The bulls are not on their best behavior these days. Much of it is to do with digesting recent gains during August, which is why we haven’t seen the kind of selling that was experienced on July 31st of this year. Nonetheless, it doesn’t hurt to have a combination of long and short positions in

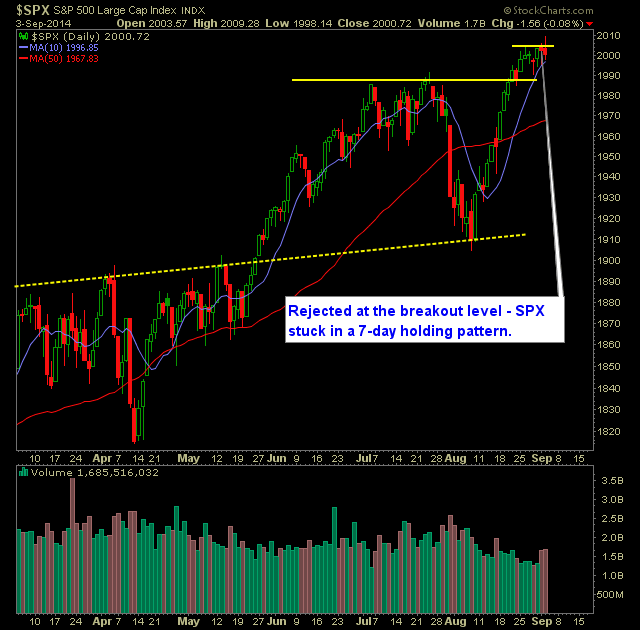

Pre-market update: Asian markets traded -0.2% higher. European markets are trading flat. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): Empire State Manufacturing (8:30), Industrial Production (9:15) Technical Outlook (SPX): Friday nullified the notion that the action from the previous two days was an

Pre-market update: Asian markets traded -0.2% lower. European markets are trading 1.1% higher. US futures are trading 0.2% higher ahead of the market open. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30), ADP Employment Report (8:15), International Trade (8:30), Jobless Claims (8:30), Productivity & Costs (8:30), ISM Non-Manufacturing INdex (10), EIA Petroleum

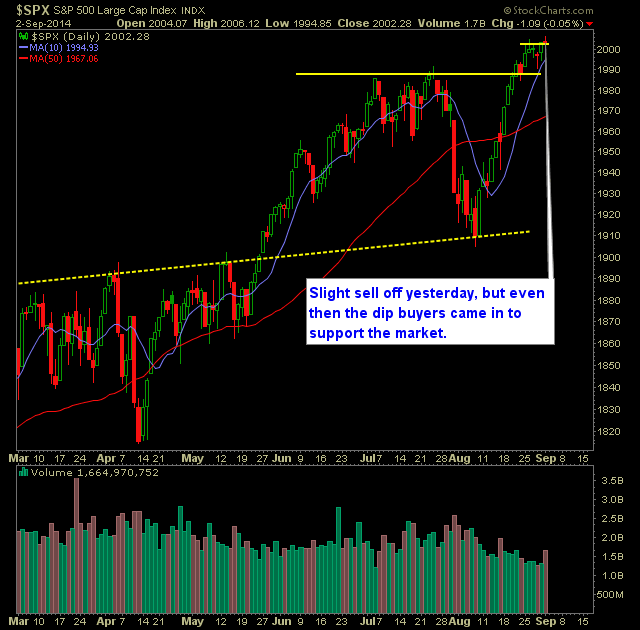

Pre-market update: Asian markets traded 1.0% higher. European markets are trading 1.0% higher. US futures are trading 0.4% higher ahead of the market open. Economic reports due out (all times are eastern): MBA Purchase Applications (7), ICSC-Goldman Store Sales (7:45), Redbook (8:55), Factory Orders (10), Beige Book (2) Technical Outlook (SPX): Minor dip yesterday, however, the

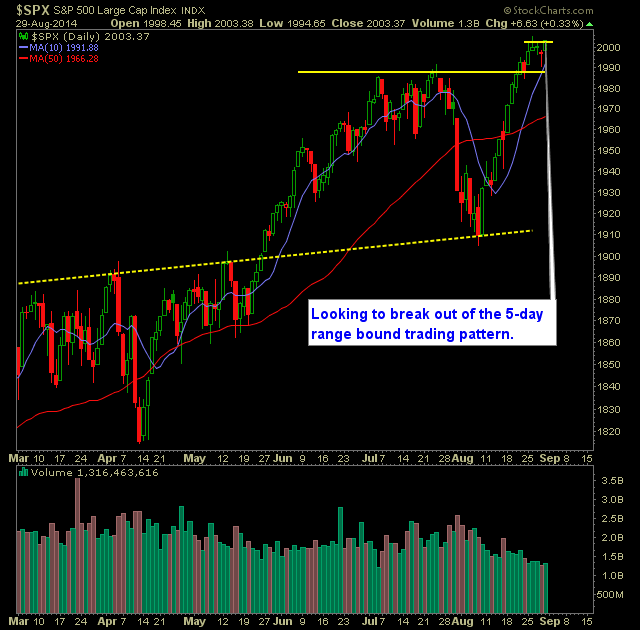

Pre-market update: Asian markets traded 0.8% higher. European markets are trading 0.1% higher. US futures are trading 0.1% higher ahead of the market open. Economic reports due out (all times are eastern): Gallup US Consumer Spending (8:30), PMI Manufacturing Index (9:45), ISM Manufacturing Index (10), Construction Spending (10) Technical Outlook (SPX): A mini short squeeze into

Trading is so much better when you do it with friends I’ve been incredibly blessed with the community of traders that has formed in the SharePlanner Splash Zone. There are traders of all types, of all experience levels, and with various strategies. I find myself learning from them probably more than they learn from me

Pre-market update: Asian markets traded 0.7% higher. European markets are trading 0.7% higher. US futures are trading 0.4% higher ahead of the market open. Economic reports due out (all times are eastern): None Technical Outlook (SPX): For the second straight day, SPX has formed a hammer candle – very bullish and indicative that dip buying

Pre-market update: Asian markets traded 0.3% lower. European markets are trading 0.2% higher. US futures are trading 0.1% higher ahead of the market open. Economic reports due out (all times are eastern): Treasury Budget (2) Technical Outlook (SPX): As predicted in yesterday’s trading plan the SPX put in the day’s low in the first 30-minutes