I'm watching to see if Advanced Micro Devices (AMD) pulls back to the rising trend-line from the Nanuary lows. If that Holds it could create a nice bounce opportunity. Netflix (NFLX) attempting to finish off this head and shoulders topping pattern. Watch for SoFi Technologies (SOFI) to retest year long support. If it

Episode Overview In this podcast I unravel my strategy behind taking profits in big winning investments when they're up over 100%. This podcast episode illuminates not only the art of booking profits to mitigate risk but also the skill of reinvesting those profits for potential long-term gains. Through real-life examples, I break down my

Episode Overview In this swing trading podcast episode, we delve into the intricate world of swing trading and position trading, two highly effective strategies employed by seasoned investors and traders across financial markets. I unpack the key differences that set these two approaches apart, we explore everything from time horizons and trade frequency to risk

$BTC.X nearing a breakout through year-long resistance. $SOFI coming up on a key support level at the 38.2% retracement level that it will need to bounce from, otherwise, likely looking at a 50% retracement in the $7.30's. $PAYC rejected at the declining trend-line, now retesting support at the breakout. Watch to see if it can

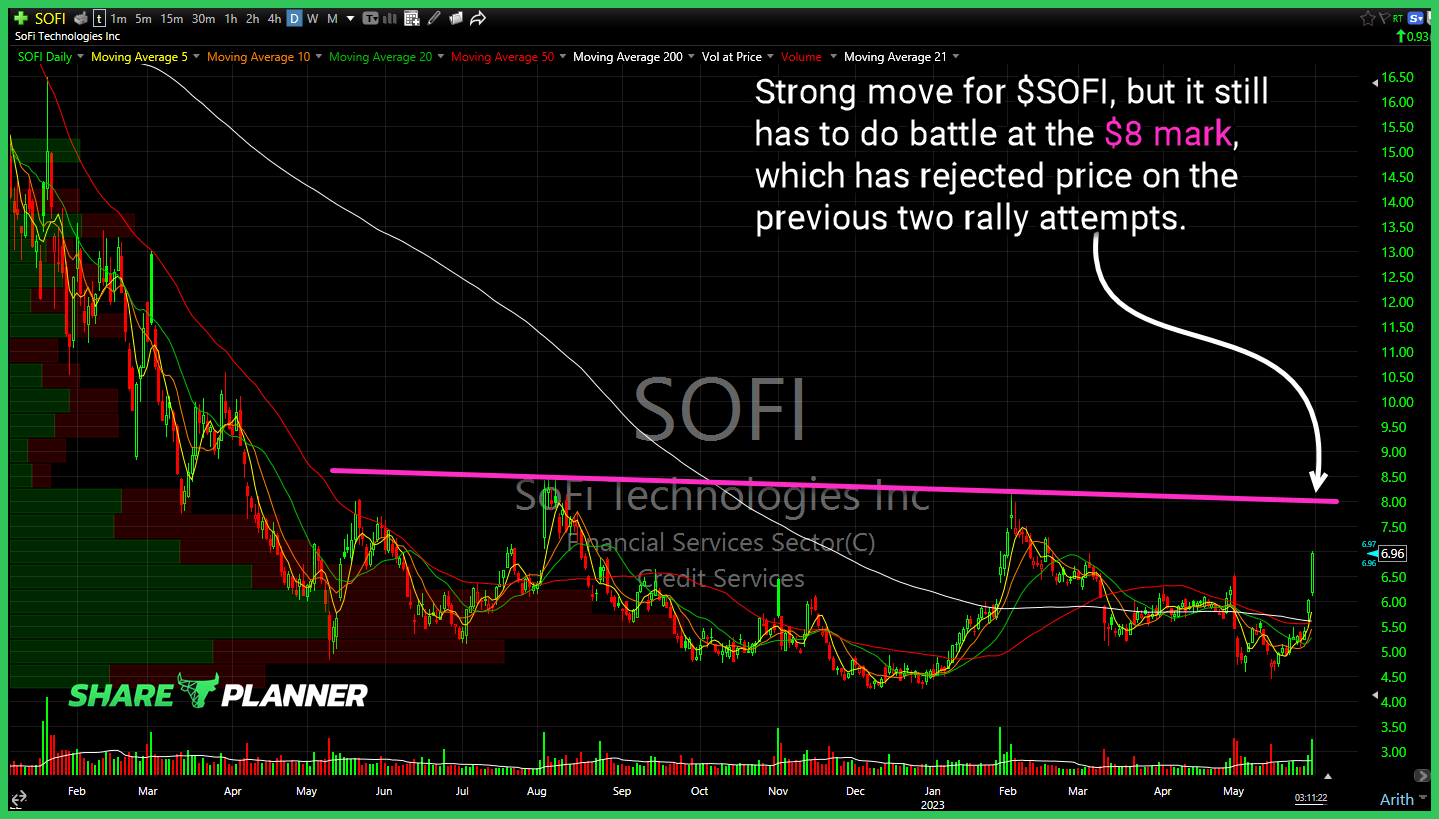

Strong move for $SOFI, but it still has to do battle at the $8 mark, which has rejected price on the previous two rally attempts. $NVDA gap closed, but the effort to bounce it after that failed. Watch for an attempt at filling the second gap. $UNH price action still a struggle, but if it

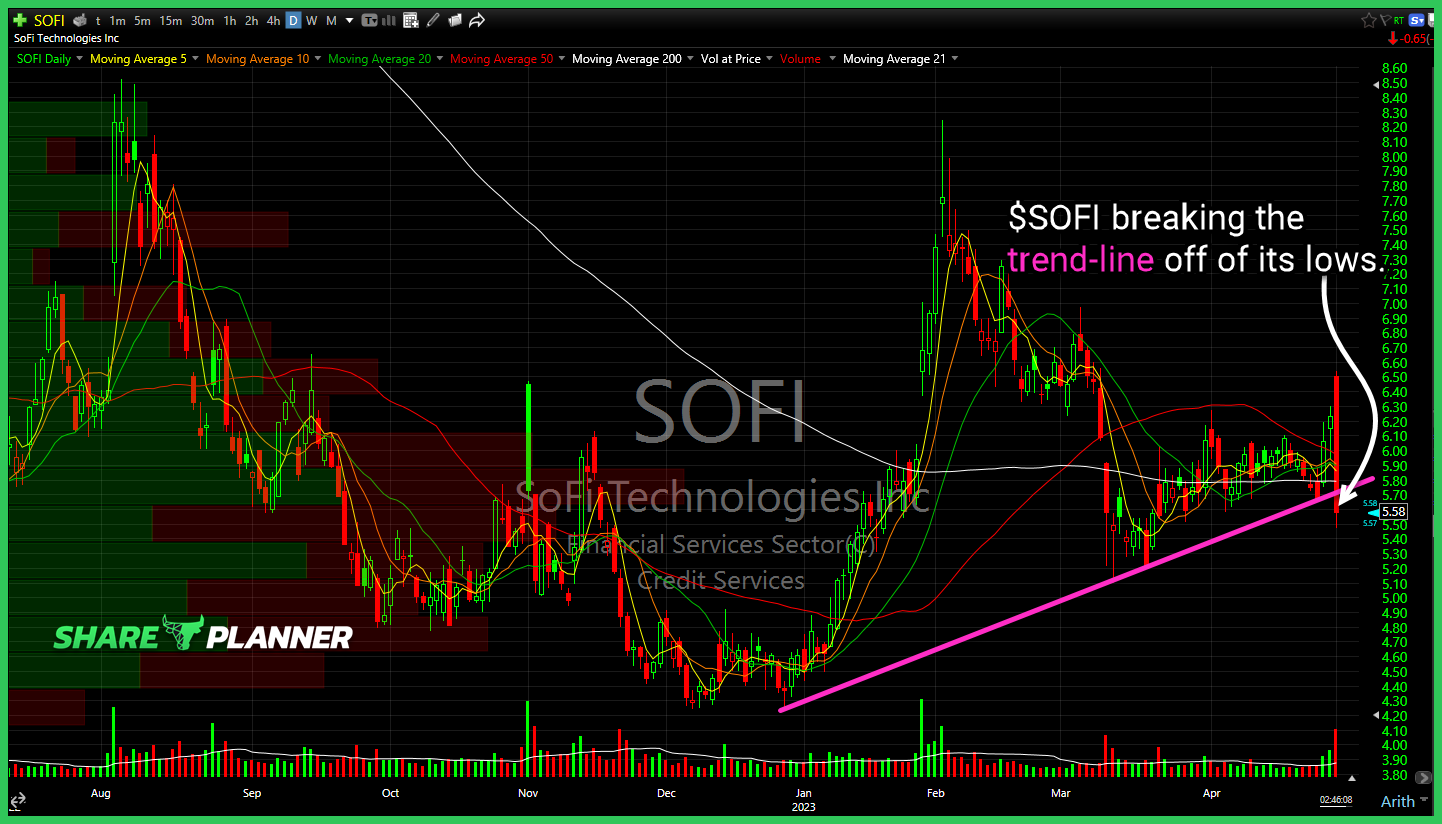

$SOFI breaking the trend-line off of its lows.

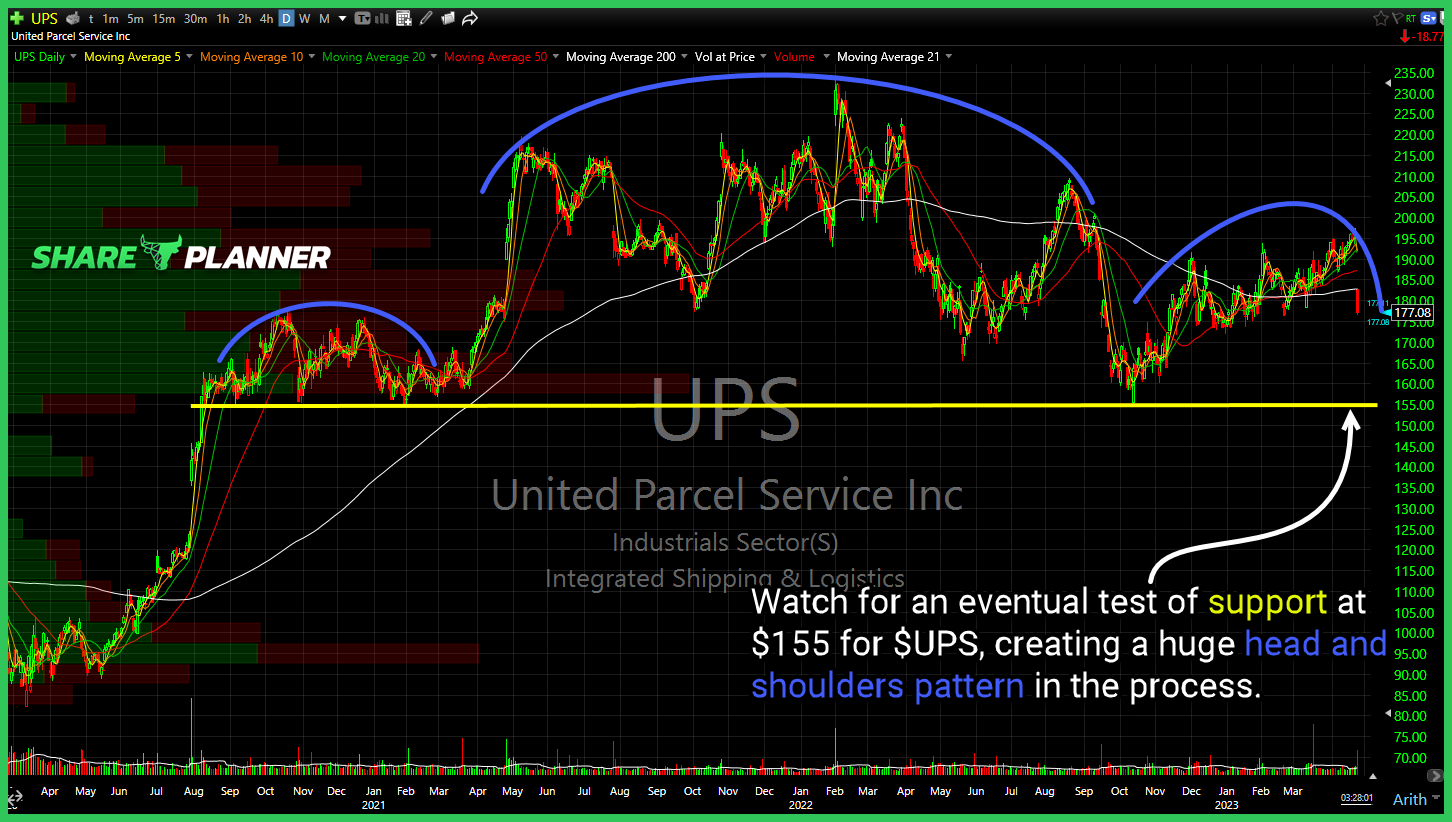

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.

$ALB weekly has a broken long-term trend-line that is now acting as resistance. Potential leg lower here.

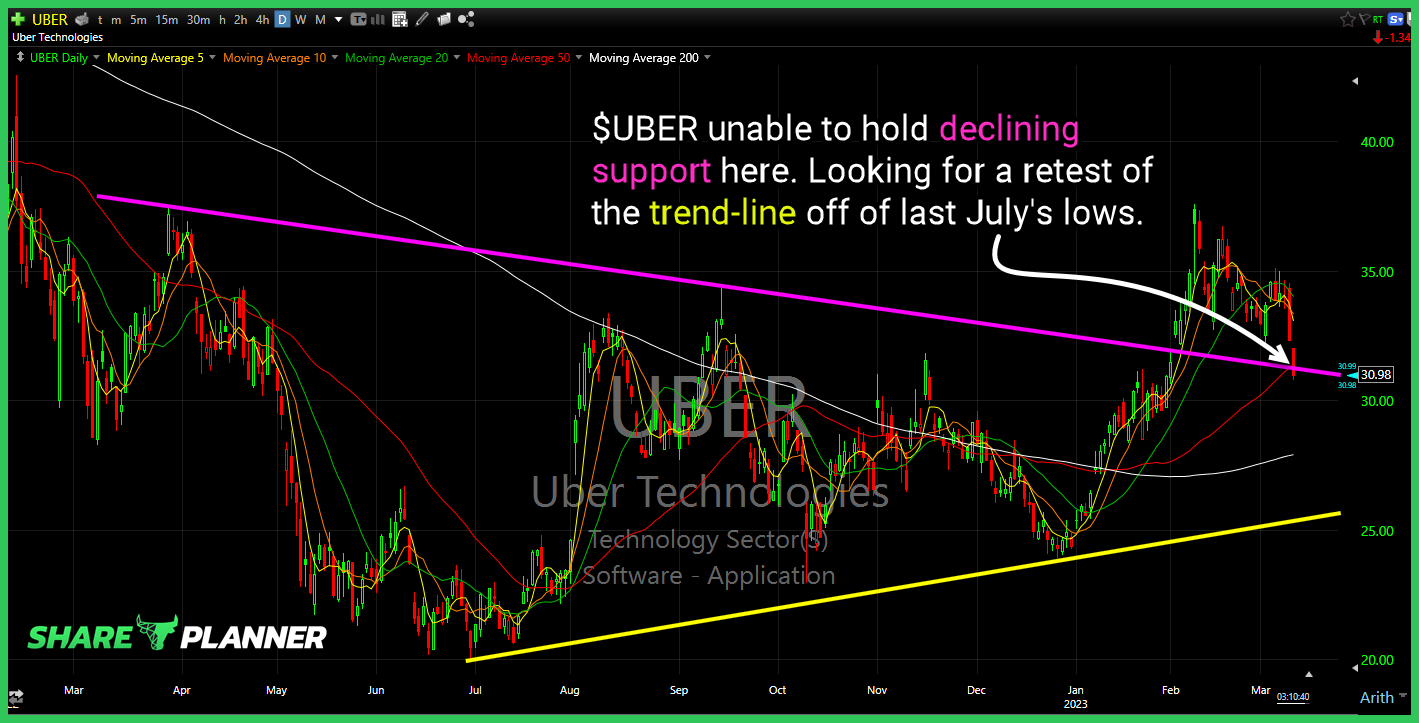

$UBER unable to hold declining support here. Looking for a retest of the trend-line off of last July’s lows.

$CLF inverse head and shoulders pattern testing the neckline for a potential breakout here.