Pre-market update (updated 9am eastern):

- European markets are trading mixed/flat.

- Asian markets traded -0.5% lower.

- US futures are moderately higher.

Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), Jobless Claims (8:30am), Productivity and Costs (8:30am), EIA Natural Gas Report (10:30am)

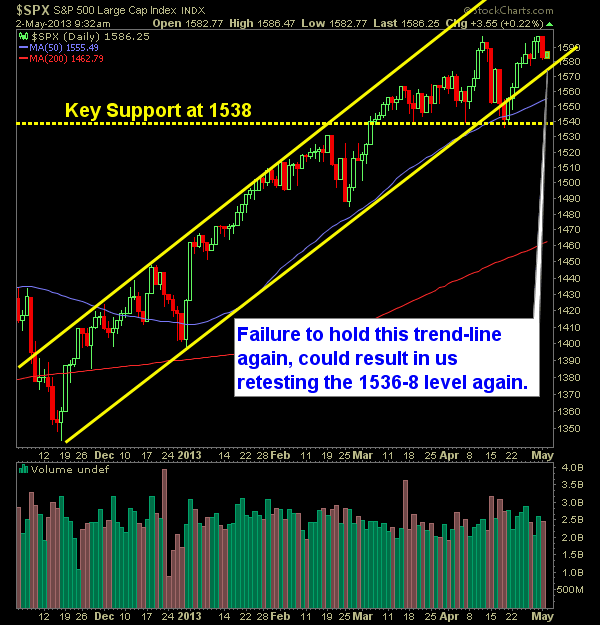

Technical Outlook (SPX):

- First significant sell-off since 4/17 in the markets. It was warranted and don’t believe it is a game-changer yet.

- The biggest worry for the bulls is if the bears can confirm the double top that is forming here by pushing below 1536.

- A lot of apprehension in the markets ahead of the Friday’s Employment number.

- Volume has been higher than what we have been seeing of late.

- The sooner the bulls can push above the 1600 level, the sooner some of this market apprehensions can clear up. A number of traders believe we might be in an early roll over phase.

- FOMC Statement yesterday was really just a non-event.

- SPX firmly in overbought territory.

- 1570 remains a key rising support level that was formed off of the channel that started back in November.

- VIX settled in at 14.5 – Some what of a bearish divergence since the VIX couldn’t come close to making new lows with the market making new highs.

- Markets don’t care about the economy. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

- Both channels (July October 2012) and the price channel we are currently in are very similar in nature.

- We haven’t seen a market pullback in excess of 4% since October/November time-frame.

My Opinions & Trades:

- No new trades yesterday.

- Will be looking to add 1-2 new long positions today.

- Remain Long TSM at $18.37, WDAY at $60.35, TXN at $36.02, CMG at $364.85, TSCO at $107.62

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.