Remember my post from a little over a week ago, about how to trade Google (GOOGL) successfully in the coming days? Well check it out right here.

My Swing Trading Approach I won’t rule out adding additional position or two to the portfolio today, but I’m not looking to pile on in this market. Manage the trades that I have, trim the ones that don’t provide a solid reason to keep, and raise the stops on the rest. Indicators

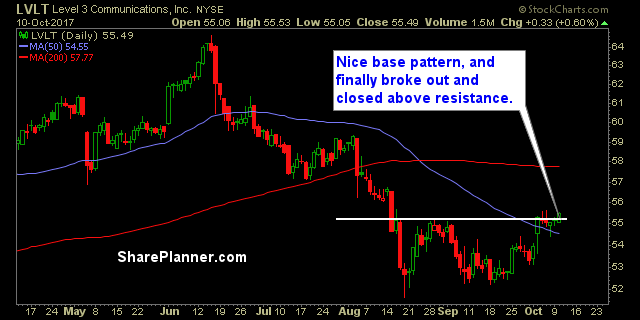

Thursday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Join me for the last quarter of 2017 by jumping in the Splash Zone and making some profits for yourself! Long Masco (MAS)

What a Great Month for Swing-Trading! A 60% Win Rate Profits both long and short A market that went nowhere, but SharePlanner has awesome profits. Consistent profits were the name of the game. The market had a few monster sell-offs, but ultimately bounced higher as a result of those sell-offs.

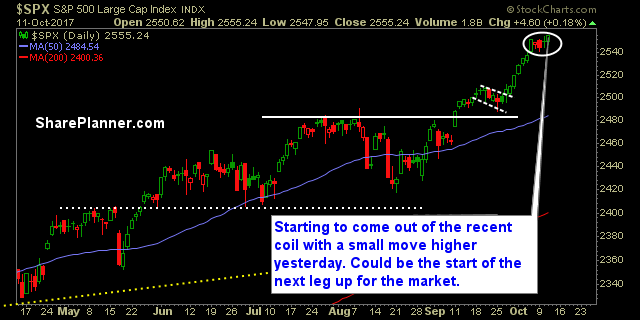

My Swing Trading Approach I trimmed my long exposure quite a bit yesterday. Booked a lot of profits. I added two new positions as well. If the market wants to break out of recent consolidation then I will likely add new positions again today. Indicators

Wednesday’s stock picks Join me for the last quarter of 2017 by jumping in the Splash Zone and making some profits for yourself! Long EOG Resources (EOG)

Here’s the updated list of short setups I am following. It’s a pretty good list and most of them have fared pretty well of late.

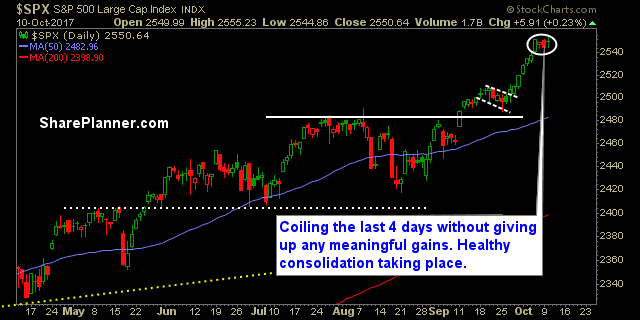

My Swing Trading Approach Don’t take profits for granted. It’s convenient to ignore risk management on the trades, but you have to keep raising those stops. I will also look to add 1-2 new long positions today. Indicators

Tuesday's stock picks September was a great month for traders in the Splash Zone, and an even better quarter of trading. Join me for the last quarter of 2017 by jumping in the Splash Zone and making some profits for yourself! Long Amazon (AMZN) Long Aerojet Rocketdyne (AJRD) RELATED: My Free Patterns to

At this point, what good is a list of short setups. I keep them of course, and will post them tomorrow, but overall, they have been good for nothing really. The market continues to ramp higher, unabated. And if there is some selling, it is minimal, so that any quality sell-off never has any quality