My Swing Trading Strategy

I attempted to play the bounce in the Nasdaq yesterday, but as the day were on, it became obvious that no such bounce was going to happen. I got out of the trade for a whopping $0.01/share profit. I won’t brag too much about it. I also was knocked out of two other trades as well. I am skeptical of the pre-market bounce, because the bears will often use that as an opportunity to short the market even more.

Indicators

- Volatility Index (VIX) – A 28% move yesterday and a bullish kicker, gave the VIX its first close above 20 since 1/22/19. More upside does seem possible for the indicator in the days ahead.

- T2108 (% of stocks trading above their 40-day moving average): A 28% decline took the indicator down to 36%. Still not oversold though. Even general stochastics on SPX daily isn’t oversold yet.

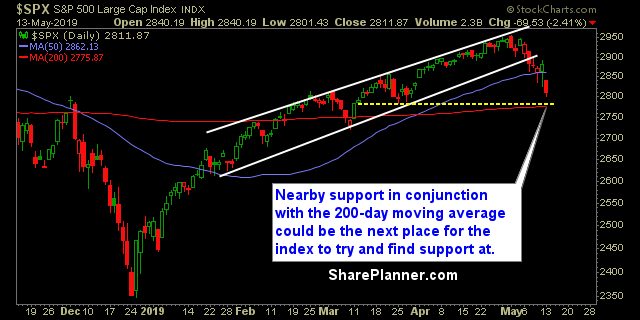

- Moving averages (SPX): The 50-day MA was broken and never even retested yesterday. Now a test of the 200-day MA seems all but likely here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities finished in the green for a second straight day, and setting up for a test of all-time highs. The bull flag in Staples took a hit, but still hanging on. Energy has been oversold for almost a month and of all the sectors this is one that seems primed for a bounce of any kind. Discretionary setting up for a test of its 200-day moving average and Technology is in a bit of a free fall right now.

My Market Sentiment

I tend to be skeptical of gap ups in a bearish market, as I expect them to usually be sold off. Typically there is one final push lower that can’t be sustained that usually results in the eventual rally higher and it comes in extreme oversold conditions which we are not currently in right now. Even the Q4 sell-off and bottom was formed intraday with similar price action where it attempted to push lower before eventually getting bought back up.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.