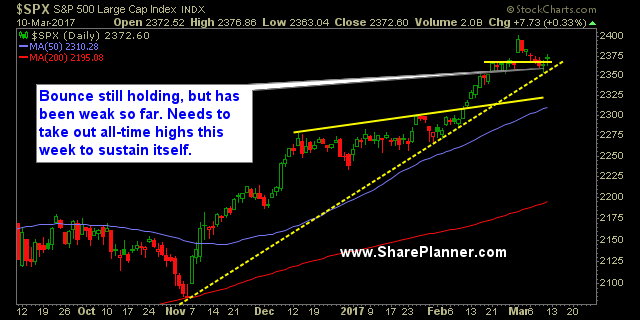

A lethargic S&P 500 Index Chart

The S&P 500 Index chart (SPX) is holding true to the rising trend-line and is holding the 20-day moving average as well. The FOMC is also upon us. This is the week that they are likely to raise rates, and if you remember, I’ve been saying for a couple of months now that they’d raise rates because with the market soaring and jobs still coming in strong, they have no other choice but to take advantage of the strength the market is showing and raise rates, especially if they want to appear credible at year-end with their projected three rate hike projection.

Banks may pop on the news but in the past week, they have shown no signs of it with price stalling considerably – especially among the regional banks.

Volume on SPDRs S&P 500 (SPY) been solid the past two days, which is unusual considering the price action of late. Friday’s action represented a breakout of the bull flag on SPY as well, but once again the intraday price action was nothing to get thrilled about.

T2108 (% of stocks trading above their 40-day moving average) bounced on Friday by 5.3% and managed to climb back above 42%.

Finally, keep an eye on oil – It has been on a hard 5-day pullback. It has been a while since we have seen considerable weakness in the commodity, but if it persists, eventually it will effect the broader markets more directly.

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 4 long positions

Recent Stock Trade Notables:

- American Airlines (AAL): Short at 44.76, Closed at 44.03 for a 1.6% profit.

- UPRO (Day-Tade): Long at 95.35, closed at 96.50 for a 1.2% profit.

- OZRK: Long at $56.12, closed at $54.69 for a 2.5% loss.

- FNSR: Long at $34.25, closed at 34.70 for a 1.3% profit.

- UPRO (Day-Tade): Long at 96.92, closed at 98.03 for a 1.2% profit.

- JP Morgan Chase (JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

- Chevron (CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

- Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.