My Swing Trading Strategy

Another gap down this morning, which obviously doesn’t bode well for a market that has yet to finish in the green this week, and on track to have its work week so far of 2019. I played TQQQ for a day-trade yesterday and a +2.3% profit. On the flip side I was stopped out of a couple other existing trades as well, that had been held overnight. However, on the whole, I’m holding up well to the market sell-off. I don’t want to get short at this juncture, because we are one positive headline away from shooting this market up 40-60 points overnight.

Indicators

- Volatility Index (VIX) – Despite the market finishing lower yesterday, the VIX gave up all of its intraday gains, that had gone over 23, and closed 1.6% lower at 19.10. That could be a short-term top for the indicator as we we have seen similar behaviors before, throughout 2019.

- T2108 (% of stocks trading above their 40-day moving average): Finished 2.6% lower, but again, managed to finish back above the March lows.

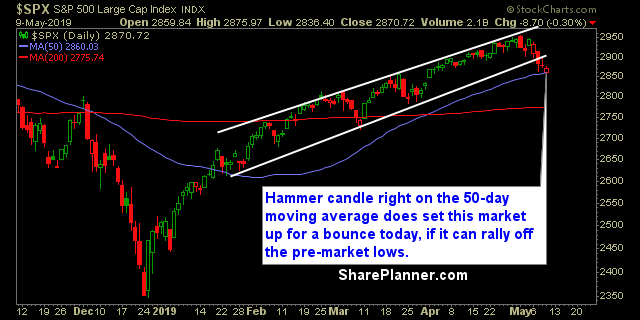

- Moving averages (SPX): This 50-day MA keeps getting tapped, but each time it has held it into the close, even yesterday where it dropped decisively below it, intraday.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

No major sector sell-offs yesterday, with the worst coming from Materials that was down 0.7%. Telcom saved itself from a topping pattern with yesterday’s bounce, while Utilities sits on the brink of a major rollover. Industrials still looks solid as it is holding the 50-day moving average and sets up for a higher low here. Same can be said about Financials, Discretionary and Technology.

My Market Sentiment

SPX has been down six of the last seven trading sessions, and every day this week. And guess what? It is down yet again this morning. I think there is a good chance we bounce into the weekend and I think there’s also a good chance that Tech leads the way higher today. All speculation, but remember this is a headline driven market, so the big question becomes whether the US and China can resolve their differences. I think we will likely see a solution in the near-term.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.