Pre-market update: Asian markets traded 0.8% lower. European markets are trading 0.5% higher. US futures are trading 0.2% higher ahead of the market open. Economic reports due out (all times are eastern): None. Technical Outlook (SPX): Should be a low volume day on the market with banks and bond markets closed. Friday saw another major

Pre-market update: Asian markets traded 1.5% lower. European markets are trading 0.8% lower. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): Import and Export Prices (8:30), Treasury Budget (2) Technical Outlook (SPX): Another huge reversal yesterday, wiping out the bull gains from the FOMC

Pre-market update: Asian markets traded 0.2% lower. European markets are trading 0.3% lower. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): Jobless Claims (8:30), Wholesale Trade (10), EIA Natural Gas Report (10:30) Technical Outlook (SPX): That was an amazing bounce yesterday where SPX rallied

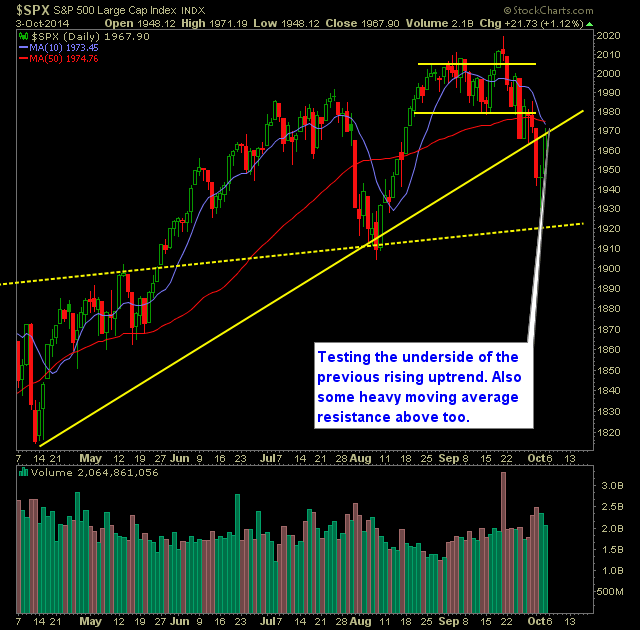

Pre-market update: Asian markets traded 1.0% lower. European markets are trading 0.4% lower. US futures are trading flat ahead of the market open. Economic reports due out (all times are eastern): MBA Purchase Applications (7), EIA Petroleum Status Report (10:30), FOMC Minutes (2) Technical Outlook (SPX): SPX confirmed the rejection at 1978 and finished lower

Pre-market update: Asian markets traded 0.2% lower. European markets are trading 0.8% lower. US futures are trading 0.4% lower ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), Consumer Credit (3) Technical Outlook (SPX): Weakness heading into the open followed by rejection at 1978 on SPX

Pre-market update: Asian markets traded 1.1% higher. European markets are trading 0.7% higher. US futures are trading 0.4% higher ahead of the market open. Economic reports due out (all times are eastern): Treasury STRIPS (3) Technical Outlook (SPX): Huge follow through on Friday to pile on gains from the large doji-candle formed on Thursday. Strong signs

Join me by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). If you’d like to see just how good my past performance has been, you can do so by clicking here. Here’s tomorrow’s swing-trading

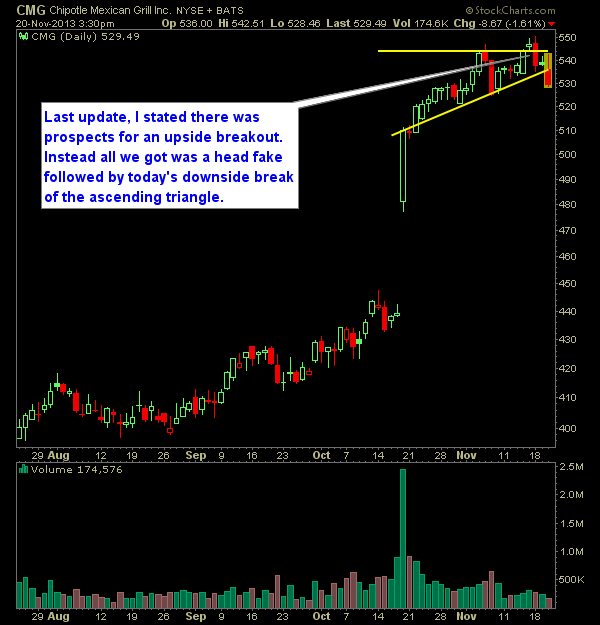

Last update, I stated there was prospects for an upside breakout. Instead all we got was a head fake followed by today’s downside break of the ascending triangle. From here, look for targets to the downside that includes $510 and if that cannot hold, a move to the lower $480’s is possible, though this will

Watch for another breakout in Chipotle (CMG) – this time in the form of an ascending triangle. The stock looks solid enough for an upward move into the $560’s to $570’s I like the stop-loss placement as well on this trade, as you can easily place it just below the short-term uptrend that helps form the

Pre-market update (updated 9am eastern): European markets are trading -0.5% lower. Asian markets traded traded in a wide range between -1.6% and as high as +0.9%. US futures are down moderately ahead of the opening bell. Economic reports due out (all times are eastern): Durable Goods Orders (8:30am) Technical Outlook (SPX): First 2-day pullback that we