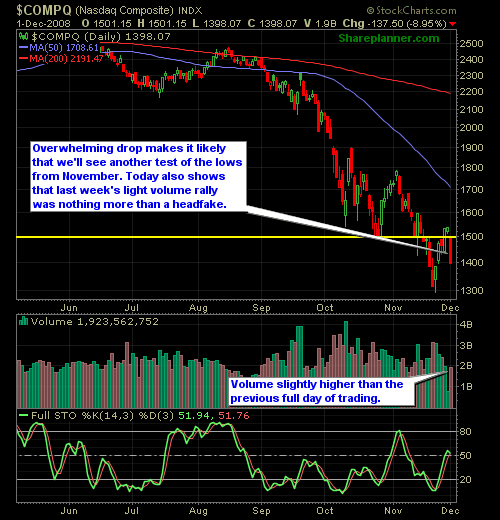

Brutal market today for the longs. It took off early in the morning with a significant gap down and never looked back, closing down over 8% on the day. This is going to send jitters throughout the world markets, and the question becomes, not so much if it goes down from here, but where does it put the breaks on at.

Honestly, one of the biggest discouraging factors for a bottom being put in this market, is that too many people are calling one at the current price levels, believing that the November’s lows were the end to all the pain and suffering. Thus the reason that on a traditionally, low-volume, holiday week, we got such a huge rally.

But what I believe we will see is a the November lows taken out, and the chorus of CNBC yuppies that insistently call these bottoms will be shut up, and never again call a bottom; all the retail investors, and bloggers will finally give in and say, “I give up on finding the bottom” and then at that point, the bottom likely will be formed.

Am I Predicting a bottom? Absolutely Not! Maybe we go to 7000, perhaps 6000, heck maybe even 4000 on the Dow. I don’t know and I honestly don’t care. What I will be doing is compiling a list of stocks that I will focus on once, the market finally does turn over a new leaf, and be ready for the incredible opportunity that will be before us.

Here’s the Nasdaq and S&P charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.