Swing Trading Results for April were solid – this despite an unmovable and dull stock market

The month of April finished higher for the month with some really good swing trading profits but it wasn’t until April 24th, when the market finally decided to gap higher in a big way, did the S&P 500 break a profit for the month.

I firmly believe that the key to a dull market like what was seen in April, and even in our swing-trading in March too, is to tightly manage the risk. You don’t want to be taking a 10% or 15% loss when the market is trading in a 1% price range.

It makes recovering from that kind of loss extremely difficult.

You also want to keep risk tight because if you find yourself on the side of a trade that happens to net you 10-15%, you then find yourself in a position to significantly outpace the market returns.

And that is a good thing!

You want to trade in a such a way that puts yourself in a position to benefit from the benevolence of the market when it comes your way.

The risk that I took on average in April was about half of what I normally take in a trending market. Instead of 3-4% stops in a strong trending market, I was looking for 1.5-2% in a sideways/consolidating market.

Now, lets get down to what worked in April for me:

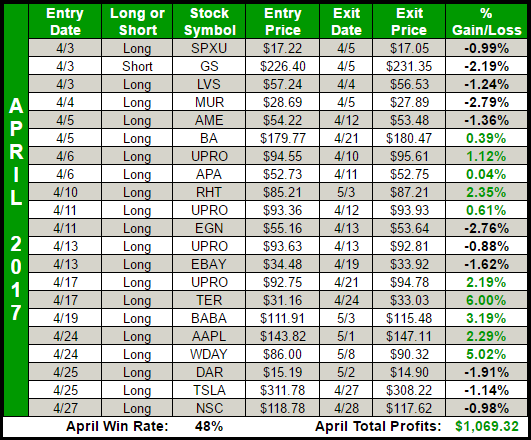

April marked my 15th straight profitable month trading in the stock market. It wasn’t an easy month by any means, as I got off to a slow start, but quickly recovered from the early losses to put up a profit at month’s end.

The Nasdaq/Technology stocks were the go-to stocks for the month. The Nasdaq trended nicely and that is where I put my capital for the most part. Trades in Teradyne (TER) netted me a solid 5% when I traded it over the course of a week from $31.16 up to $33.03.

Another favorite trade of mine was in Workday (WDAY) that rose from $86 up to $90.32. I was very much focused on preserving the swing trading profits and ultimately got stopped out for a 5% profit. The bummer in all of that is that the stock continued to rise higher in the month of May – all the way up to $100.00.

But enough about the coulda, shoulda, wouldas. Let’s break down the month’s performance:

-

I was correct on 48% of my trades overall.

-

10 out of 19 (53%) trades were profitable that that were focused on bullish/long setups.

-

0 out of 2 (0%) trades were profitable that were focused on bearish/short setups.

Take the first two trades out of the month that were focused on the short side of the market (SPXU is a 3x Bearish ETF on the S&P 500), and I actually win a majority of my trades for the month.

RELATED: Swing Trading Stock Returns in February

On April 5th, that trading session, really stunk. There is no better way to describe it than that. Essentially the market opened up and ran very hard early on. The internals were bullish, the price action was bullish, everything was bullish. I came into that day short, but that run early on ran my stops in my two short positions. Not too soon there after that happened, the stock market began to sell-off.

Once the intraday reversal took place, that was obviously where I wish I still had my short positions in hand, but I had to follow my stop-losses. Long-term it is always the better option for insuring profitability.

But still, that day royally sucked!

The market finished only 8 points lower that day, but from highs of that day to where it closed, represented a 26 point sell-off. That was a difference of 2% in swing trading profits for both of my trades SPXU and GS, had I not been stopped out on the initial run up.

And those kind of sell-offs are rare, they don’t happen that much. Looking back, that would have been a good cue for me to get short on the market for the next 4-5 days, so I do consider that an opportunity missed.

On the long side of things, the market was a very choppy one and lacked a lot of opportunity. But I hung around long enough to benefit from that end of month pop that took place over a four day period, from April 20th through the 25th. That was the difference maker.

Much of the success that comes with my swing trading profits, hinges on a few good trades during the course of a month. Nail those while managing the risk in others, and you’ll be okay.

The other area of my trading where I find myself grimacing a bit is with the oil trades I made.

I made three of them, and two of them were not profitable while the other one finished a smidge above breakeven. While the losses were not enormous in them, they, in my opinion, should have been less. Each of them had profits at some point, and in the case of Murphy (MUR) and Energen (EGN), I should have been more aggressive with the raising of the stop-loss to where I at least got out at breakeven. Apache (APA), wasn’t necessarily a wildly successful trade but the risk was managed correctly, and had I done that with the other two, in a similar manner, the swing trading profits would have been better for my trading on the overall month.

Finally, what did work?

Well, let me ask, what does Redhat (RHT), Teradyne (TER), Apple (AAPL), Alibaba (BABA), and Workday (WDAY) all have in common? They are technology stocks and they were the source of most of my profits.

Then you have UPRO – the 3x Bullish ETF of the S&P 500 – I have made a career of timing my entry into this ETF. Somewhat of a calling card I guess you could say, but I have done fairly well with it over the years as the key is timing and letting the charts develop for you and not forcing the trade. Its evil counterpart, SPXU I have also had plenty success with, but not to the same degree, and definitely not during the month of April, as my one attempt didn’t fair so well. With the latter, you have to basically give it a 1 to 2 day window. Go beyond that and the market is bouncing on you and you are likely going to be on the losing end of the trade. Eventually that will change, but you have to play it for what it is doing right now for you.

Keeping it real with my swing trading profits

It might sound like I am berating myself for what was otherwise a decent trading month in a market that was not so good. And I am.

I am also convinced that the best of traders tend to be the hardest on themselves, and by me evaluating myself publicly, like I am doing here, allows for me to honestly assess my performance, both good and bad and to allow you to learn from where I could have done better so that you can do even better for yourself in your own trading endeavors.

I’d also like to invite you to be part of Trading Block’s community of traders. It is there that I place all of my trades and make them available to you in real-time via the chat room, text message and email. There are also some fabulous auto-trading options available for you too, just in case you can’t take all the trades on your own.

This is the place you need to be for your trading; to grow, to become profitable and to experience what it mean to excel as a trader in all market conditions. So join me today and get your Free 7-Day Trial to the Trading Block.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.