Futures are looking ‘okay’ right now, but there is some fair value cooked into them. For instance, the Nasdaq isn’t down only a few points, instead, it is down about 1% from where it closed the day at 4pm eastern. From the looks of things with Google (GOOGL) and Microsoft (MSFT) putting

Perhaps this market bounce isn’t over just yet, we’ll know more are the week progresses as there are massive amounts of earnings reports including Apple (AAPL), Facebook (FB), Boeing (BA), eBay (EBAY), Visa, (V), Catepillar (CAT), Chevron (CHV) and many, many more. Not to mention that you have the dadgum

It’s still never too late to finish the year off right – and you can do so by signing up for the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my chat-room that I trade

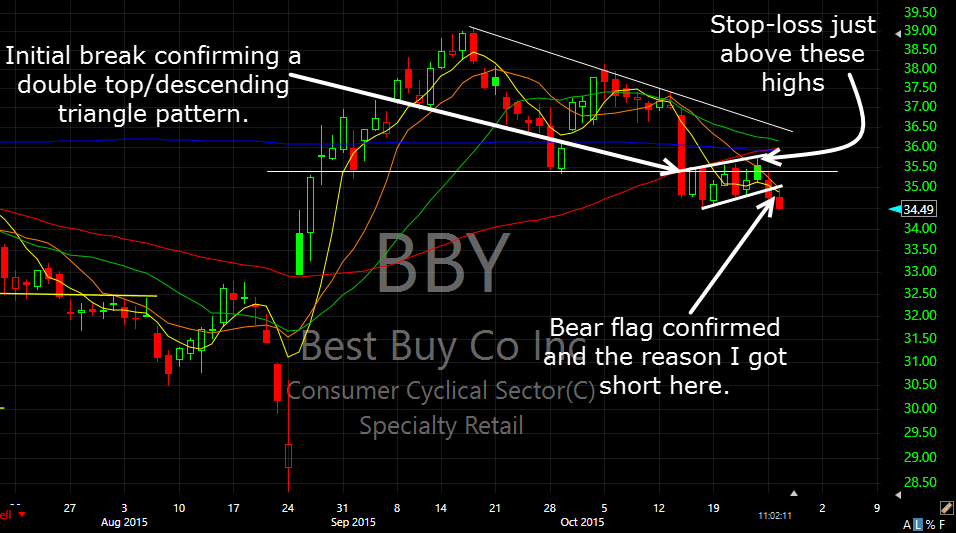

Well, back on October 27th, I thought it would be genius to add a short position in Best Buy (BBY). And at the time it looked like a good idea as a hedge against my multiple long positions in the portfolio. SPX was in the middle of a two day pullback and things were

Learn to take low-risk swing-trading setups by joining me in the SharePlanner Splash Zone. You can try try it out today with a with a Free 7-Day Trial. With your membership, you will receive all of my swing-trade alerts via email and text (international too) as well as access to my world-class chat-room that I trade in

It was an incredible year of trading in 2014. Now it is on to 2015 and another year of profitability. Whether you are new to trading or experienced, you need to try out the SharePlanner Splash Zone by signing up for a Free 7-Day Trial where you will be given access to the member chat room as

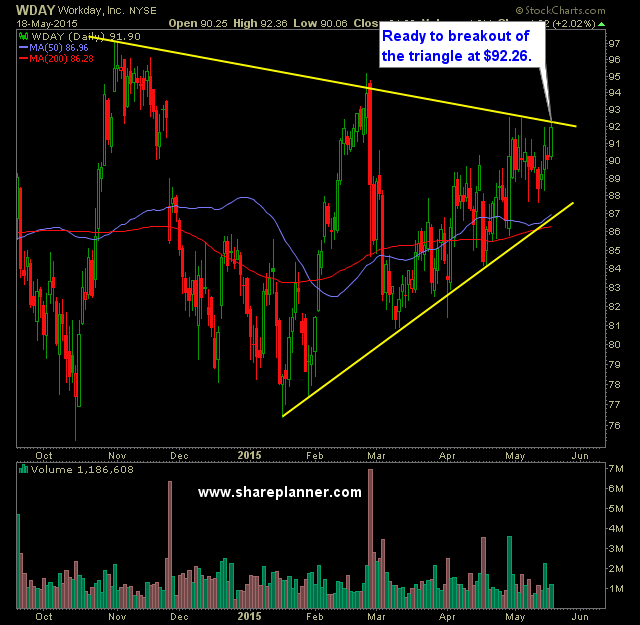

Be sure to sign up for the SharePlanner Splash Zone Free 7-Day Trial and receive access to my chatroom and real-time trade alerts via text and email (including international). You can also automate all my trades through Ditto Trade. Click here to subscribe. Here is tomorrow’s swing-trading watch-list: Long Bed Bath & Beyond (BBBY) Long

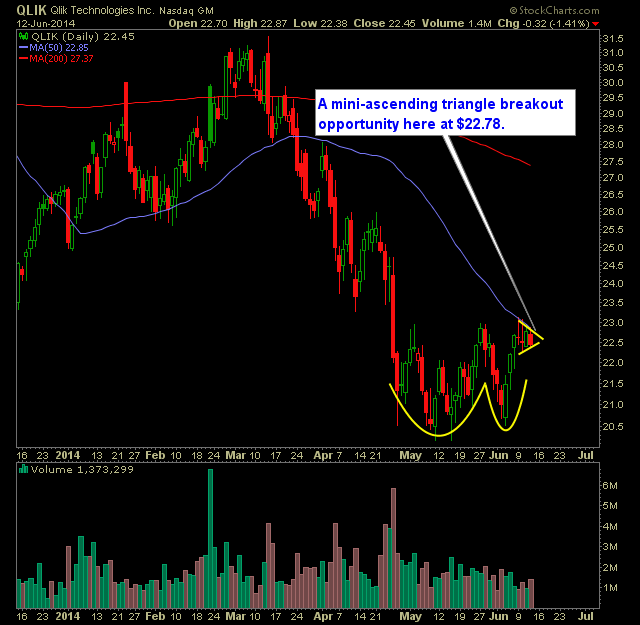

Here’s tonight’s swing-trading watch-list: Long Qlik Technologies (QLIK)

Here are tonight’s trade setups for tomorrow’s market: Short Citigroup (C)

Visa (V) is firing a warning shot for all to see today. I hate trading off of aging trend-lines. There was a time in my life, where I could never pass one up. It seemed so secure, so dependable, and so easy to cash in on. But like humans the older we get, the closer