Bearish Reversal Setting Up

This has probably been one of the most unexplainable market rallies of our time. Of course when you realize the Fed has added unlimited amounts of funding to the financial market with no care for inflation, and even signaling negative interest rates in the near future, well, I guess, I can see where the market might like such a thing.

You also have the Robinhood bros that are piling in their stimulus checks and unemployment compensation into the hottest stocks on the market like Tesla (TSLA), Roku (ROKU) and Wayfair (W) hoping to get instantly rich.

But what they are not doing is managing risk, and that is the only thing you should ever concern yourself with in the stock market. You either protect yourself to the downside or you eventually lose, and lose big.

Right now, everything in sight is bullish:

- More Covid deaths: Bullish

- More job losses: Bullish

- Shrinking GDP: Bullish

- Small business shutting down permanently: Bullish

- Inflation: Bullish

- Adults doing cringy TicTok vidoes: Bullish and still Cringy

- China and US Trade Starting back up the trade war: Bullish

- Ending the Trade War: Bullish.

Yes, trade talks are rallying the market along today despite 15% unemployment, because, of course traders have to YOLO into their SPY OTM Calls and make bank, am I right?

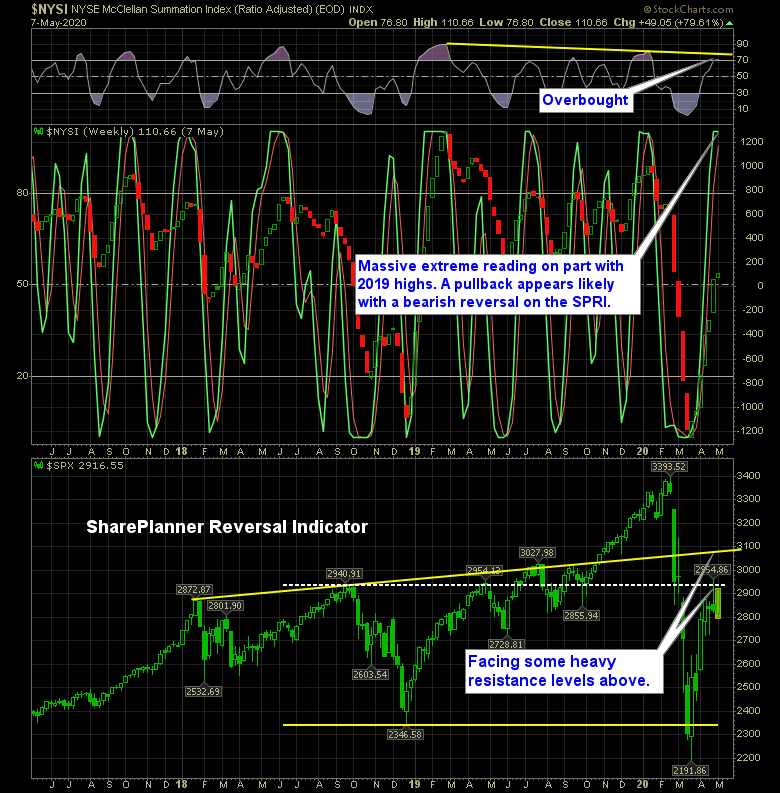

But below you have another story unfolding, the SharePlanner Reversal indicator suggests that people are fighting at bullish extremes for less and less gains. What happens when that occurs? The rug gets pulled. Look, traders as a whole do not make money. Right now they are, but that has to end at some point, because unless it is “different this time” (and it never is), these people are going to have to spill their blood into the streets in the form of their hard earned capital (and gov’t money too).

Here’s the SharePlanner Reversal Indicator:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.