My Swing Trading Strategy

I tried to play the market bounce yesterday. I took about at 1% profit in HES, followed by a small profit in UPRO, however, by the end of the day, I had flipped to the bear side and added SPXU which sets up to have a nice day today. There are two long positions to deal with still, which I will tighten existing stops on.

Indicators

- Volatility Index (VIX) – Dropped 12% yesterday, but not enough to make people think that it was ready to make a dramatic move lower. Instead, it is likely to test 20 yet again today.

- T2108 (% of stocks trading above their 40-day moving average): Breadth was good yesterday, and a 15% move in this indicator, sent it back above 41%. However, still very bearish at this point.

- Moving averages (SPX): Rejected at the 5-day moving average, and looks more inclined to retest the 200-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Not surprising that Utilities took a break yesterday following two strong days of gains. All of your growth sectors, particularly Technology, Discretionary, Financials and Industrials had inside days, so even though there was a bounce, the bounce itself was minimal.

My Market Sentiment

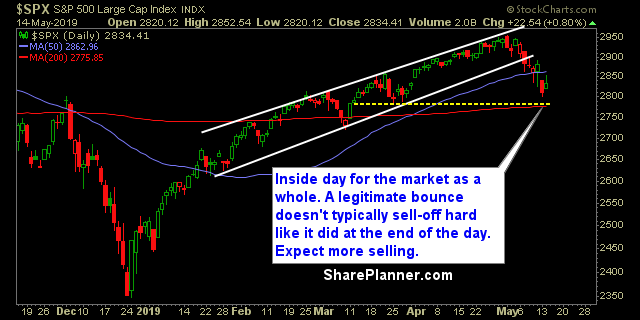

Yesterday’s rally did little to change the current market sentiment surrounding this market. The end of day selling, made the rally overall feel and look like a textbook dead cat bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long, 10% Short