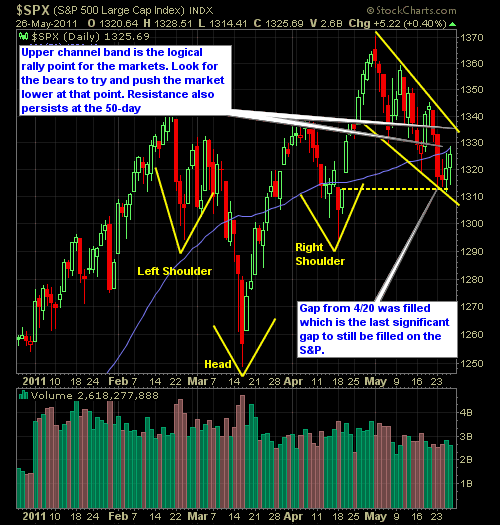

Pre-market update (updated 8am eastern): European markets are trading 0.1% higher. Asian markets traded trading 0.7% higher. US futures are slightly lower. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Producer Price Index (8:30am), Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Industrial Production (9:15am), Housing Market Index (10am), E-Commerce Retail

Pre-market update (updated 8am eastern): European markets are trading 0.1% higher. Asian markets traded traded mixed/flat. US futures are slightly higher. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Import and Export Prices (8:30am), Redbook (8:55am) Technical Outlook (SPX): SPX managed to close at all times highs for the second straight

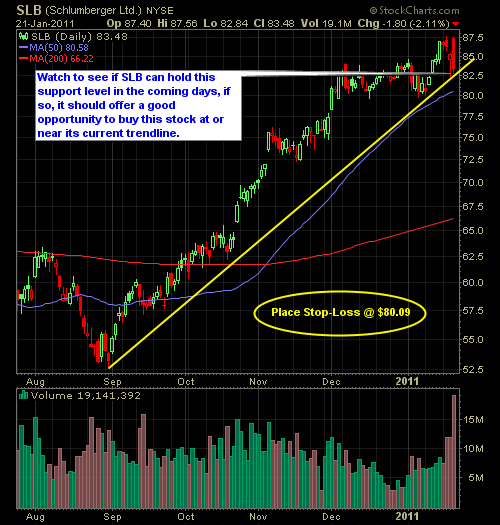

A few long setups to consider for a market that could very well continue this bounce into tomorrow. LONG: CF Industries (CF) LONG: Varian Medical Systems (VAR) LONG: Pioneer Natural Resources (PXD) LONG: Boeing (BA) LONG: Schlumberger (SLB)

Current Long Positions (stop-losses in parentheses): SLB (82.77) Current Short Positions (stop-losses in parentheses): None BIAS: 100% Cash Economic Reports Due Out (Times are EST): S&P Case-Shiller HPI (9am), Chicago (9:45am), Consumer Confidence (10am), State Street Investor Confidence Index (10am), Farm Prices (3pm) My Observations and What to Expect: Futures are up strong

Current Long Positions (stop-losses in parentheses): SLB (82.77) Current Short Positions (stop-losses in parentheses): None BIAS: 10% Long Economic Reports Due Out (Times are EST): Personal Income and Outlays (8:30am), Consumer Sentiment (9:55am), Pending Home Sales Index (10am) My Observations and What to Expect: Futures are slightly higher at the open. Asia was

Current Long Positions (stop-losses in parentheses): PEP (70.10), NFLX (237.25), GLD (144.73), ANV (34.25), FDO (53.28), SLB (82.77) Current Short Positions (stop-losses in parentheses): None BIAS: 10% Long Economic Reports Due Out (Times are EST): GDP (8:30am), Jobless Claims (8:30am), Corporate Profits (8:30am), EIA Natural Gas Report (10:30am) My Observations and

After taking profits in all my positions except for Family Dollar (FDO), which included NFLX (+5.3%), GLD (+0.6%), ANV (+1.9%), and CMI (+3.2%), I decided to get into Schlumberger (SLB) at $84.17. I like the trade a lot and has the potential to make a run to $88 in the very

After taking profits in all my positions except for Family Dollar (FDO), which included NFLX (+5.3%), GLD (+0.6%), ANV (+1.9%), and CMI (+3.2%), I decided to get into Schlumberger (SLB) at $84.17. I like the trade a lot and has the potential to make a run to $88 in the very

Here are Monday’s Daily Long and Short Setups… LONG: Schlumberger (SLB)

Current Long Positions (stop-losses in parentheses): None Current Short Positions (stop-losses in parentheses): None BIAS: 100% Cash Economic Reports Due Out (Times are EST): Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Housing Market Index (10am) My Observations and What to Expect: Futures are mixed, with the Nasdaq down over 15 points