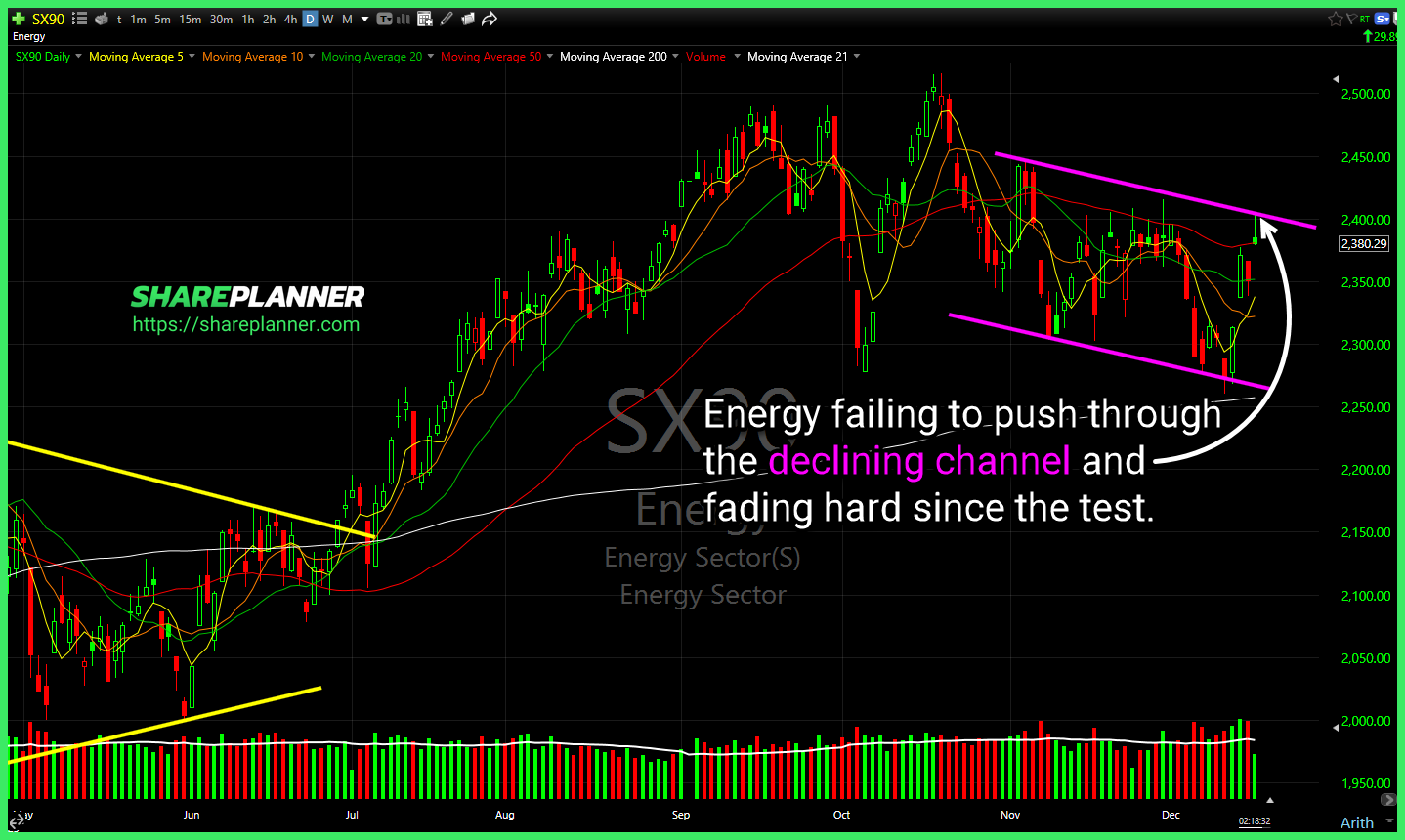

Energy $XLE has the potential to shine here if it can break out of this declining channel. Some much needed consolidation this week. . $XLB tight and well constructed bear flag in the materials sector and toying with a confirmation over the past couple of weeks. $ALB huge support going back to November, with bounces

Energy sector failing to push through the declining channel. $XLE $GPCR these days there's no limits to what the bulls won't go to, to buy the dip. This time off of a -50% push lower & bounce off the rising trend-line. Gap and crap on $NIO following the gap higher. Watch to see here whether

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

Long-term support on Ford Motor (F) broken today. This is a scenario where trying to guess at where support might loom is not worth it. Best to let the stock start to base first instead of guessing where it might bounce. Financial Sector (XLE) nearing a potential bounce area here. Alphabet (GOOGL) slicing

Mara (MARA) hitting up against some short-term resistance. Should it break through watch old trend-line resistance. Spotify Technology (SPOT) tested rising trend-line on Monday, and following earnings, had a strong bounce. Break July highs would establish higher high and the continuation of the existing trend. Nice gap above the resistance on Coinbase Global

$GLD getting some push back here at the resistance from the broken descending triangle $XLE Watching for a pullback to the rising trend-line here. $IWM broke the rising trend-line today, and looking at another test of major price level support. Below that, watch for October '22 lows retest. $TPST Couldn't have seen that one coming...

Coinbase Global (COIN) finally starting to break out of the declining channel from mid-July. Very little resistance overhead from here to continue to the climb. Imagine getting stopped out on a random 7% drop mid-day for no reason at all on Oracle (ORCL). No news that I can find anywhere. Starbucks (SBUX) breaking

Match Group (MTCH) broke out and through its declining trend-line. I'm watching whether it pulls back to the trend-line and declining support for a potential bounce. Energy Sector (XLE) coming back to test the breakout support level. Watch to see whether it can bounce here. US Global Jets ETF (JETS) rising trend-line broken

Massive triangle $DOCU not to far from its all time lows. Formed a double bottom in the very short-term but that pattern is simply part of the much larger triangle. Pullback on $NIO could be targeting a retest of multiple breakout levels underneath. Watch to see if either provides a bounce going forward. $PLUG pushing

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the