$OXY trend-lien that I am watching to see if it can bounce or not.

Episode Overview One of the biggest problems among traders in the stock market is in the inability to not trade. To show patience and wait for the right setup. Ryan Mallory talks directly to traders to make them look at patience as a strategic approach to trading successfully in the most volatile and unpredictable of

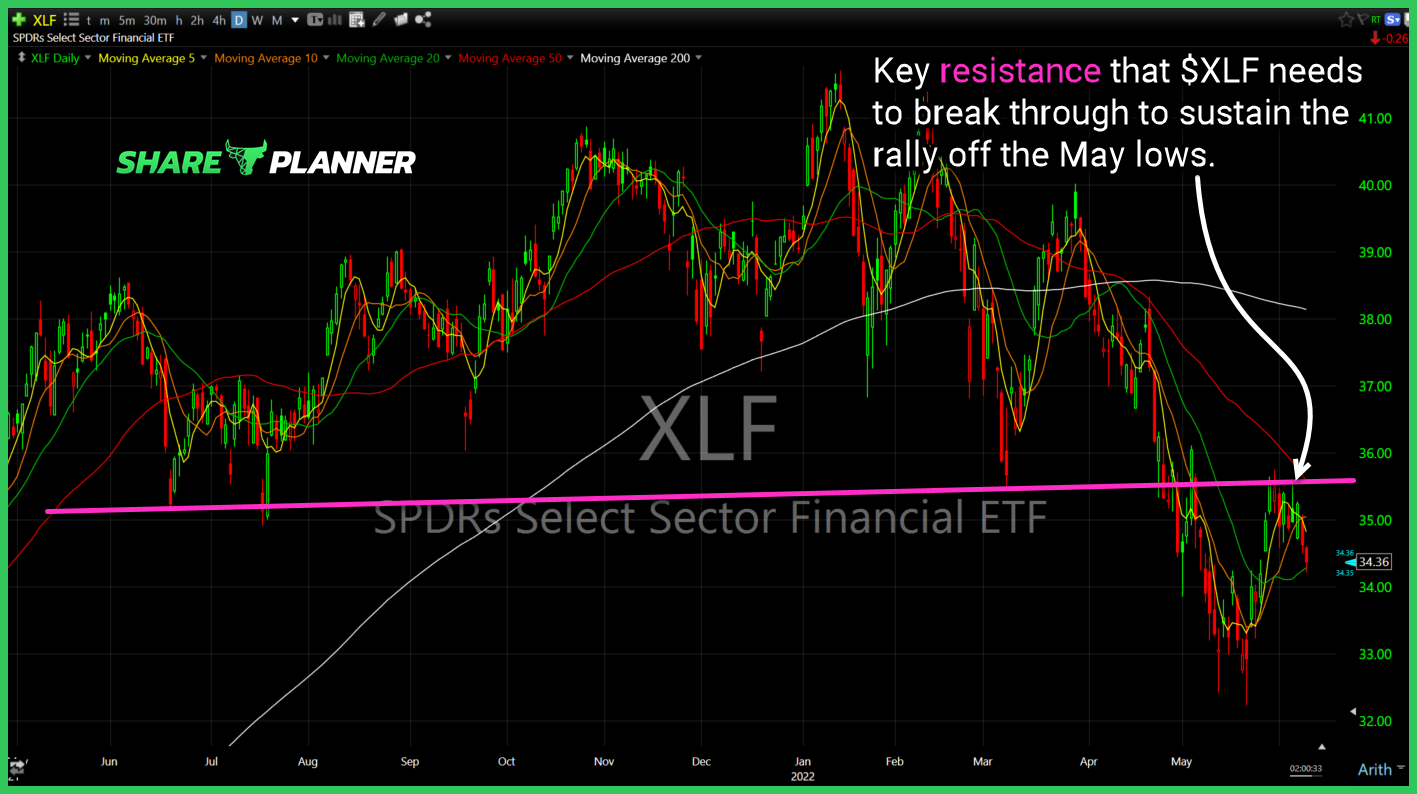

$XLF needs to make another run towards resistance and break that resistance, if the bounce off the May lows is going to stick.

$ROKU resistance break through today.

Episode Overview Ryan Mallory dives in deep on the role that fundamentals play in swing trading, whether it is worth paying attention to along side of technical analysis, and the scenarios that he has benefited the most from it. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Introduction to Fundamentals in Swing

$GME closing in on the 200-day MA and possibly the declining trend-line.

The stock market, in the midst of a historic stock market crash in 2022, has managed to rally over the last two weeks. But now that stocks are consolidating, what is the next move for the stock market? Will the stock market continue to recover and rally, or will stocks continue the stock market crash

$RUN moving towards a double bottom breakout.

Episode Overview Is there an opportunity to capitalize on a trade by buying a stock before ex-dividend, and selling a day or two after? Is there opportunities post earnings to play the immediate move. Ryan explains the pitfalls of both approaches to trading and what you need to be aware of. 🎧 Listen Now: Available

$APP challenging its declining trend-line.