$XLK fighting a major resistance level that goes back for the past year.

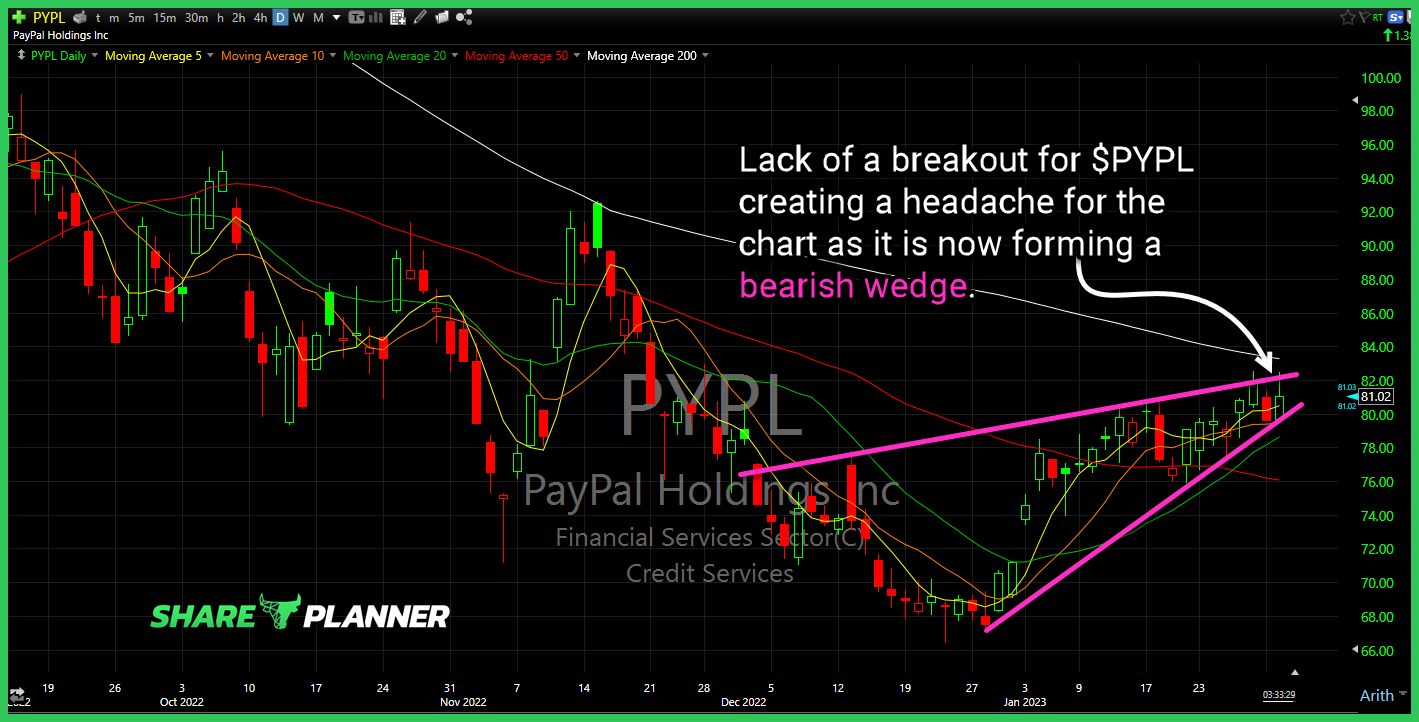

Lack of a breakout for $PYPL creating a headache for the chart as it is now forming a bearish wedge.

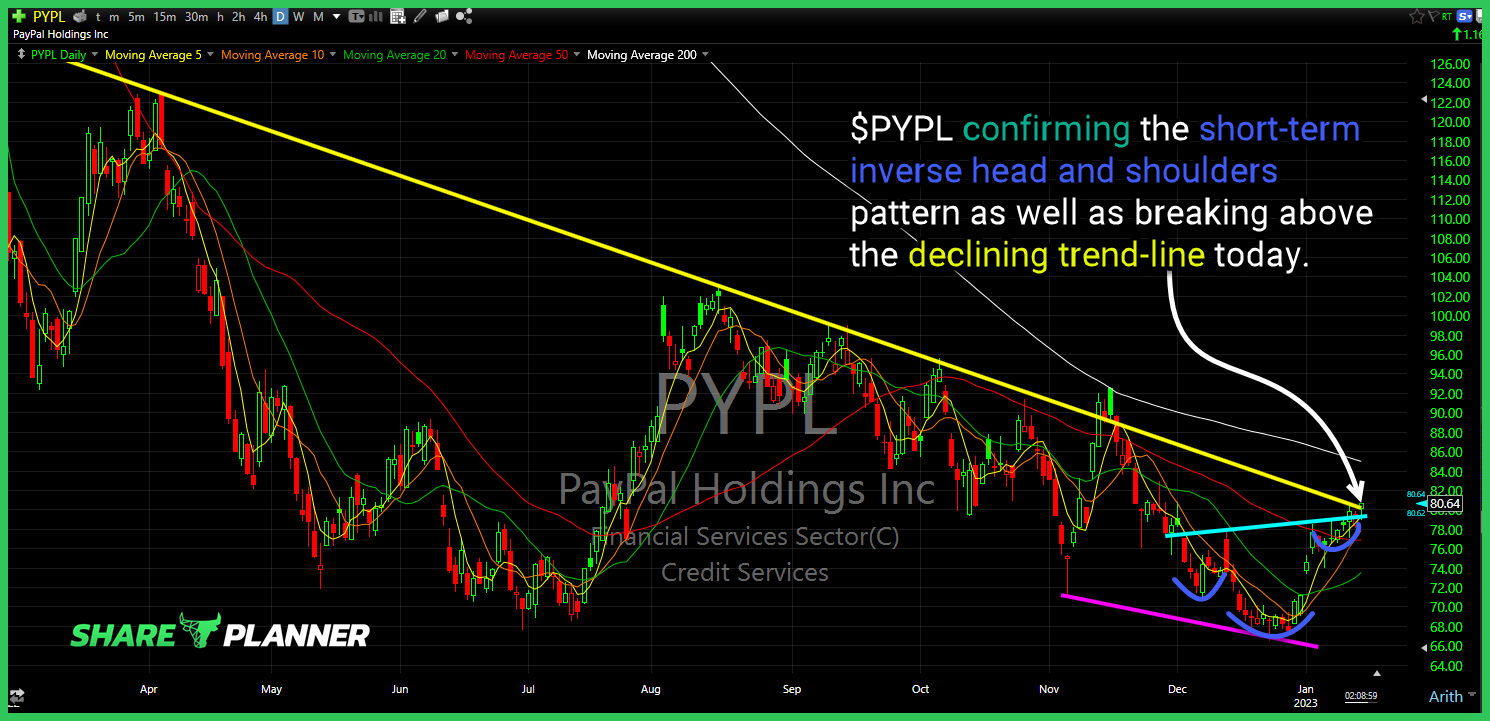

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.

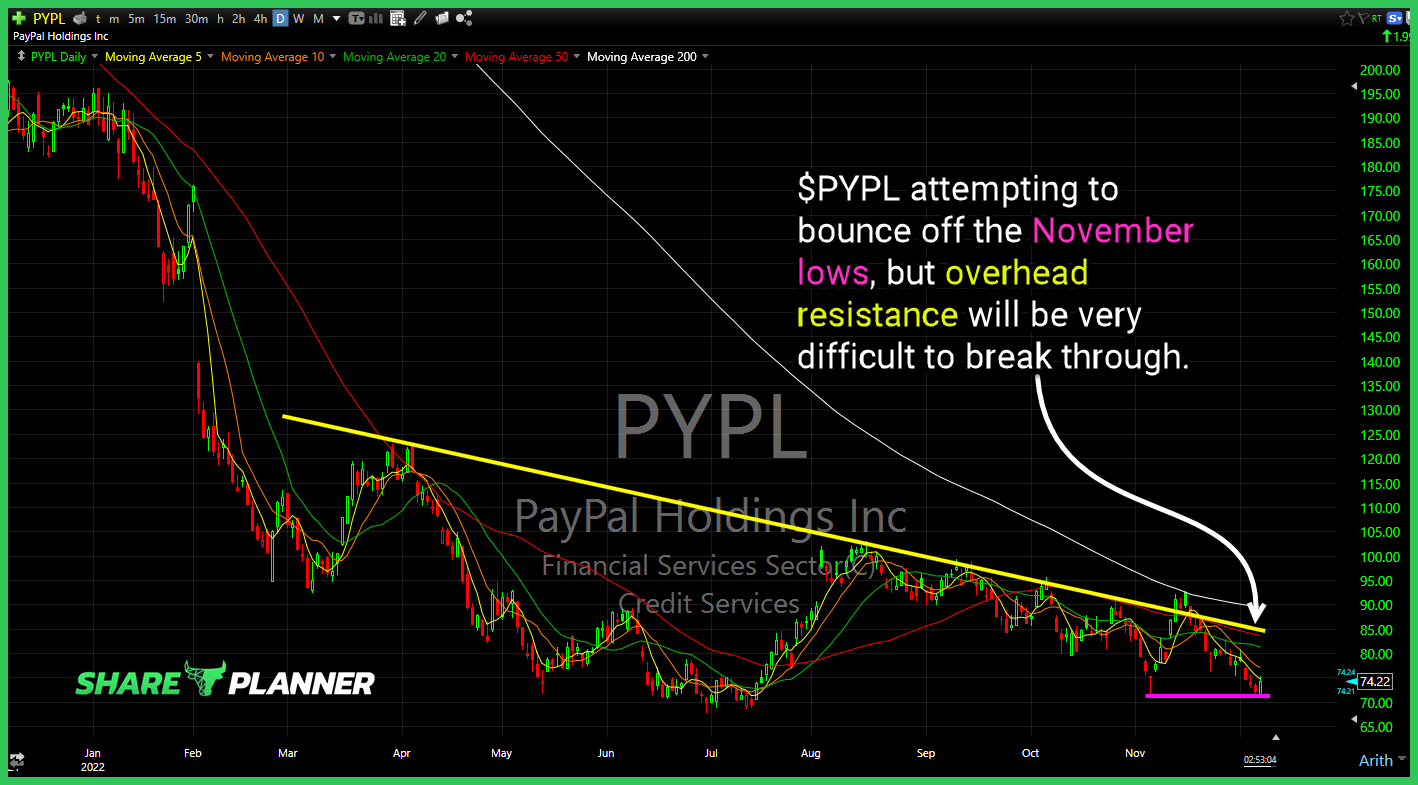

PayPal (PYPL) attempting to bounce off the November lows, but overhead resistance will be very difficult to break through. Applied Materials (AMAT) Watch the triangle pattern here for a potential breakout as it attempts to bounce off of the rising trend-line. Bear flag confirmed on Western Digital (WDC) Utilities (XLU) solid uptrend remains

$MSOS testing resistance on the spike higher.

$COST holding on to the rising trend-line here. Watch for a potential bounce.

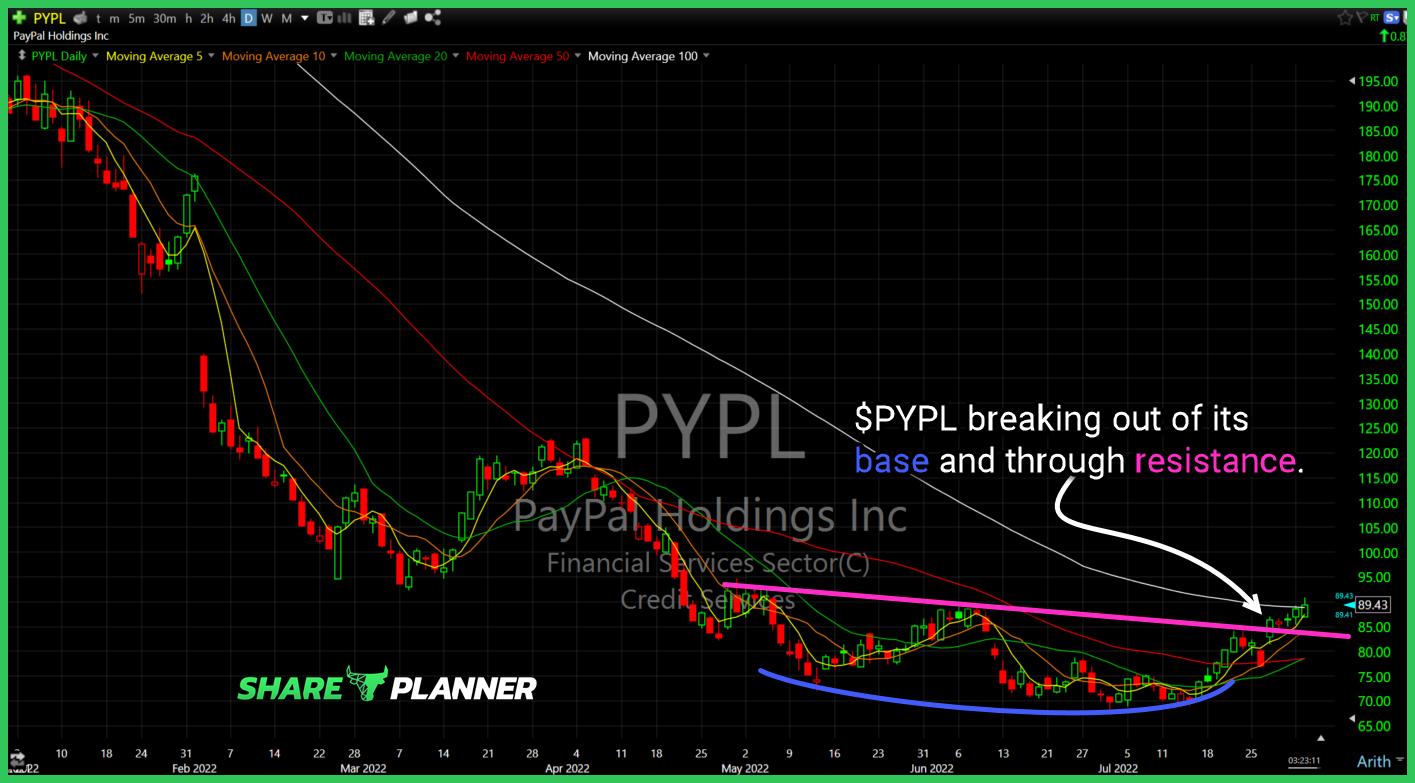

$PYPL breaking out of its base and through resistance.

Quite the reversal for $SPY $SPX today.

Anyone still investing in $SPOT is in the red after it broke support and hit new all-time lows. Breaks my heart to see it happen.

$PYPL 1) Major gap filled today going back to May of 2020, 2) major price support being tested here from 2019. Not worth buying on the day, of, but worth watching to see if there is a willingness to bounce off the level in the days ahead.