My Swing Trading Approach

I added three new trades to the portfolio yesterday, while being stopped out by another. Right now they are all positioned well, to add to their gains from yesterday’s rally. However, caution is warranted as this market has proved plenty of times this past month that it doesn’t like to hold gaps up. In fact Monday’s decline came from a similar scenario.

Tuesday’s Swing-Trade Ideas:

Take a look at three trading ideas to prep you for the trading session.

Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself!

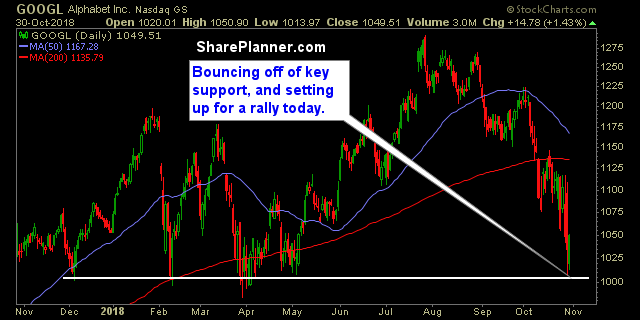

Long Alphabet (GOOGL)

Long Veeva Systems (VEEV)

RELATED: My Patterns to Profits Training Course

Long RPM International (RPM)

Indicators

- Volatility Index (VIX) – Attempted to move higher yesterday, but gave way into the final two hours of trading, dropping 5.4% down to 23.35. Still highly elevated, so a big drop here today, wouldn’t be surprising. Also, hasn’t seen rapid gains over the past four days of trading, despite heavy selling in the market.

- T2108 (% of stocks trading above their 40-day moving average): A 45% move Tuesday, sent price all the way up to 17%. Expect further gains today, as the market appears to be finally bouncing after a dismal month of trading.

- Moving averages (SPX): The biggest takeaway from yesterday was SPX breaking back above the 5-day moving average. Something that the market has been unable to do over the last nine trading sessions. Today the 10-day MA will be in view .

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the market leader yesterday – and a good sign for equities that Tech was back at the top. Energy showing some willingness to bounce but still lots of resistance overhead. Discretionary and Industrials should be targeted today as potential areas of strength in a market bounce.

My Market Sentiment

I am looking for follow through today on SPX, and the first day of consecutive gains for the market in the month of October. The market, should it hold its opening gap, is poised for a major move, as little short-covering has been seen in this market, relative to the amount of selling we have seen so far this month. Some support in the chart below has finally been found for the market, though I wouldn’t trust the market that this is anything beyond a dead cat bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.