Yup - they are back to the dip buying.

Mag7 stocks are the ones leading this market lower this year relative to the rest of the S&P 500.

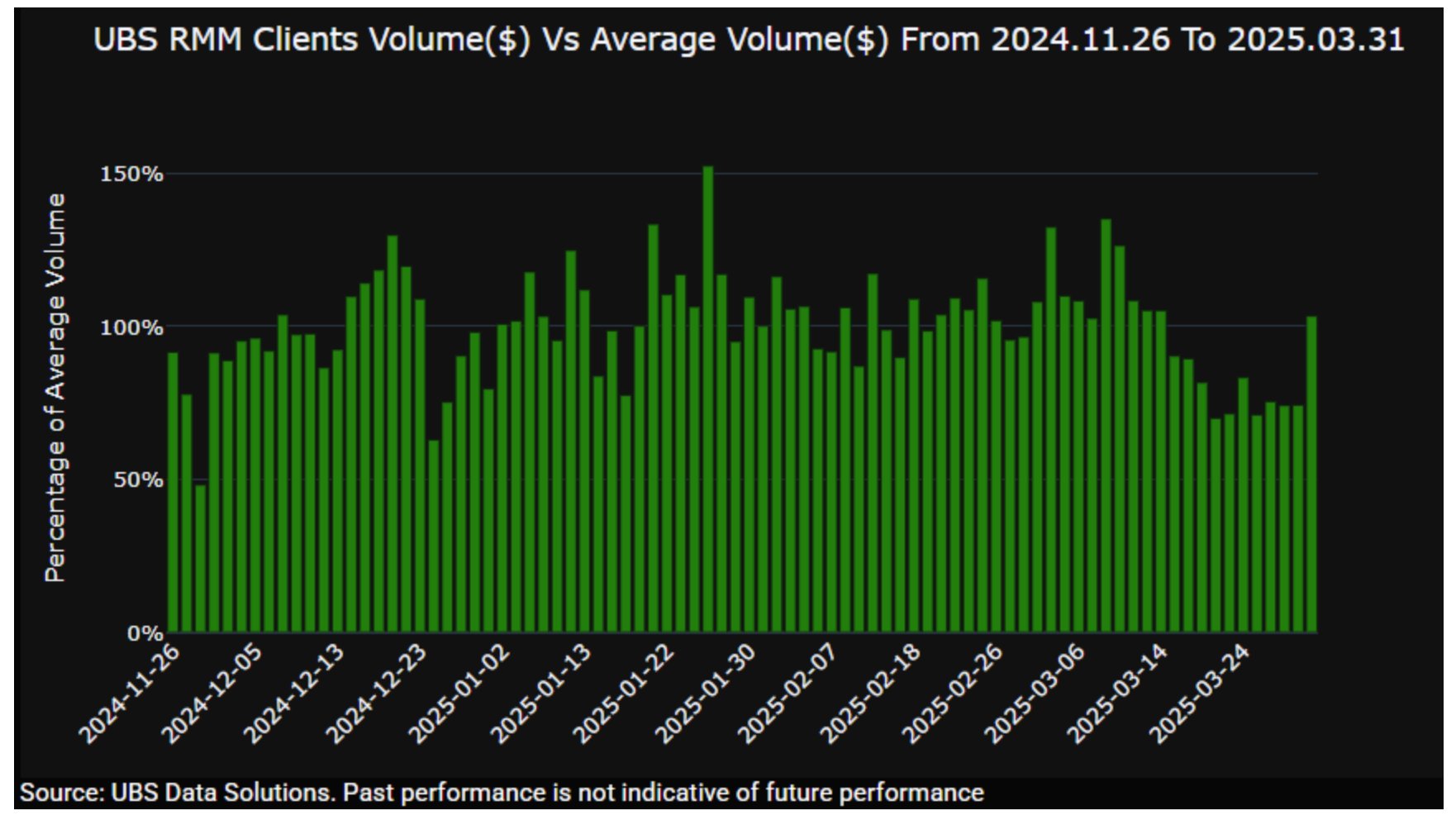

Largest net selling in stocks by hedge funds last week in the last 5 years.

Resistance on VIX is no joke! Going back to 2020, continues to get crushed at this level.

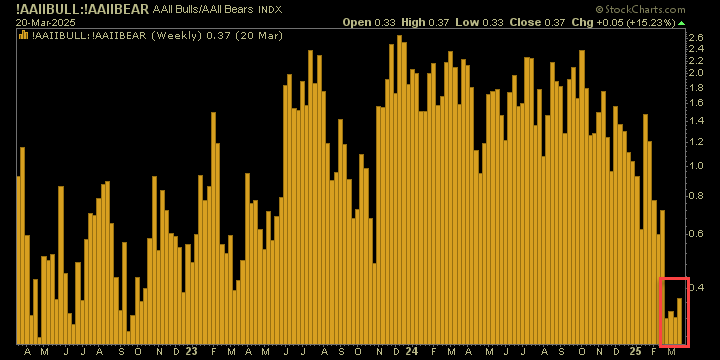

Sentiment from retail has seriously fallen off a cliff and smacked the bottom!

DIS bull flag pattern, but also playable is the bounce off of the 50-day and 200-day moving averages. Keep watching the bull flag in NFLX...not in play today, but could be in the new year. T2108 (% of stocks above their 40-day moving average) remains extremely overstretched and seeing some divergence in the last three

The stock market bubble looks unstoppable And it makes you actually wonder "will the stock market always go up?" With each sell off in stocks, comes the feeling of a stock market crash, only for the dip buyers to buy in at critical support levels. And as we continue investing in stocks and in a

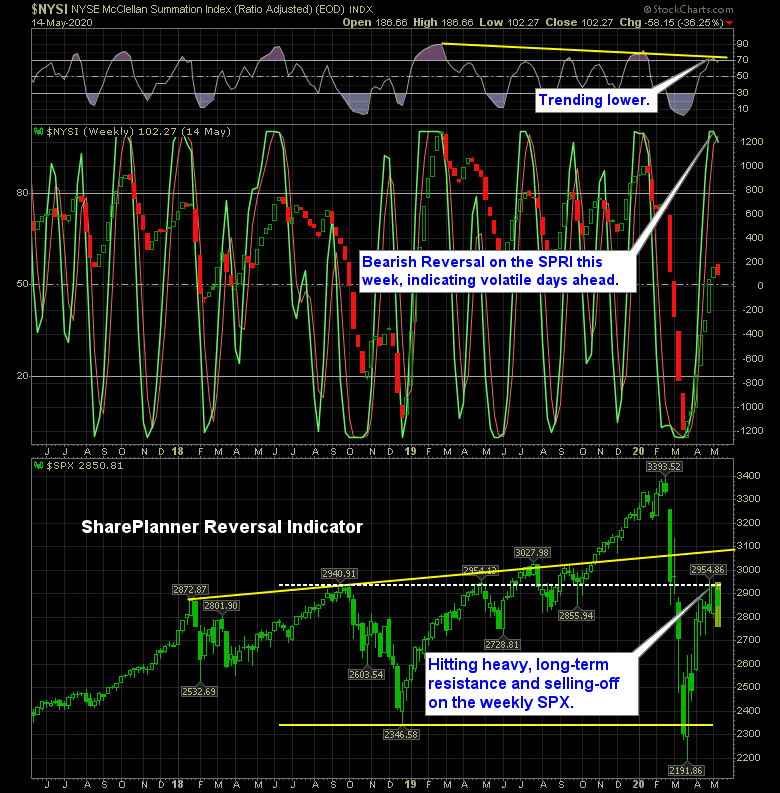

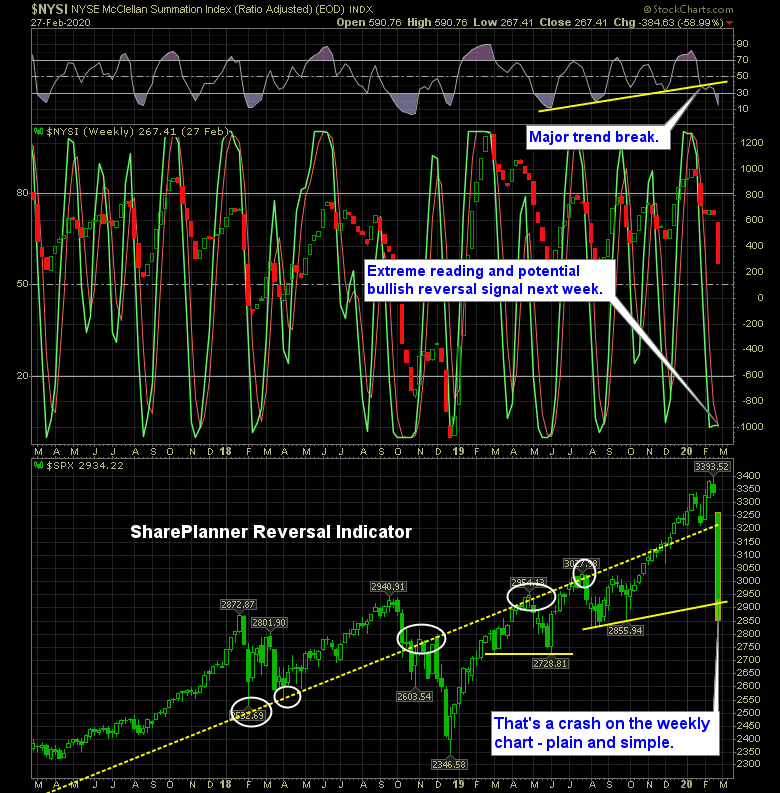

Stocks setting up for further downside. Phenomenal rally of late, but considering the overzealous nature of the market of late, and irrational behavior of the Robinhood Bro’s to keep buying the dip at a relentless pace, the SharePlanner Reversal Indicator is flashing reversal signs that further downside beyond what has been seen this week

Bearish Reversal Setting Up This has probably been one of the most unexplainable market rallies of our time. Of course when you realize the Fed has added unlimited amounts of funding to the financial market with no care for inflation, and even signaling negative interest rates in the near future, well, I guess, I can

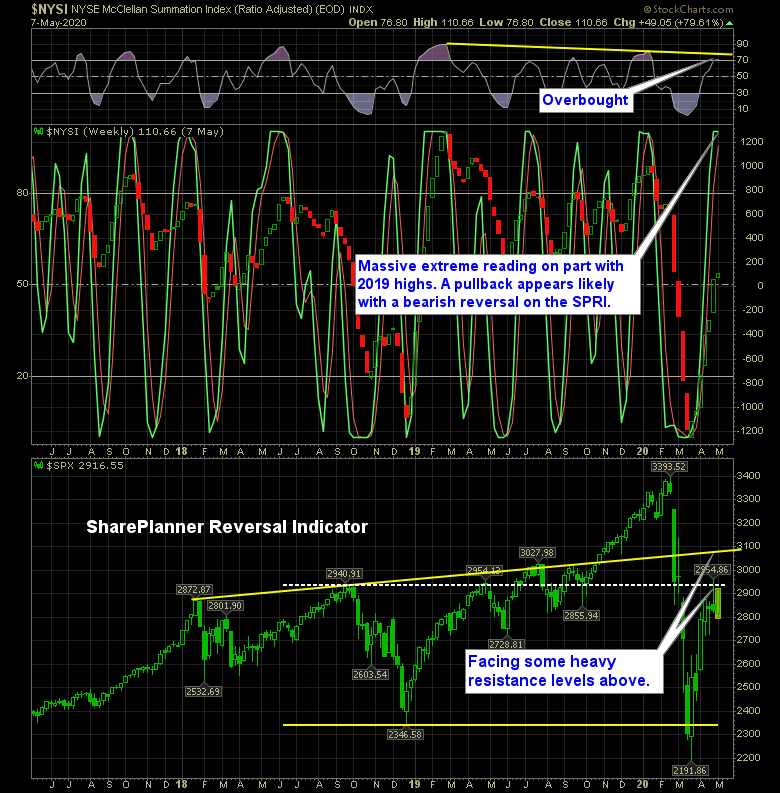

Nearing a bullish reversal, but for now, this stock market is still crashing And should be treated as such! Yes, the SharePlanner Reversal Indicator, over the years, has been amazing at timing bullish reversals in the market, and it is nearing one here. No, it isn’t there yet, but next week is certainly a possibility.