Swing Trade Approach:

I mean, the market gives little incentive to those looking to short this market, so it is hard to have any sizable short presence in this market. I have a few positions, but I am by and large, very long on this market. I’m looking for reasons to book gains at this point. I took half my position in Royal Caribbean (RCL) for a +12.6% profit and will let the rest ride. I took a 5.7% profit in KLA Corp (KLAC), there were two additional long positions that I closed out as they were no performers and hit their stops. Yup, even in a bull market, you’ll have a few of those.

Indicators

- Volatility Index (VIX) – Pushed over 16 this morning, but quickly fell apart and closed 1.2% lower at 13.85.

- T2108 (% of stocks trading above their 40-day moving average): Finished 1.3% higher, after opening the day below 60%. I’m still dumbfounded how many stocks are still struggling in this market.

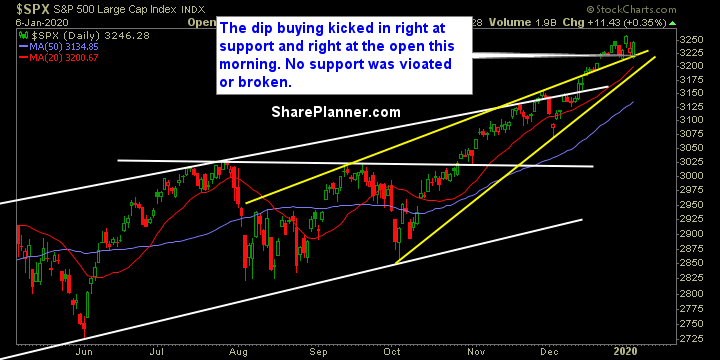

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy continues to be phenomenal. The rally off of the December lows, is as good of a rally as you’ll ever find in a sector. But you also have Healthcare which has its eye on almost 20% worth of gains going back to the beginning of October. Watch the bull flag there to break out to the upside and continue the trend higher. Real Estate and Telecom are the two sectors that I would avoid at this point. They simply aren’t doing anything for traders.

My Market Sentiment

Consolidation over the last two weeks, and a breath away from new all-time highs. For the bulls, the consolidation works off the overbought conditions, and sets it up for another leg higher.