The beloved stock on the NYSE CAT is getting pummeled today.

And if you have been watching the financial news or following me on Twitter, you’ll know that they are getting investigated today by practically every agency in the Federal Government at their corporate offices. This isn’t new for Caterpillar (NYSE: CAT) as it has had its run-ins with the law in the past. But this was a stock that was setting up beautifully for a breakout over $100, and instead it has dropped 4.7% to where it is sitting at a key support level now. But if this doesn’t hold, and you’re not one to use stop-losses (which you should be using), then there are four additional support levels to watch, and I have mapped them out for you below.

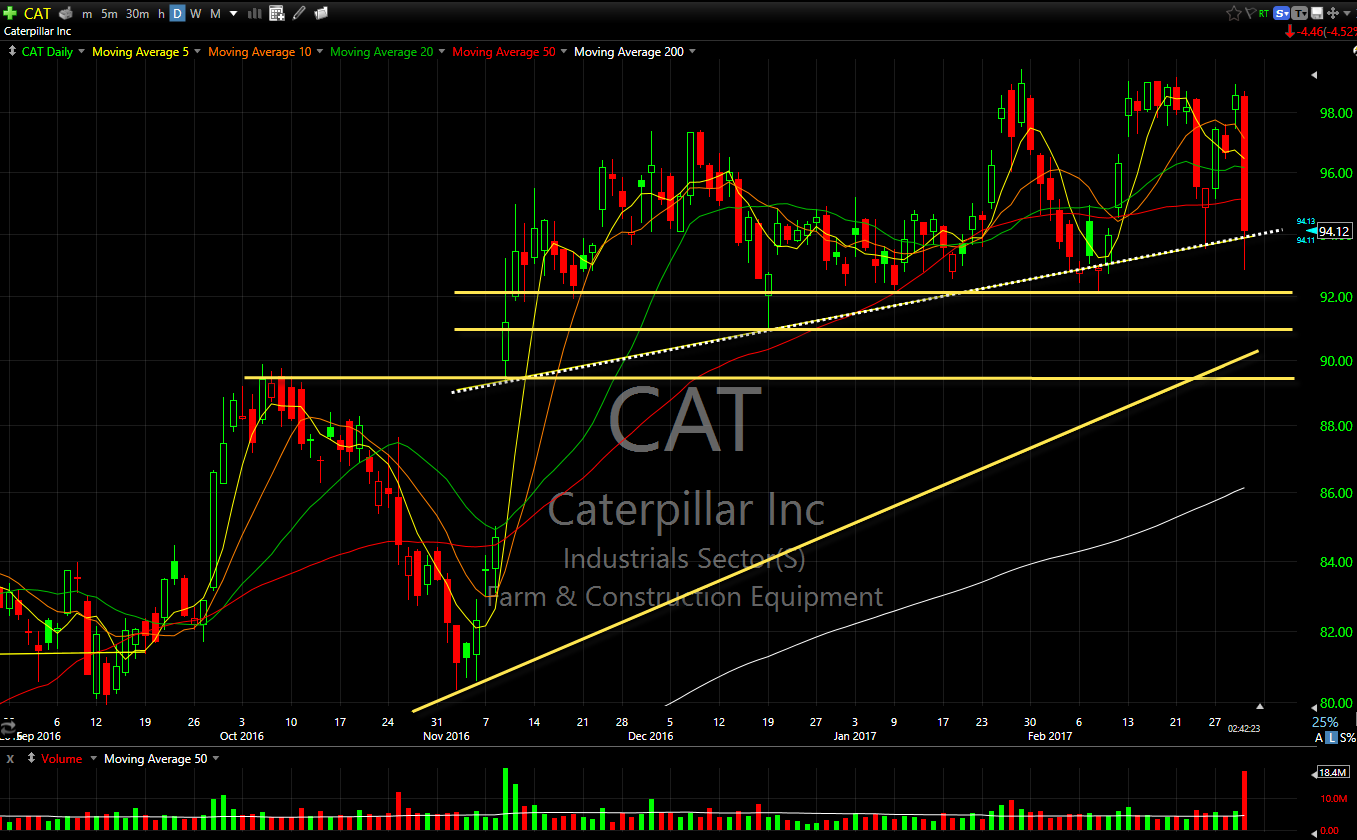

Here is the Caterpillar Stock Chart

The first one which is a dotted line that is rising off of the gap up lows from back in November has been successfully tested multiple times and has held each time. Now it is testing that level yet again, and needs to close above it for the bullish thesis of this stock to remain in place.

The best price entry for a trade in CAT is

If that price level breaks, and because it is a trend-line, that support will keep rising higher and higher each day, making it more difficult to sustain, then then there are three more price levels to watch on CAT that will or could act as support. I would consider each of these support levels to be minor ones and not to be trusted to any great extent. Finally, the big one is the rising trend-line off of the June lows that was established back during the Brexit meltdown. Since then, CAT has held very, very strong and would look for this to be the ultimate entry level for the stock if it were to continue to drop. Right now, that entry is hovering around the $90-level.

So keep an eye out for that with the CAT stock price and whether it can ultimately test that level for swing-traders. And most importantly – manage your risk!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.