Yes, I am pumped about Patterns to Profits, my new and FREE training course that I am giving away. So excited that I thought I'd put together a podcast detailing what it is all about and how you as a trader will benefit from it! Check it out!

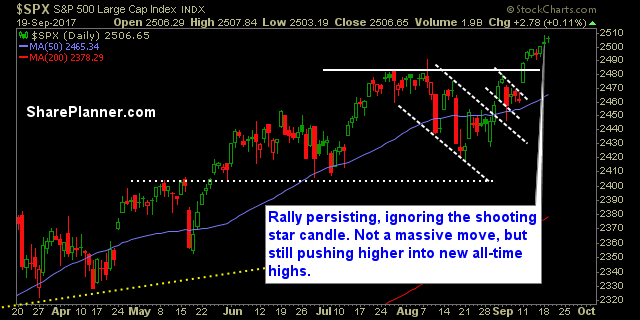

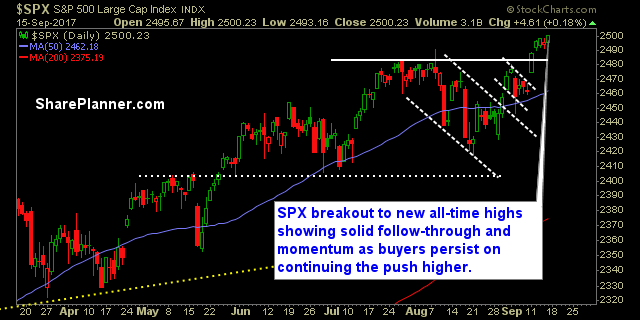

My Swing Trading Approach I’m not opposed to adding new long positions at this point in the rally, but I am cautious about overloading the portfolio with too many long positions at this point, as we are more likely than not to see a 1-2% pullback in the near term (in the coming weeks).

Today’s stock picks September has been a great month so far. So what are you waiting for? Jump in the Splash Zone and start making some profits for yourself! Long TTM Technologies (TTMI)

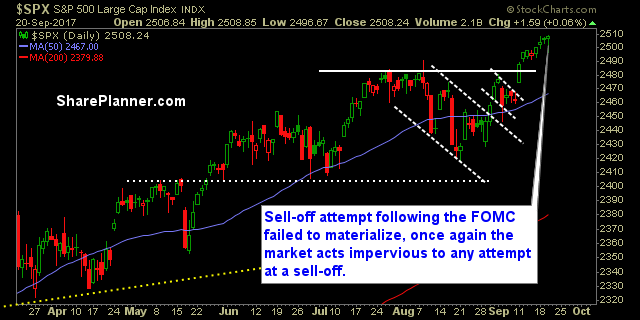

My Swing Trading Approach I don’t expect to make any trades during the morning. I will hold off until after the FOMC meeting to make any new trades to the portfolio. Continue to increase my stop-losses on existing positions. Indicators

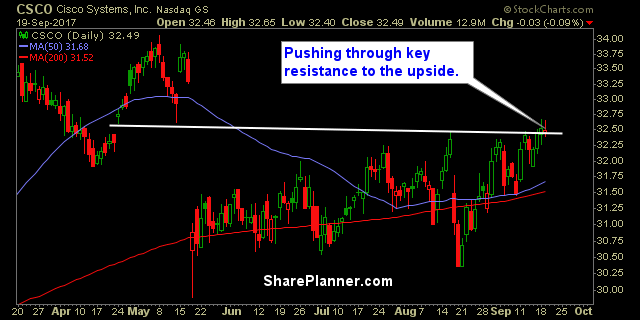

Today’s stock picks September has been a great month so far. So what are you waiting for? Jump in the Splash Zone and start making some profits for yourself! Long Cisco Systems (CSCO)

Talk about an exercise in futility – coming up with these bearish lists of trade setups have been a waste of time for about 99% of the time so far in 2017. Yeah, there are some good setups on there, and you’ll find in the list below there are some great setups.

My Swing Trading Approach I want to see early on, whether this market wants to hold the gains from yesterday and the previous four trading sessions. If so, then I will add more long exposure. Otherwise, I will curb risk further. Indicators

Today’s stock picks September has been a great month so far. So what are you waiting for? Jump in the Splash Zone and start making some profits for yourself! Long Unum Group (UNM)

Bulls are white knuckling this market making sure it does nothing but go higher. Two problems though with finding quality stocks to trade in the current market:

My Swing Trading Approach I will continue tightening my stops on existing trades so that the majority of profits are locked in. Also, I want trades with tight risk parameters, so that any new long positions avoid major impacts to the portfolio if the overall market reverses. Indicators