Early reversal on the indicator has the bulls feeling optimistic for all-time highs. I’ll admit though, if we have to deal with this kind of chop fest on our way to all-time highs, it isn’t going to be a very fun experience that’ll be for sure. Money is rotating in and out of sectors and

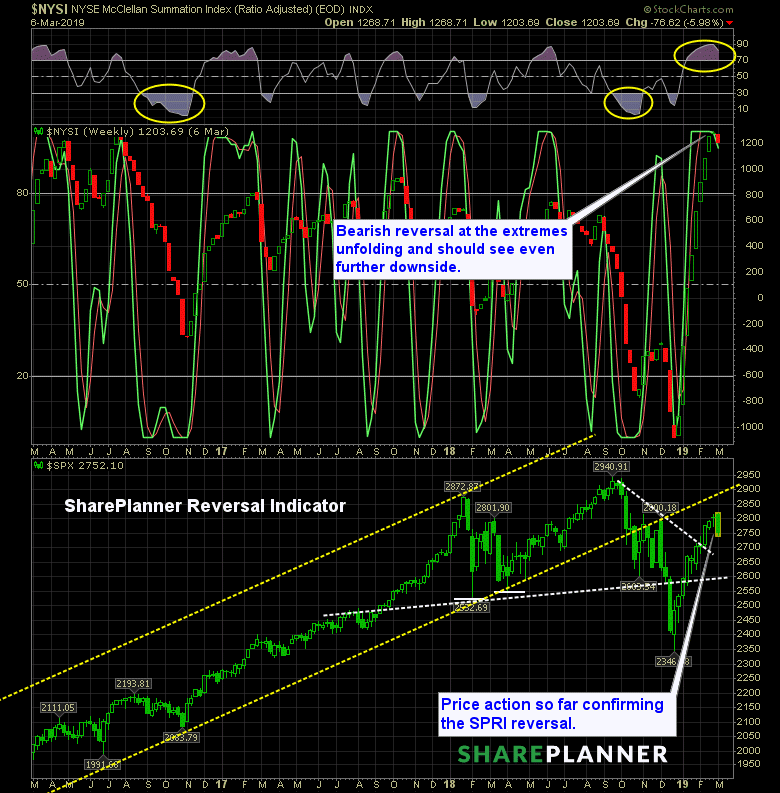

Bearish reversal a month ago results in choppy price action since. That is often the case with the bearish reversals following a strong market rally. It offers the market a chance to consolidate price. So far, with the bearish reversal starting to hit the lower extremes of the indicator, anticipating a major price correction becomes

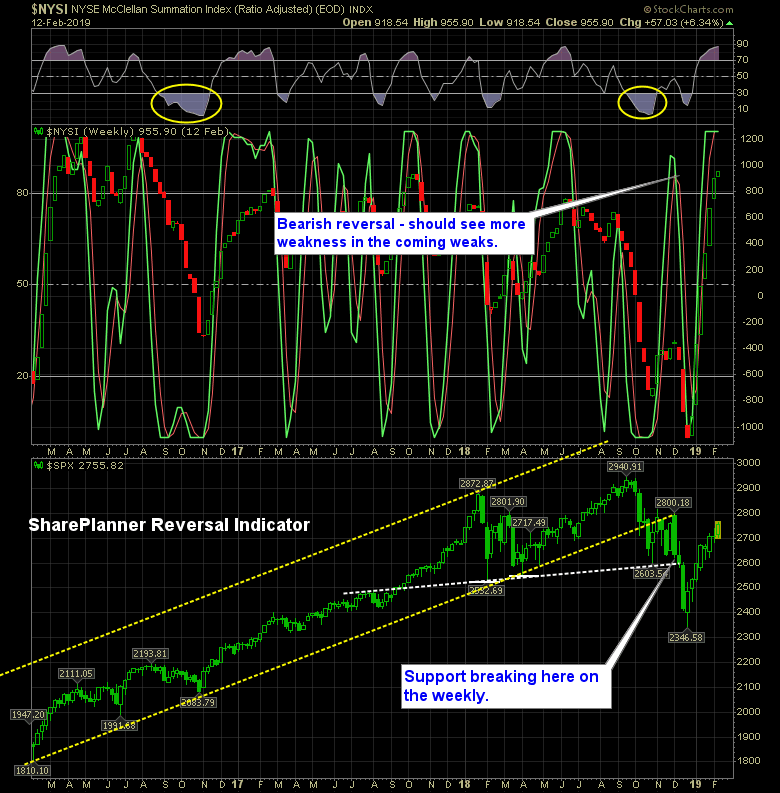

Bearish on my reversal indicator For nine out of the last ten weeks, the market has risen in a ferocious manner. Unhinged you may even say. But this week has been quite different, and on the weekly chart the bulls are staring into the face of a bearish engulfing candle pattern. More importantly is the indicator

Equities are overbought and the Reversal Indicator Agrees We’ve seen for the past 10 years how a market can get overbought and stay overbought for a very long time, and for the past couple of weeks, the market has been extremely overbought, and there are signs that the buying is exasperated as indicated by the

My Swing Trading Approach I used yesterday to take advantage of the strength in Square (SQ) and book profits for a +4.5 profit. I also added another trade to the portfolio yesterday, and will look to do the same, as long as the market can hold up today. But any additional trades at this

My Swing Trading Approach Yesterday was a damn good day with a +13.1% profit in my ROKU swing-trade. The trade was placed last Wednesday and closed out yesterday following an amazing run. I still hold two additional long positions, and held off adding anything new yesterday to the portfolio. Indicators Volatility Index (VIX) – VIX

My Swing Trading Approach Stopped out of one position but added another on Friday. Holding respectable gains in two of my positions, but likely to stay put as the market remains on uncertain footing at recent highs. The market continues to have issues over the past week with fading morning gains, throughout the afternoon. I

My Swing Trading Approach I added one additional long position to the portfolio yesterday. I may add another today, but the market will have to show me it is intent on rallying again and none of this meandering like we saw following yesterday’s gap higher. Indicators Volatility Index (VIX) – Closed right on the 200-day moving

My Swing Trading Approach I added two new long swing-trades to the portfolio yesterday. However, I will be a little more reserved about how many new longs I add today. The market will have to prove it wants wants to break the declining downtrend off of the October highs. Indicators Volatility Index (VIX) – Looking at

My Swing Trading Approach I am coming into today 100% cash, but also very skeptical about getting long on this market as most trading sessions where there is a strong earnings report that comes out, usually sees price fade throughout the trading session. I closed out my position in Bank of America (BAC) yesterday