My Swing Trading Strategy I tried to play the market bounce yesterday. I took about at 1% profit in HES, followed by a small profit in UPRO, however, by the end of the day, I had flipped to the bear side and added SPXU which sets up to have a nice day today. There

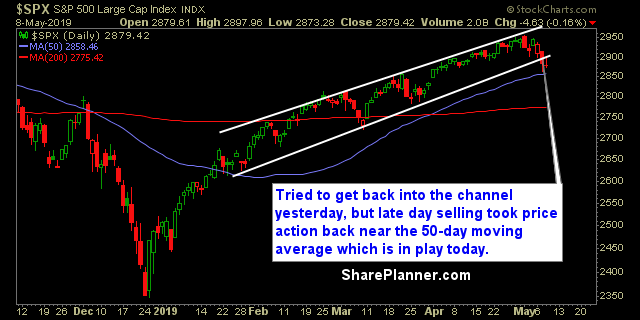

My Swing Trading Strategy I attempted to play the bounce in the Nasdaq yesterday, but as the day were on, it became obvious that no such bounce was going to happen. I got out of the trade for a whopping $0.01/share profit. I won’t brag too much about it. I also was knocked out

My Swing Trading Strategy I day-traded TQQQ on Friday, but sold it before the close for a 4.4% profit. I added one additional position on the bounce on Friday, but will be focused on managing the risk and honoring stop-losses this morning on existing positions, with the huge gap lower this morning. Indicators Volatility

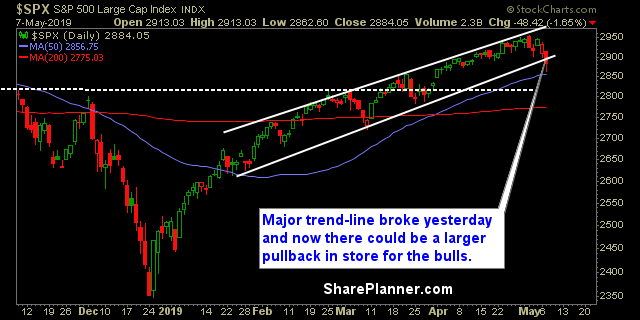

My Swing Trading Strategy Another gap down this morning, which obviously doesn’t bode well for a market that has yet to finish in the green this week, and on track to have its work week so far of 2019. I played TQQQ for a day-trade yesterday and a +2.3% profit. On the flip side I

My Swing Trading Strategy Today is about managing risk. At this stage, the bulls simply can muster enough strength to bounce this market, so it looks to be more than your simple pullback that you buy the dip on. Not looking to add anything on this dip today, unless there is a convincing bounce

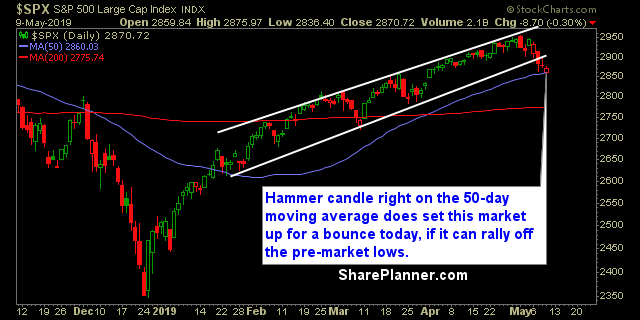

My Swing Trading Strategy I took profits in one position while getting stopped out of two others for losses. Not an ideal day of trading, but nonetheless, I did add one new position in the afternoon yesterday to play the end of day bounce. I may add another long position today, if the market can

My Swing Trading Strategy I added one new position yesterday on the market dip, early in the trading session. While the market is pointing towards another lower open, I’m hesitant to do so again, unless there is a very strong and convincing bounce. Indicators Volatility Index (VIX) – VIX popped 20% yesterday, but saw readings at

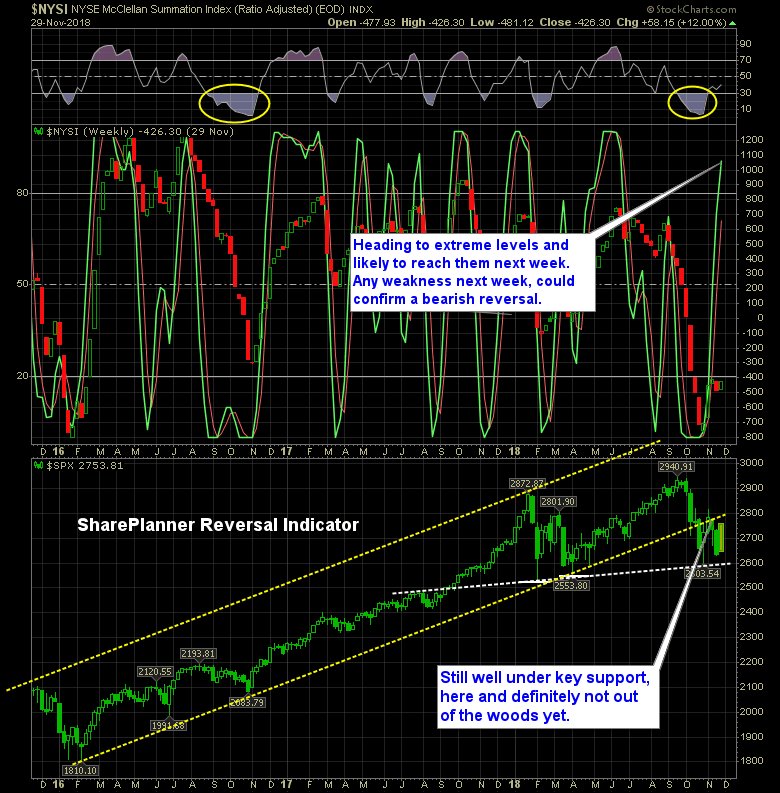

After two hard weeks of selling, the bulls are set to finish higher on the week, and thereby lifting the optimism of Wall Street heading into the weekend. I’m 100% cash now, and I plan to keep it that way heading into the weekend. For reasons unbeknownst to me, traders are optimistic and have fueled

The S&P 500 is stuck in a long drawn out triangle pattern but refuses to give up the 50-day moving average in the process. Should the market hold and eventually rally, you are going to need a good list of bullish stocks that you can fall back on and trade from. That is what I