Swing Trade Approach: Busy day on Friday. I covered one of my short positions, Nutrien (NTR) at 44.39 for a 6.7% profit. Nice gain for a short position that I have held since November 26th at $47.60. But I didn’t stop there. I sadly closed out one of the more impressive trades of the year Visa (V), which

Swing Trade Approach: Overall a profitable day. I scaled back a tad, my long exposure, while keeping my short exposure the same. Still, I’m not against adding more positions here, but I have no desire to take on a ton of new long positions. I sold half my position in Shake Shack (SHAK) for a +12%, sold half

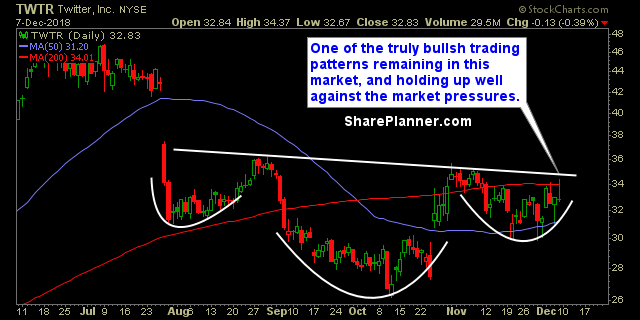

Monday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Twitter (TWTR)

My Swing Trading Approach I took profits in my trade in Visa (V) for a +2.4% profit yesterday, and added another swing-trade later in the day. Holding +7% in profits with Netflix (NFLX). I don't expect to add anything today ahead of the G20 Summit, but instead will look to add more swing-trades, if the

Thursday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Adobe Systems (ADBE)

Thursday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Alphabet (GOOGL)

September is off to a great start. Traders in the Splash Zone are up despite the market selling-off. Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you will get each and every

Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my

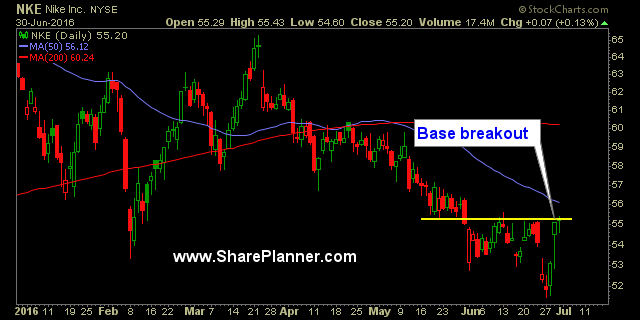

The second half of the year is upon us. Get your portfolio right and start consistently profiting in this crazy and volatile market. Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription,

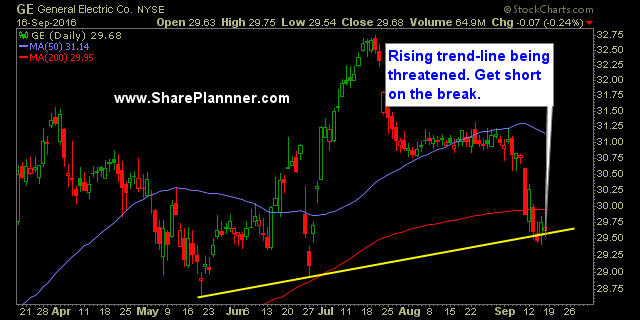

Technical Outlook: First legitimate sell-off on SPX yesterday since April 7th. SPX finished the day trading below the 5-day moving average. Watch the rising trend-line off of the February 11th lows. Currently the trend-line sits at 2087. A slew of earnings came out last night and this morning resulting in hard sell-offs in