Episode Overview How do you keep the emotions to the side and avoid becoming so passionate about your stocks that you are practically married to them for better or worse? In this podcast episode, Ryan talks about how swing trading without passion is absolutely key to making solid, rational decisions in your trading process. 🎧

$CRSP attempting to hold the declining trend-line following a massive sell-off today. Watch for a potential bounce here. $SOFI pushing through the declining channel to the upside. Little resistance until $9.15. $MS attempting to breakout of overhead resistance. Has already broke through the declining trend-line.

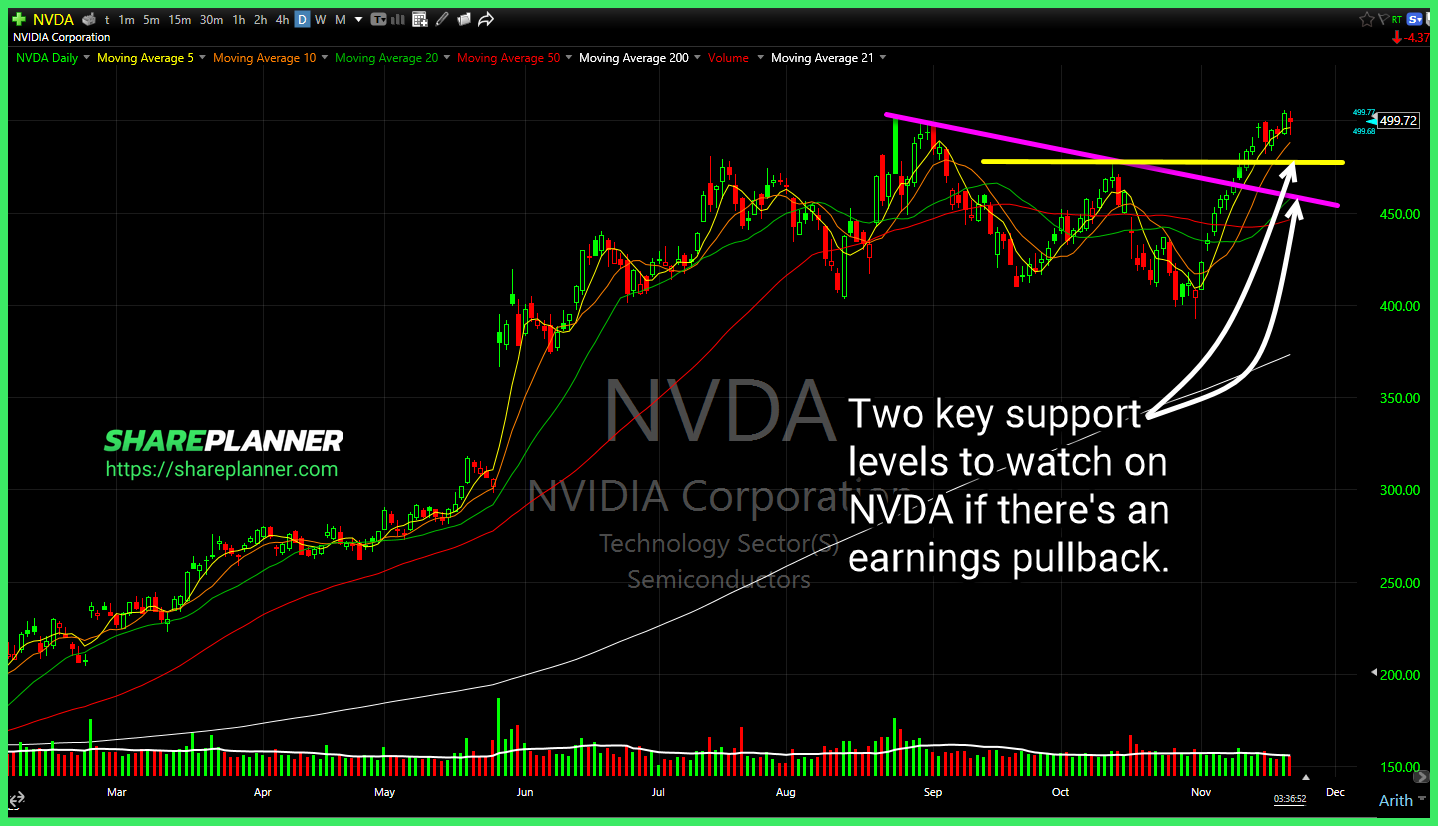

Two key support levels to watch on Nvidia (NVDA) if there's an earnings pullback. Lower channel band on SoFi Technologies (SOFI) getting tested again, without a test of the upper channel band. Watch out below if this level fails to hold. Considering the amount it has sold off during its downtrend, Conagra Brands

$SOFI attempting to bounce off of declining support but still faces overhead resistance. $PLTR breaking out of a declining resistance $AIG may be forming a wedge pattern to play the breakout on, but resistance overhead remains a problem.

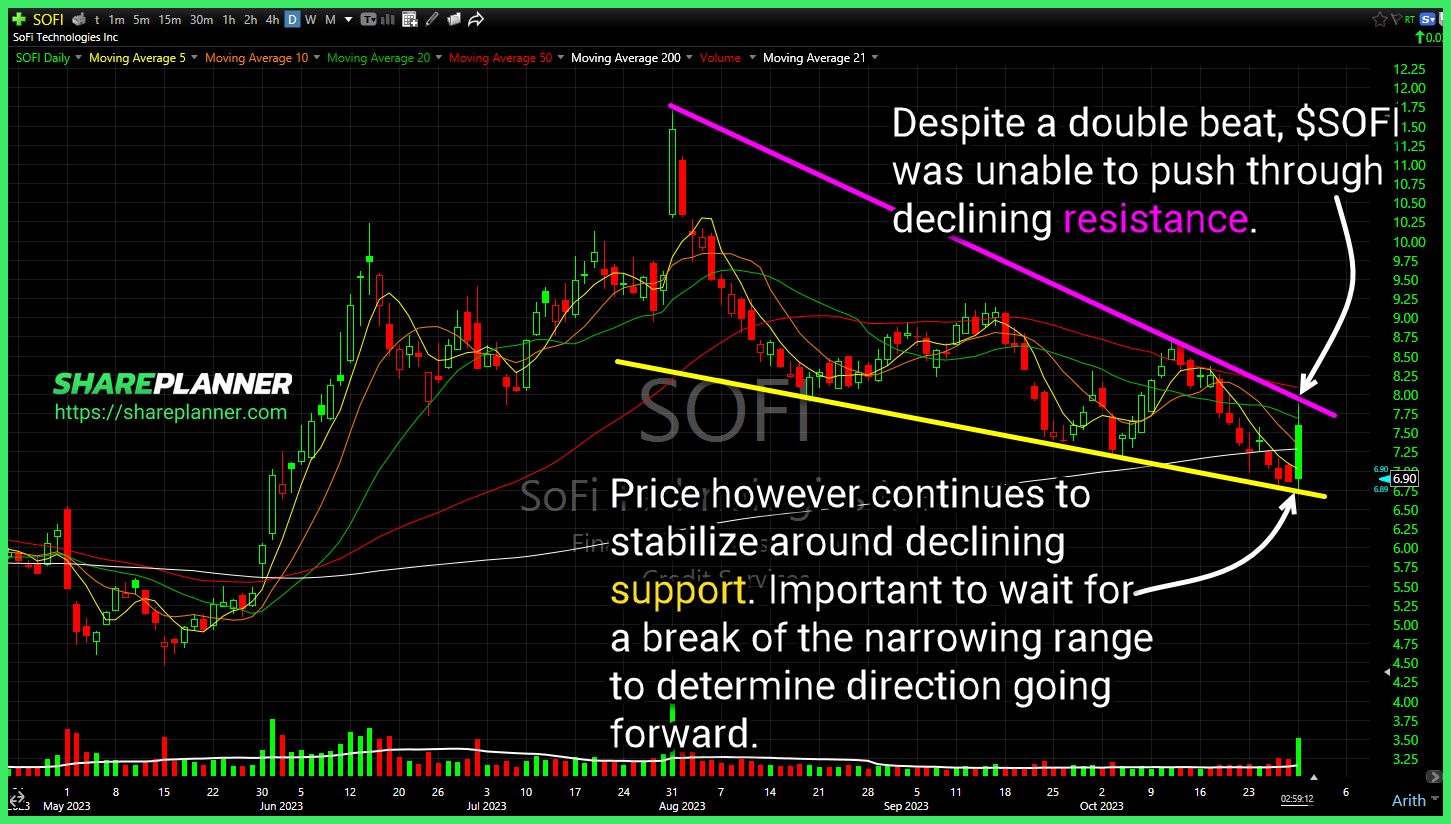

Despite a double beat, SoFi Technologies (SOFI) was unable to push through declining resistance. CBOE Market Volatility Index (VIX) giving up a lot of its gains from the past three days. A break back below support could signal a dead-cat bounce for equities underway. Become a Self-Made Trader Today: Two developments in Rivian Automotive (RIVN)

SoFi Technologies (SOFI) Possible bullish wedge trying to form, but with price testing support, could be setting up for the next leg lower, which has very little support until sub-$5 Big move here out of CBOE Market Volatility Index (VIX) today. May be setting up for another move up to 30. Holding support and bouncing

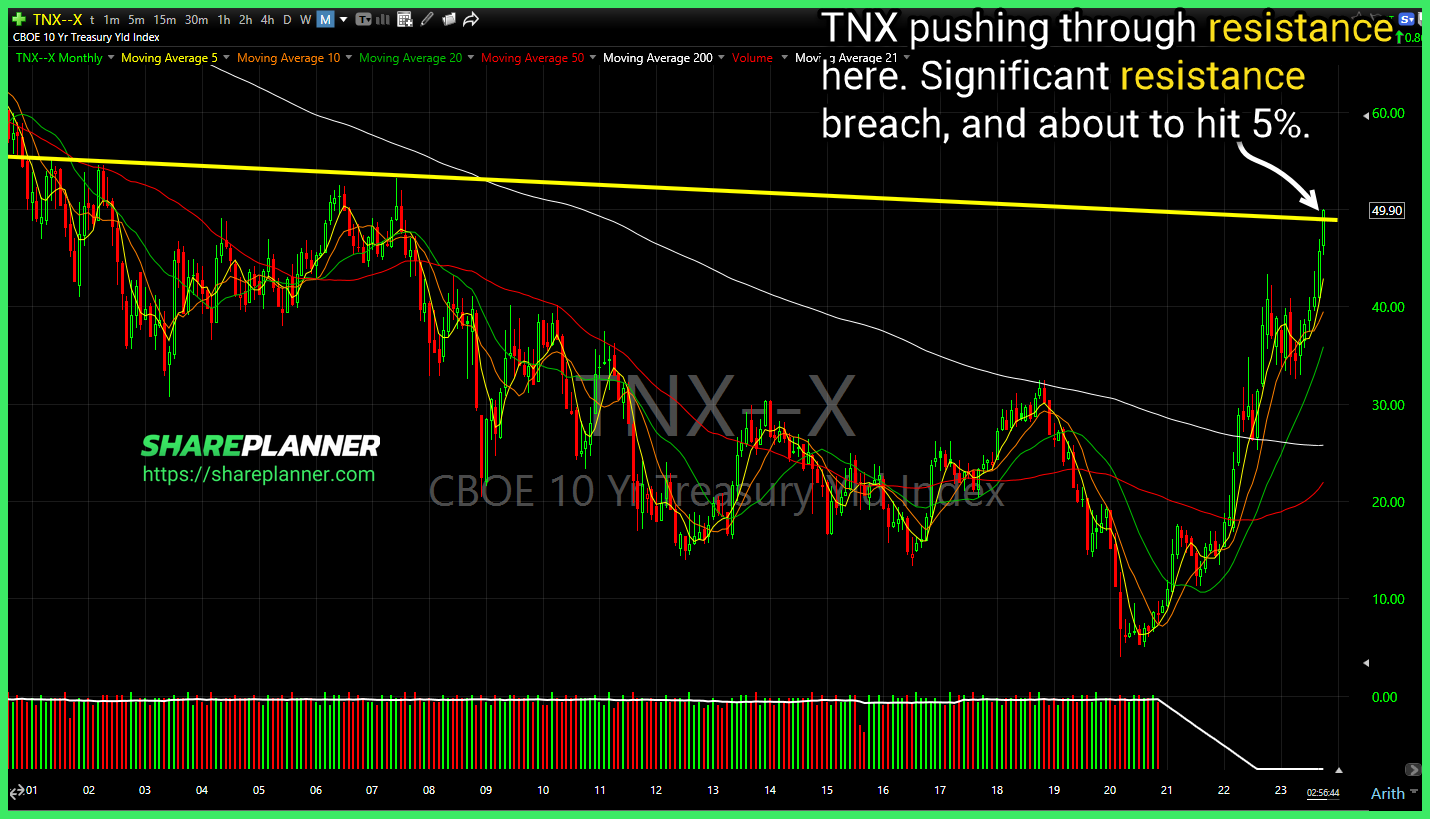

CBOE 10-year Treasury Yield Index (TNX) pushing through resistance here. Significant resistance breach, and about to hit 5%. SoFi Technologies (SOFI) Price breaking back below major support levels. A significant market sell-off could take SOFI back below $5. Triangle pattern in Healthcare Sector (XLV) nearing a break to the downside. Bounce play if

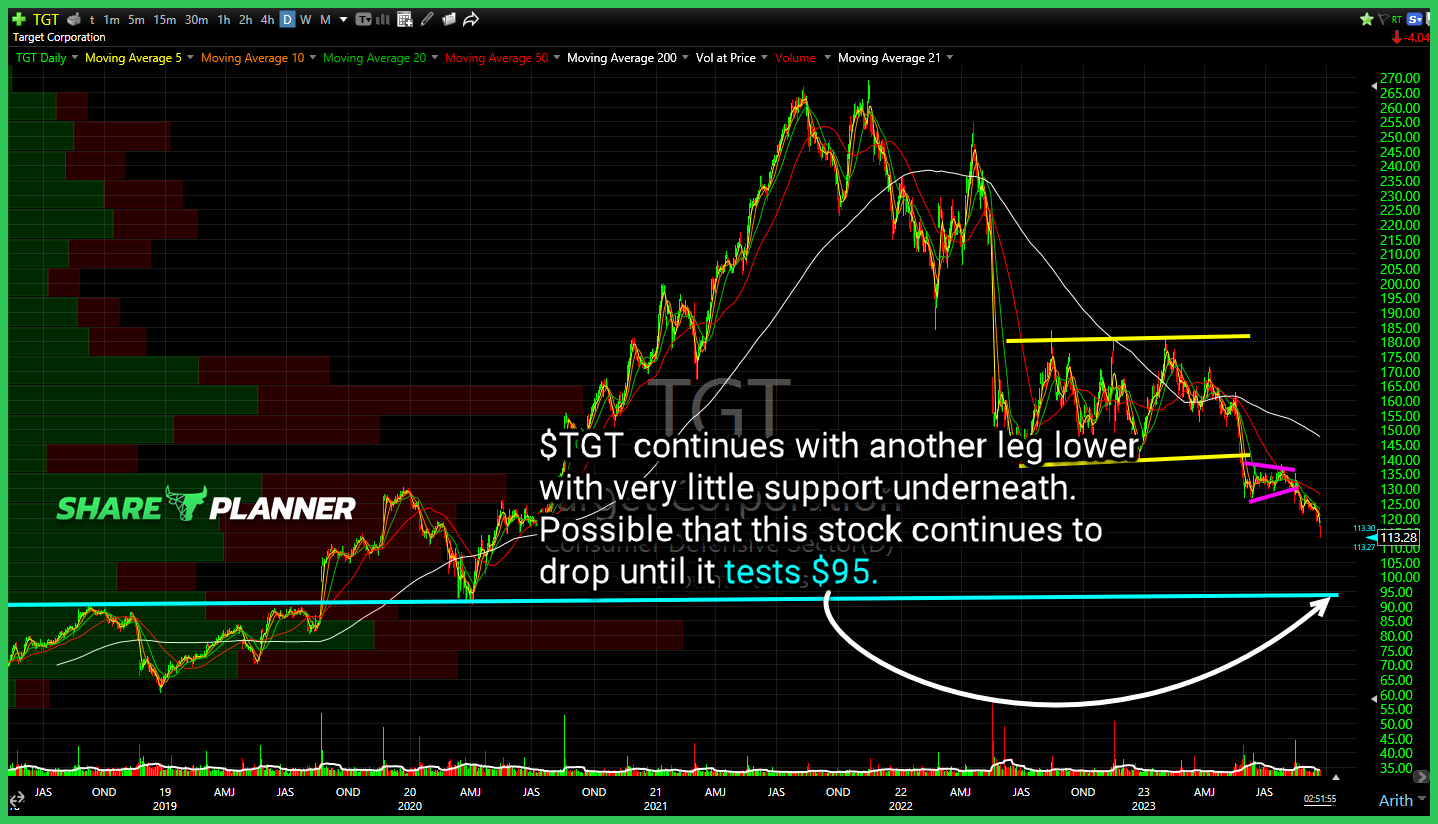

$TGT continues with another leg lower with very little support underneath. Possible that this stock continues to drop until it tests $95. $SOFI confirming that head and shoulders, with little support underneath. Next level is $6.50 followed by $5.25. $RCMT testing key resistance. A push above would create a breakout scenario.

Watch $SLB as it pulls back. If energy continues the weakness today and in the days ahead, a bounce opportunity off of support could emerge. As $ROST pulls back watch for whether it can hold this rising trend-line and ultimately bounce higher. $SOFI working on a cup and handle pattern here. Broke out yesterday, but

Episode Overview The world of meme stocks is a wild and unpredictable, and for those who swing trade these stocks, the risks are unmanageable. Swing traders are experiencing that right now with the crash in AMC stock, dropping over 70% following their 10:1 reverse stock split. In this podcast episode, I draw upon the