The US Treasury are engaged in their own form of QE now, in the form of a 4B buyback this morning.

Equites certainly don't care, but TLT breaking major support here.

Will Jerome bailout the bond market this weekend?

Volatility in bonds are through the roof right now.

Rising yields in the bond market are becoming a major problem For the financial and if they continue to rally higher, it will ultimately crash the stock market. In this video, I cover the impact of the rising yields and what it means for stocks and the stock market going forward.

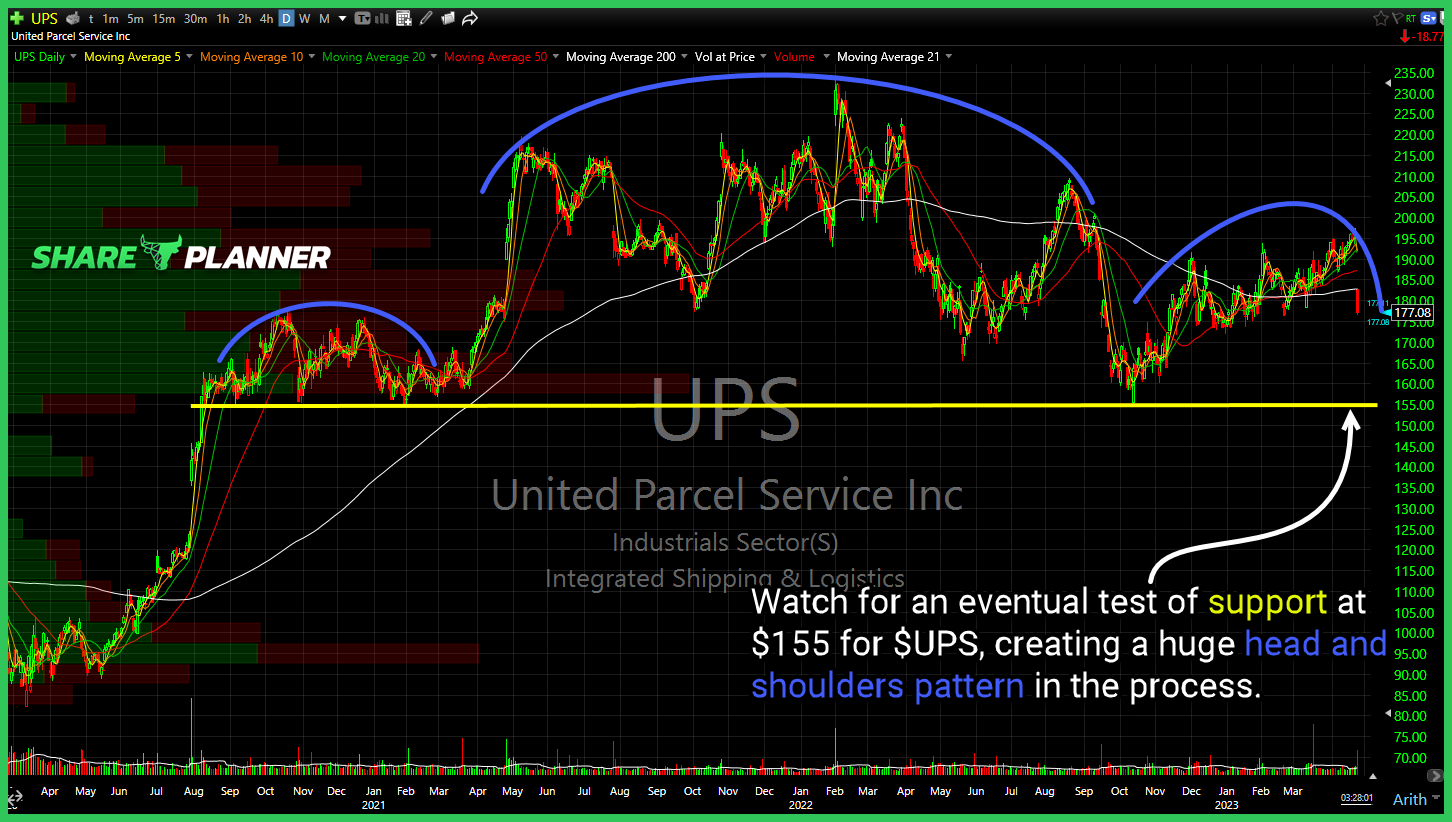

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.

Resistance on Spotify Technology (SPOT) continues to prevent price from breaking out and getting the necessary follow through. US 10 year yield (TNX) continues to bounce hard off of key support. Technology Sector (XLK) at the top end of its trading range with a potential fading opportunity. Clear Secure (YOU) attempting to bounce off

3 straight days 10 year yield is holding breakout support. Looking for a move higher from here going forward. $TNX

Salesforce (CRM) sneaking into the gap for the attempted fill. Heavy resistance starting to mount for Apple (AAPL). CBOE 10 year Treasury Yield Index (TNX) attempting to hold support at its breakout level. Advanced Micro Devices (AMD) breaking out above short-term declining resistance. Snap (SNAP) heading towards a major layer of resistance around $12.50. Loving

$CLF inverse head and shoulders pattern testing the neckline for a potential breakout here.