We could be in for an interesting day tomorrow on the stock market if the closing price action is any indication. Bulls still have control of this market on the daily charts, but the bears intraday finally showed some signs of life today. Keep an eye out for that tomorrow and make sure to keep

That was one nasty market sell-off at the close today (comparatively speaking). Plenty of people were selling stocks, myself included. The biggest concern for me right now is that only 49% of stocks are trading above their 40-day moving average. That is with us only being about a week removed from having established all-time highs.

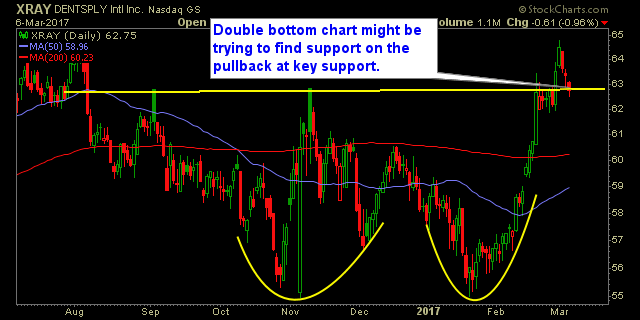

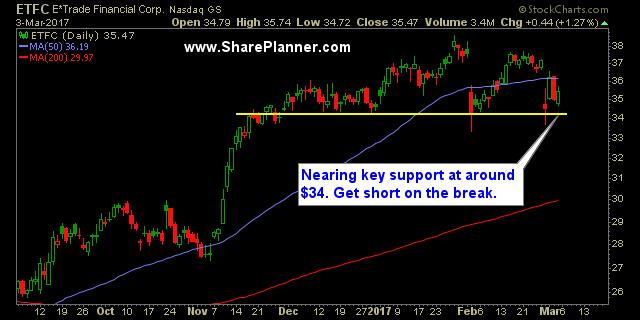

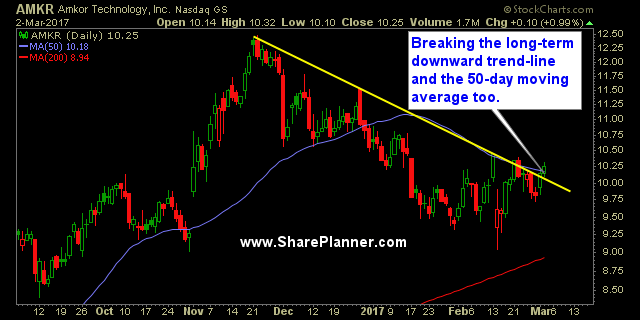

Three new trade setups – one of them long and the other being short. Either way this market decides to take us, you’ll have some options at your disposal. Keep the edge in your corner. Trade what you see always, manage the risk, and let the profits take care of themselves. Here’s the Stockwatch: Long

Stocks are a little shaky to start the week, my watch list is most filled with red stocks trading lower. Nonetheless, I have managed to put together a decent list of about eighty stocks that are worth paying close attention to this week. Trading My Watch List With any of these, the key is going

Futures on Sunday night opening up weak, but what the futures do and what the actual equity market does when it opens up in the morning have little bearing on each other. So be prepared for the market trading lower or higher, don't assume, and manage the risk accordingly and I'm sure you'll be just

No follow through for stocks yesterday. The market is a little bit tipsy here and if you need to simply not trade today until you can get a better feel for this market, well, that is okay too. I don’t blame you one bit. As always, manage the risk on the trade, youll be fine

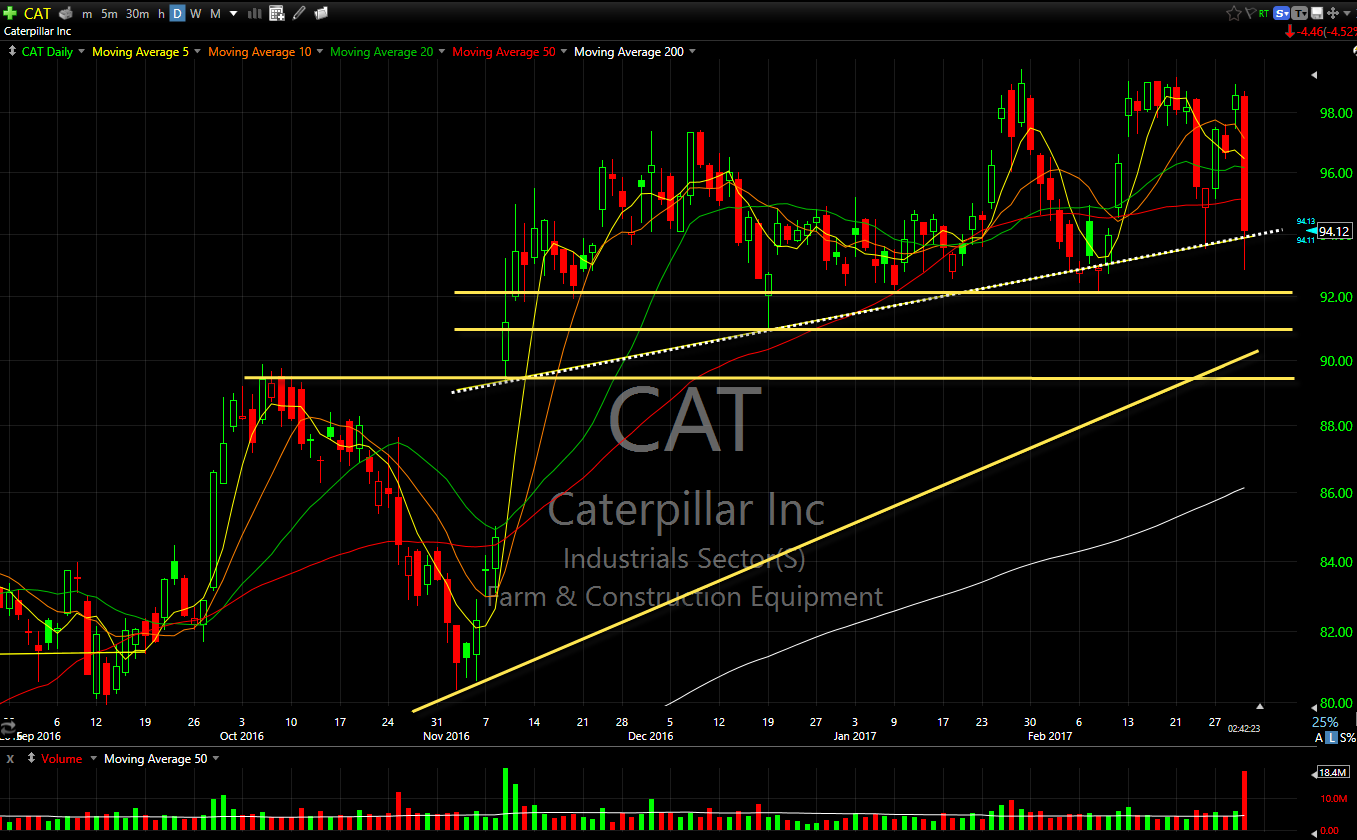

The beloved stock on the NYSE CAT is getting pummeled today. And if you have been watching the financial news or following me on Twitter, you’ll know that they are getting investigated today by practically every agency in the Federal Government at their corporate offices. This isn’t new for Caterpillar (NYSE: CAT) as it

My Trading Journal for the Stock Market Today: I’m not talking about the speech itself, though I did think the speech was a pretty darn good one, and blew away everyone’s expectations. But I am talking about whether the Trump Rally itself can follow through into additional gains tomorrow. History says, “Sure”. I mean C’mon, the

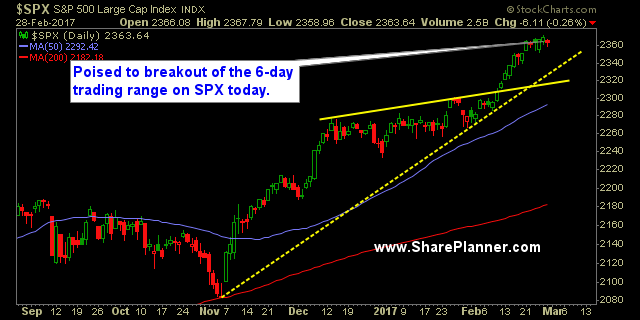

Holy cow, did you see that rally today? Where did that come from? Because for the past fifty trading sessions we have been trading in less than a 1% trading range. What a nice change of pace for once! Obviously the market liked the Trump speech from last night, and that’s all fine and dandy,

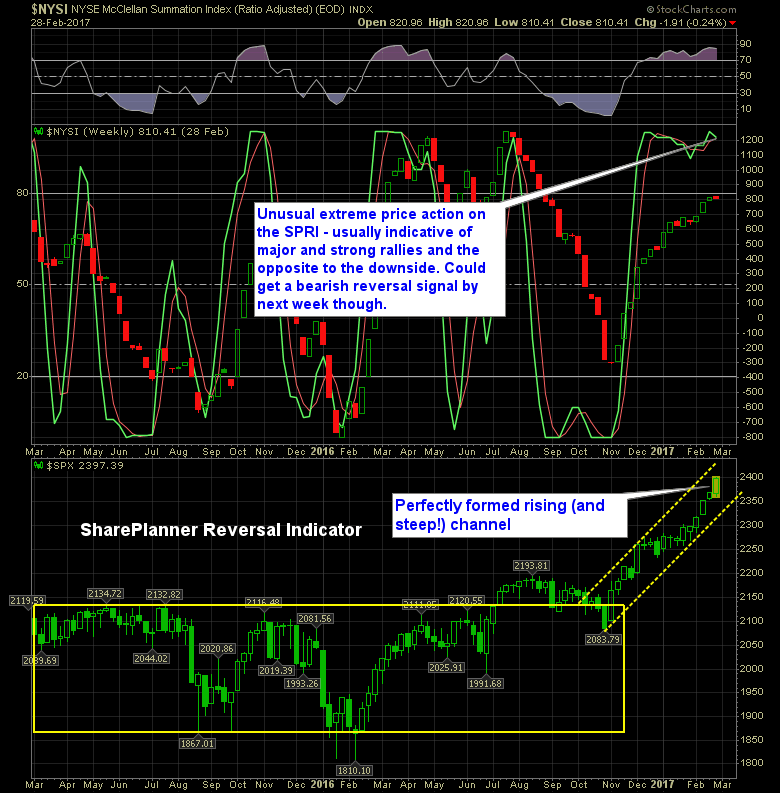

The market has held strong following the Trump election and as of yet my trend reversal indicator remains bullish. Obviously that can always change at any given time, so even in the most bullish of markets, you want to be managing your stops and curbing your risk exposure. Right now, the SharePlanner Trend Reversal Indicator