So far, as previously mentioned I added shares of Alexza Pharmaceuticals (ALXA) and Molycorp (MCP). And by the way, MCP does not look good on the day, and as a result, I’m staring at a nice head fake that’ll likely lead me to dump the position before the end of the day. As for ALXA,

I have to say, that the latest rendition of the SPRI has me thinking strongly of adding a few hedge/short positions to counter-balance my portfolio some. I’m sitting on some nice gains on all my positions and the ones like Amazon.com (AMZN) that is way outside its Bollinger Bands are also opportunities that I’m

Pre-market update (updated 8:30am eastern): European markets are trading flat. Asian markets finished flat/mixed. US futures are trading slightly lower ahead of the bell. Economic reports due out (all times are eastern): Consumer Credit (3pm) Technical Outlook (SPX): SPX continues to throttle higher, making new recovery highs, and the highest in four-years. Test at 1440

Pre-market update (updated 8:30am eastern): European markets are trading 0.8% higher. Asian markets finished 2.5% higher. US futures are trading slightly higher ahead of the bell. Economic reports due out (all times are eastern): Employment Situation (8:30am), Treasury STRIPS (3pm) Technical Outlook (SPX): Huge day for the market yesterday – breaking out to 4 year highs

Pre-market update (updated 8:30am eastern): European markets are trading 1.4% higher. Asian markets finished 0.1% higher. US futures are trading moderately higher ahead of the bell. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), ADP Employment Report (8:15am), Jobless Claims (8:30am), ISM Non-Manufacturing Index (10am), Quarterly Services Survey (10am), EIA Natural Gas

Pre-market update (updated 8:30am eastern): European markets are trading 0.5% lower. Asian markets finished -0.3% lower. US futures are trading mixed ahead of the bell. Economic reports due out (all times are eastern): PMI Manufacturing Index (9am), ISM Manufacturing Index (10am), Construction Spending (10am) Technical Outlook (SPX): Semi-decent recovery off of Thursday’s sell-off. There is a

Pre-market update (updated 8:30am eastern): European markets are trading 0.5% lower. Asian markets finished -1.0% lower. US futures are moderately lower ahead of the bell. Economic reports due out (all times are eastern): Jobless Claims (8:30am), Personal Income and Outlays (8:30am), EIA Natural Gas Report (10:30am), Kansas City Fed Manufacturing (11am) Technical Outlook (SPX): Once

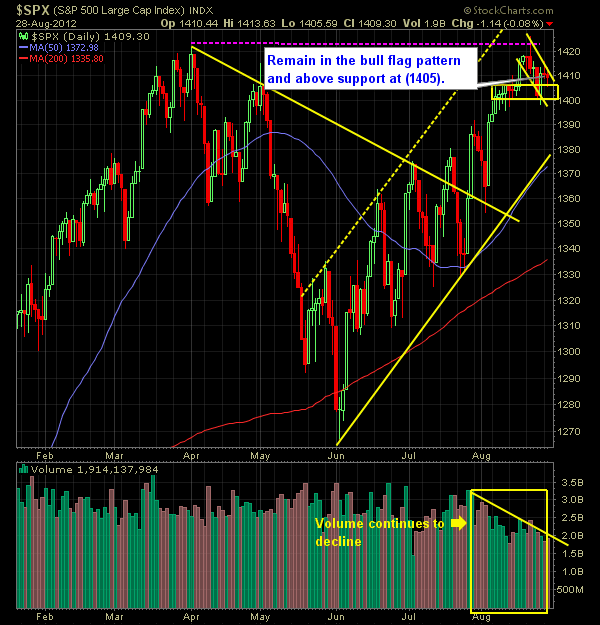

Pre-market update (updated 8:30am eastern): European markets are trading mixed/flat. Asian markets finished 0.3% higher. US futures are slightly higher ahead of the bell. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), GDP (8:30am), Corporate Profits (8:30am), Pending Home Sales Index (10am), EIA Petroleum Status Report (10:30am), Beige Book (2pm) Technical

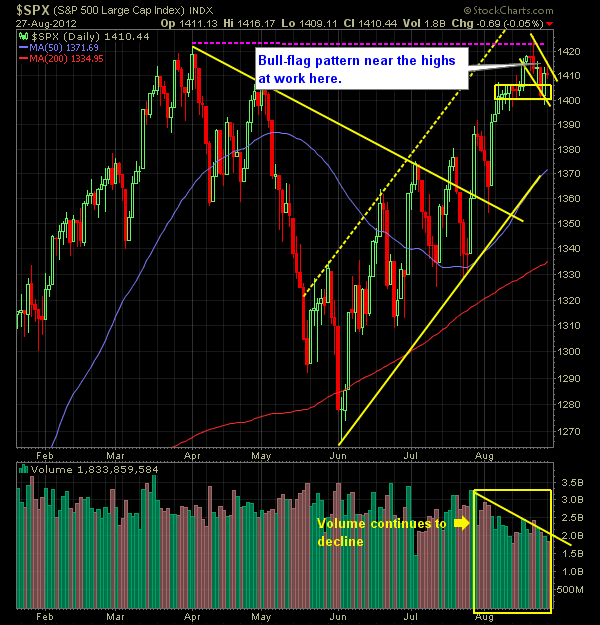

Pre-market update (updated 8:30am eastern): European markets are trading -0.4% lower. Asian markets were mixed in their trading. US futures are flat ahead of the bell. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales, Redbook (8:55am), S&P Case-Shiller HPI, Consumer Confidence (10am), Richmond Fed Manufacturing Index (10am), State Street Investor Confidence Index (10am)

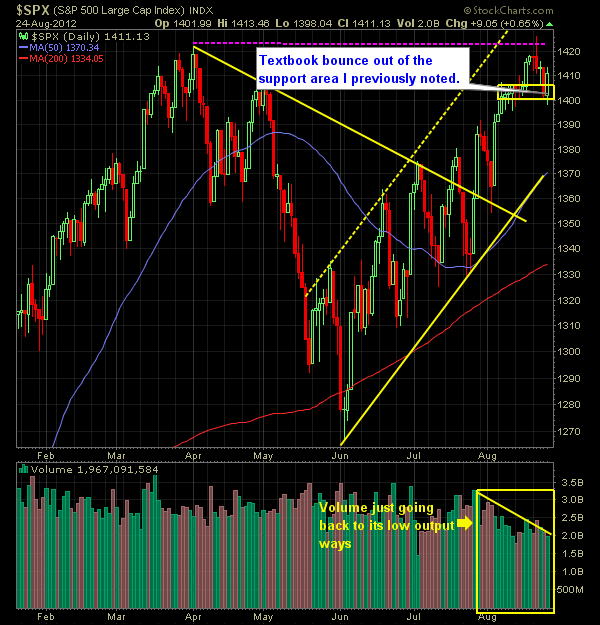

Pre-market update (updated 8:30am eastern): European markets are trading 0.6% higher. Asian markets were mixed in their trading. US futures are slightly higher ahead of the bell. Economic reports due out (all times are eastern): Dallas Fed Manufacturing Survey (10:30am) Technical Outlook (SPX): Hard bounce for the market on Friday, and in particular the SPY