My Swing Trading Approach The bulls are putting together, in the premarket at least, the makings of a bounce. If the early morning strength can hold, and improve matters technically, I’ll be a buyer. Indicators

My Swing Trading Approach Still net short, but in there with some long exposure. I’ll need to see a move from the market today, whether up or down, to convince me to add more trades to the portfolio. Sideways price action won’t lure me into making another trade. Indicators

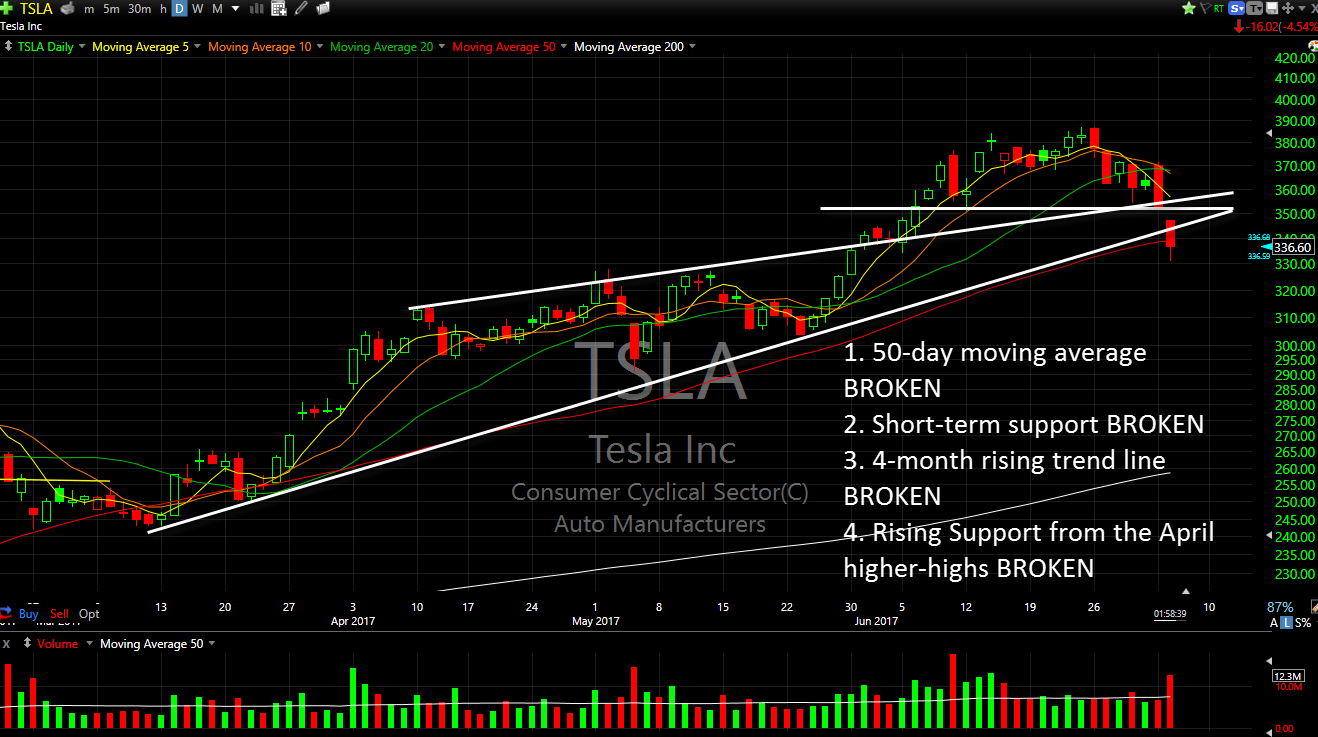

My Swing Trading Approach I closed out my one long position early on Tesla (TSLA) and added an additional short position before anything ran hard against. Yesterday proved to be a very profitable day, and will look to add more short positions today, if the market has more downside in the cards.

Trade opportunities to keep an eye on The first two trading days in April have been pathetic in terms of trading opportunities to cease. Essentially if you haven’t traded Amazon (AMZN) or Tesla (TSLA), you found yourself on the outside looking in. So here’s to hoping that the coming days, whether it be

Tesla Stock Analysis: The Technical Picture Tesla (TSLA) reported earnings last night and while it was received well initially, the Tesla stock price today is getting hammered as traders woke up to a totally different situation this morning. Tesla shares sold off by by the biggest amount that we have seen since the massive

July was a solid month in the SharePlanner Splash Zone and I look to duplicate it and more in August. Get in and start to profit by joining the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial –

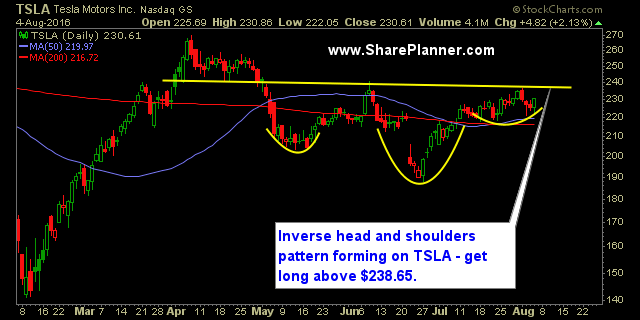

I like the trade setup in Tesla (TSLA) here. I think it provides a clear reward/risk parameter, and if earnings were not on August 3rd, a clear path to $270/share. With earnings you never know how things are going to turn out, which is why I don’t hold stocks through those events. It is

Technical Outlook: Quiet move in the market on Friday that led to another nice gain for the bulls. Slight uptick in volume on Friday but well below recent volume averages. This market has all the makings of a market the wants to continue to move higher, however, there are numerous resistance levels overhead between the

Trading is setup to create maximum frustration and elicit maximum emotion from the trader. Trading is not meant to be made up of clear cut decisions that are easy to make nor decisions that won’t lead to regret. I want to build off of the post I did yesterday entitled, “Emotions Are Part of Trading