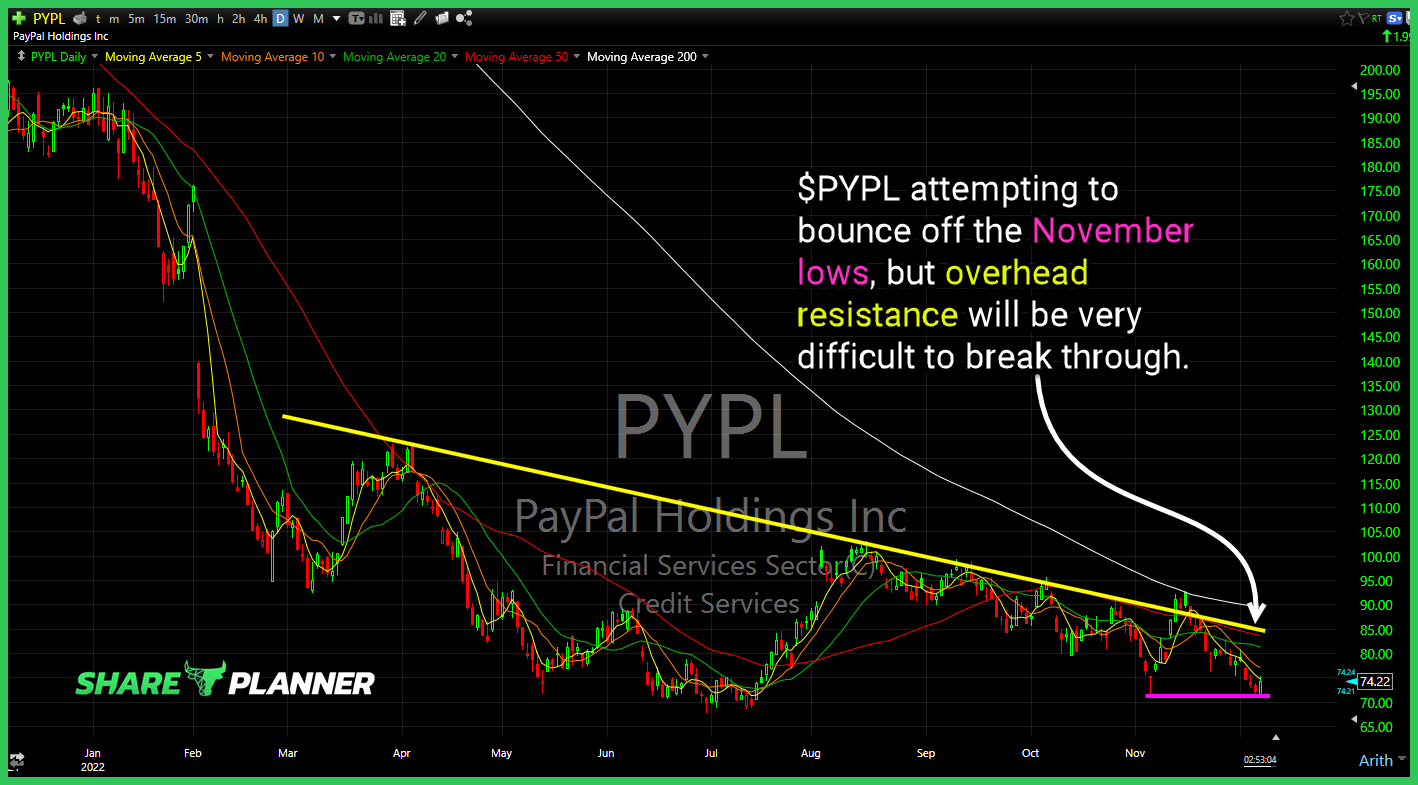

PayPal (PYPL) attempting to bounce off the November lows, but overhead resistance will be very difficult to break through. Applied Materials (AMAT) Watch the triangle pattern here for a potential breakout as it attempts to bounce off of the rising trend-line. Bear flag confirmed on Western Digital (WDC) Utilities (XLU) solid uptrend remains

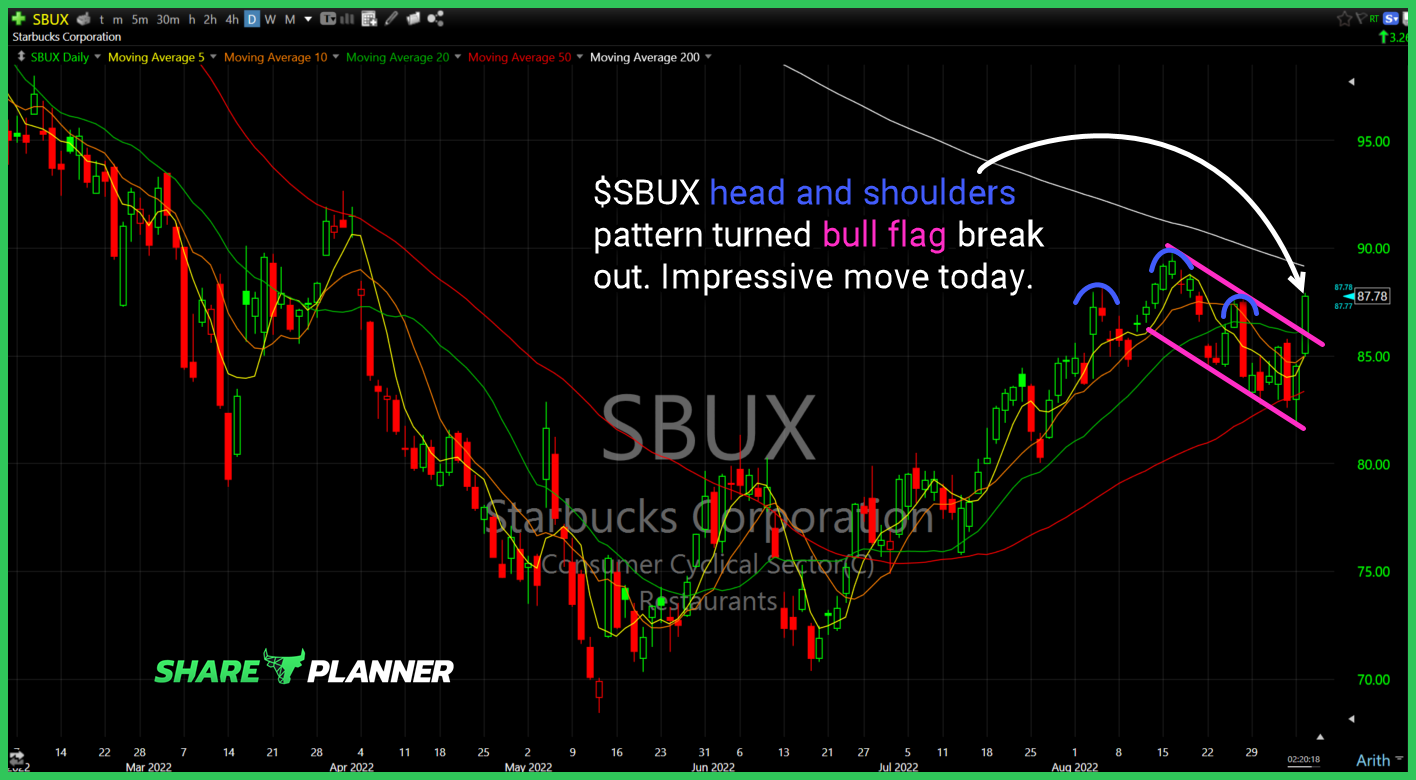

$SBUX head and shoulders pattern turned bull flag breakout. Impressive move today.

Episode Overview For working traders or those with a heavy family load, it can be difficult combing through hundreds if not thousands of stocks looking for that one quality swing trade setup. In this episode I talk about how one can trim down the stocks that they have to follow as well as trading off

Episode Overview Ryan Mallory answers a slew of questions about swing trading stocks, ETFs, and the ideal time to get short. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:56] Aggie’s Follow-Up QuestionsListener Aggie returns with a packed email full of swing trading questions, setting the stage for a wide-ranging discussion. [4:56] ETFs

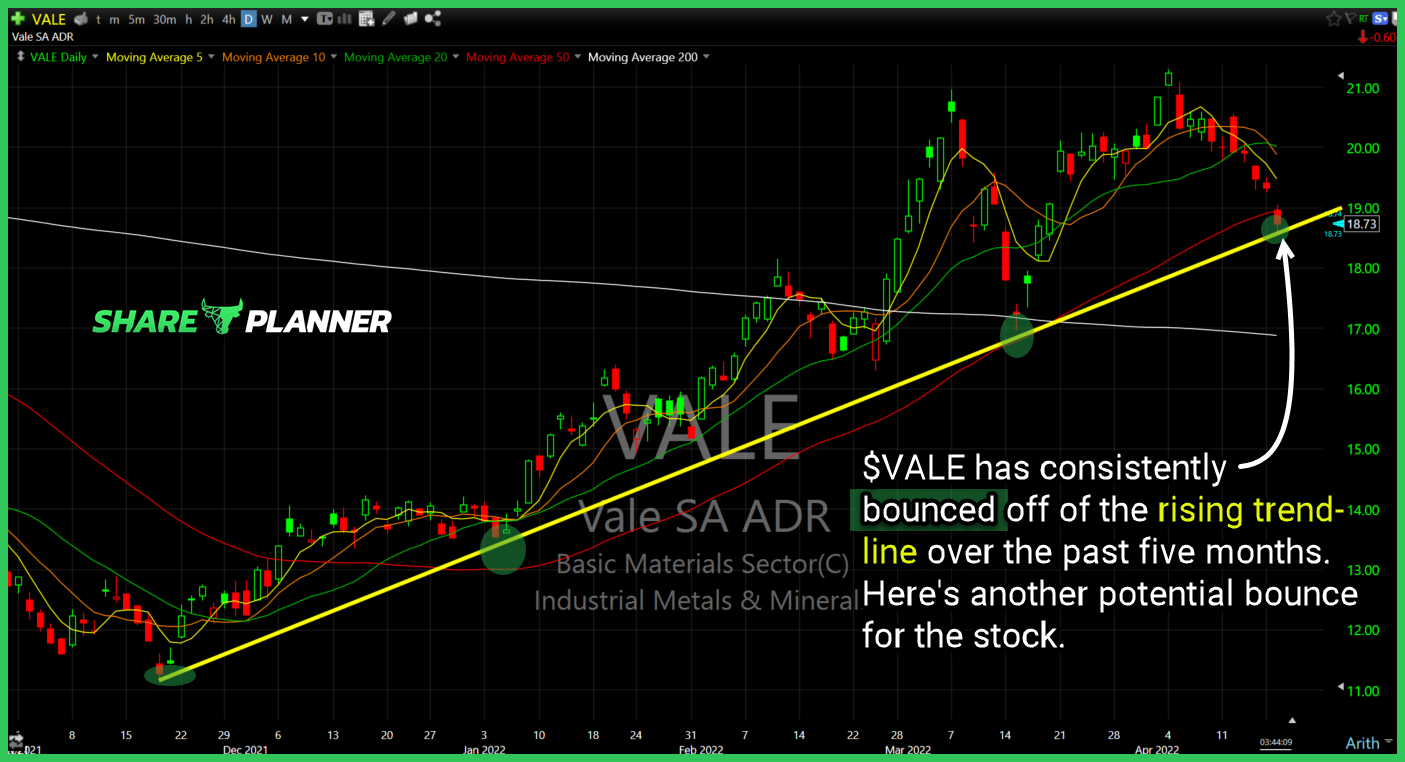

$VALE rising trend-line going back to November still remaining intact and today’s pullback has it being tested yet again.

$XLU The least talked about sector is the stock market’s best

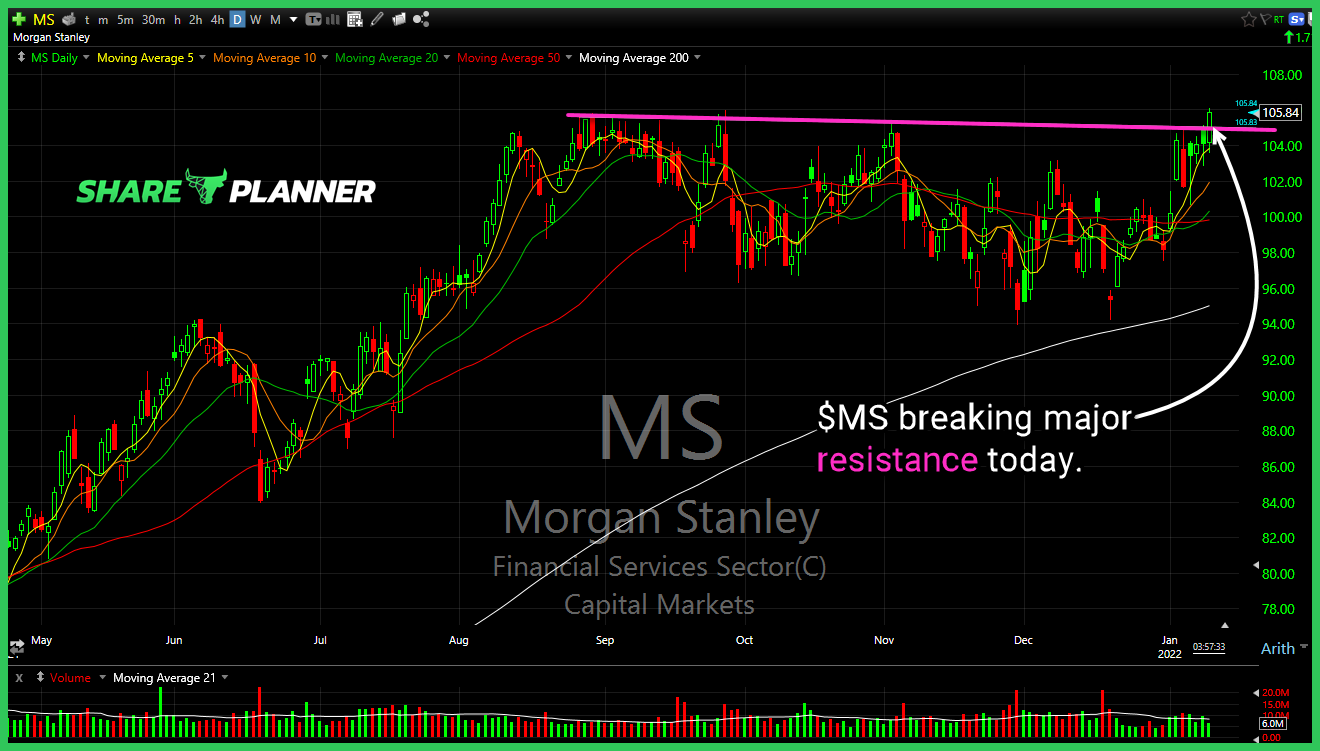

$MS breaking through some serious resistance today.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of