Pre-market update:

- Asian markets traded -0.2% lower.

- European markets are trading 1.1% higher.

- US futures are trading 0.2% higher ahead of the market open.

Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30), ADP Employment Report (8:15), International Trade (8:30), Jobless Claims (8:30), Productivity & Costs (8:30), ISM Non-Manufacturing INdex (10), EIA Petroleum Status Report (11)

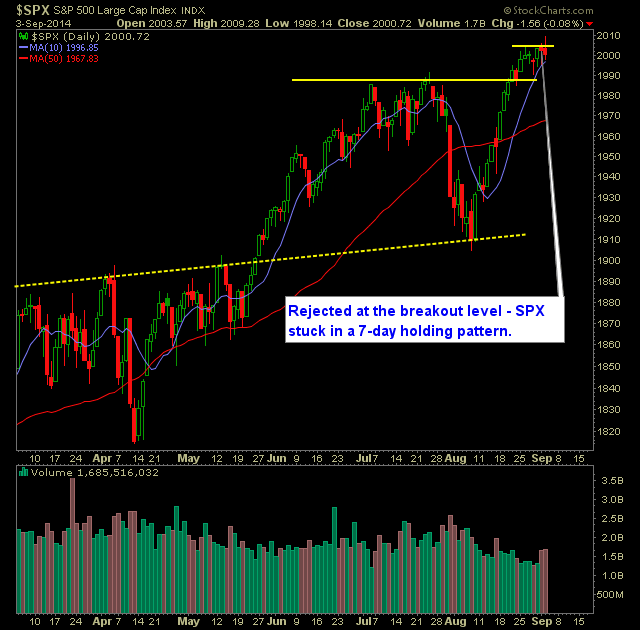

Technical Outlook (SPX):

- SPX initially broke out of the 7-day trading range yesterday, but like most gap ups it filled the gap, and even sold off a minor bit yesterday.

- The action is by no means a show stopper, as technically everything held up just fine.

- In fact, this consolidation is healthy and was necessary for the market to ensure that it could continue rallying in the future.

- Little to no fear in yesterday’s price action.

- Volume was notably off yesterday.

- VIX was only up a paltry 0.9% to 12.33.

- At the moment there is little to no fear in this market. That can always change, but no major themes in the market that cause problems for it right now.

- 30-minute chart shows plenty of consolidation taking place right now.

- SPX still remains very strong, and gives no reason to begin shorting this market at the moment.

- SPX remains staunchly in overbought territory.

- On the weekly SPX broke out of its trading range last week.

- A lot of nontraditional traders are starting to get interested in this stock market which usually starts to show that there is too much “froth” in the market.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Closed out TSLA at $283.05 yesterday for a 7.3% gain.

- Did not add any new positions yesterday.

- Remain long CTXS at 69.96, STT at 70.99, TJX at $59.65, FB at 75.65.

- Will look to add 1-2 new long position today.

- 40% Long / 60% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.