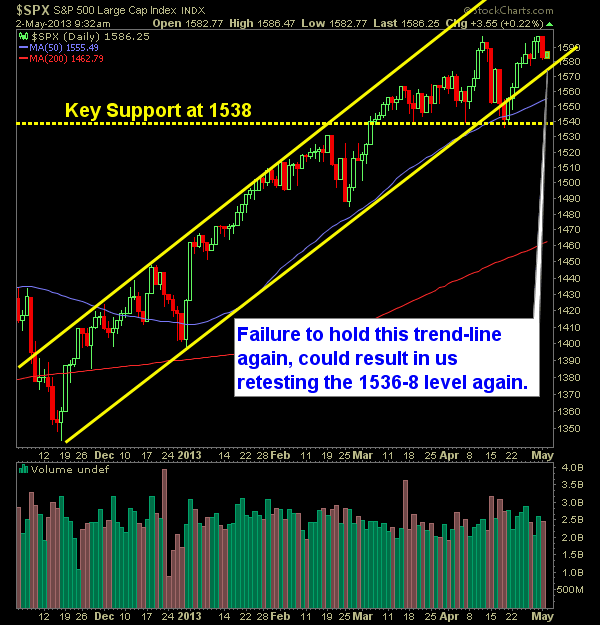

Pre-market update (updated 9am eastern): European markets are trading mixed/flat. Asian markets traded -0.5% lower. US futures are moderately higher. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), Jobless Claims (8:30am), Productivity and Costs (8:30am), EIA Natural Gas Report (10:30am) Technical Outlook (SPX): First significant sell-off since 4/17 in the markets.

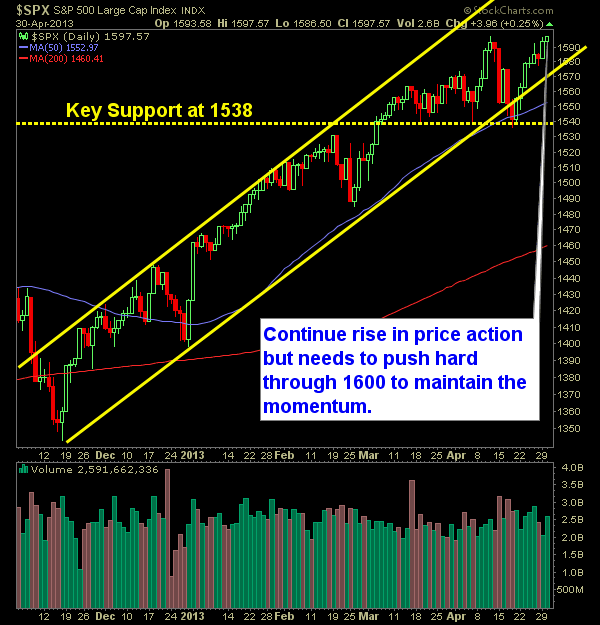

Pre-market update (updated 9am eastern): European markets are trading 0.4% higher. Asian markets traded -0.1% lower. US futures are slightly higher. Economic reports due out (all times are eastern): MBA Purchase Applications, ADP Employment Report, PMI Manufacturing Index (8:58), Treasury Refunding Announcement (9am), ISM Manufacturing Index (10am), Construction Spending (10am), EIA Petroleum Status Report (10:30am), FOMC

I got into CMG yesterday and despite it being a bit lower than where I got in at, I am still marveling at the chart pattern here. If it breaks out and starts trending higher, there is a good chance, it could be hitting $400 in short order. Chipotle Mexican Grill (CMG) once it starts trending,

Pre-market update (updated 9am eastern): Europe is trading 0.5% higher. Asian markets traded 1.4% higher. US futures are slightly higher. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), S&P Case-Shiller HPI (9am), Richmond Fed Manufacturing Index (10am), State Street Investor Confidence Index (10am) Technical Outlook

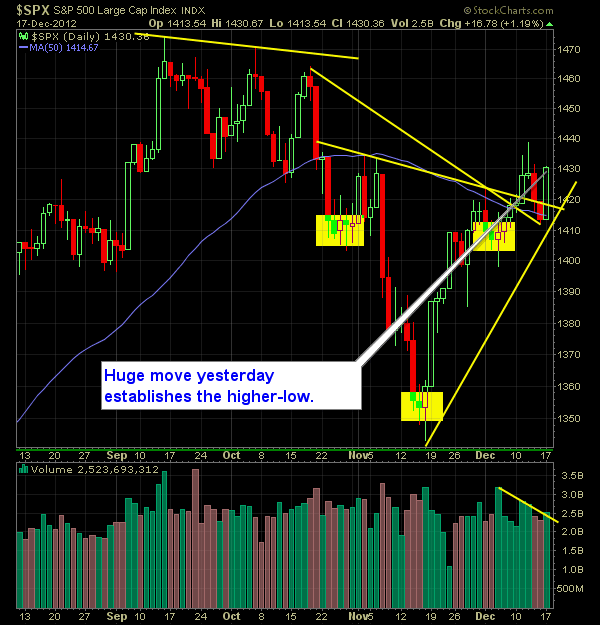

Pre-market update (updated 9am eastern): Europe is trading 0.4% higher. Asian markets traded mixed, but overall +0.5% higher. US futures are slightly higher. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Current Account (8:30am), Redbook (8:55am), Housing Market Index (10am) Technical Outlook (SPX): Huge day for the SPX yesterday, putting

Full on Burrito Breakout – notice how CMG is able to clear heavy burrito resistance. Quick Glance at the Market Heat Map and Industries Notables: Banks led the way. The only glaring area of witness was out of HPQ. Some random weakness in Services. Be sure to check out my latest swing trades and

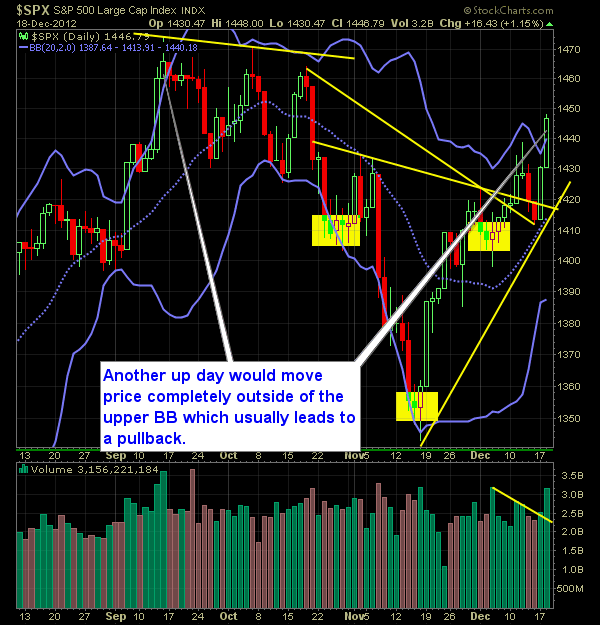

Technical Analysis and Chart Requests Video We got a nice rally on our hands at the expense of the Republicans caving in on some of the millionaire tax hikes as well as provide a debt-ceiling increase in cliff compromise. I’ll leave my own opinion out of this post, but essentially the market sees that as

Pre-market update (updated 9am eastern): Europe is trading 0.3% lower. Asian markets traded in a wide range from negative -0.4% up to +0.9%. US futures are slightly higher. Economic reports due out (all times are eastern): Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am) Technical Outlook (SPX): We’ve seen the market pullback for

Pre-market update (updated 8:00am eastern): Europe is trading 0.2% lower. Asian markets traded between break even up to +0.7% higher. US futures are flat. Economic reports due out (all times are eastern): Consumer Price Index (8:30am), PMI Manufacturing Index Flash (8:58am), Industrial Production (9:15am) Technical Outlook (SPX): We saw an orderly and continued pullback off

Technical Analysis and Chart Requests Video I think it is safe to say that the stalemate between sides on the fiscal cliff talks is finally starting to impact the market. More is likely to come if an agreement can’t be reached. I’ve put together a number of charts in the video below highlighting how or