Pre-market update (updated 8:30am eastern):

- Europe is trading 0.7% higher.

- Asian markets traded in a wide range from -1.3% up to +0.8%.

- US futures are flat ahead of the open.

Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), ADP Employment Report (8:15am), Jobless Claims (8:30am), Productivity and Costs (8:30am), PMI Manufacturing INdex (8:58am), ISM Manufacturing Index (10am), Consumer Confidence (10am), Construction Spending (10am), EIA Petroleum Status Report (10:30am), EIA Natural Gas Report (10:30am)

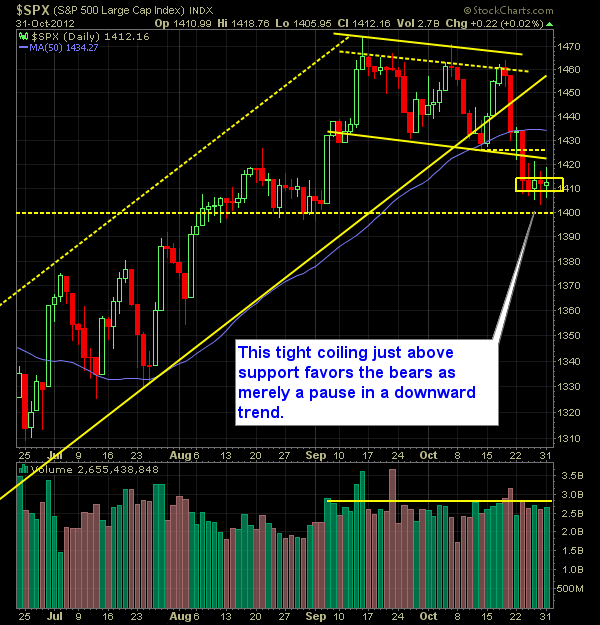

Technical Outlook (SPX):

- Another flat day in the market, but saw us once again test the rising trend-line off of the October 2011 lows. Today that support lies at 1409.

- There is overhead resistance between 1425 and 1432, that the bulls will need to break through, before I can have any optimism towards this market.

- We are just barely coming out of short-term oversold conditions. Longer-term we are definitively oversold.

- We have consolidated very tight for four straight days. A sharp move is likely in the coming days. The tight coiling suggests it is to the downside.

- 1400 has been well defended of late, particularly in the S&P futures overnight. We’ll see whether the bears can push price below that level or not.

- Employment number comes out tomorrow, and will carry much weight towards the U.S. presidential election. We could see a sharp reaction on a significant beat/miss.

- Triple-top confirmed on the SPX over the past two months.

- Weekly chart also supports a breakdown in the previous channel, and end to its longer-term uptrend off of the June lows.

- VIX spiked above 18 yesterday.

- Fed’s QE3 launch is going to add a lot of buying power to this market and drive more people out of interest-bearing assets and into equities in search of some kind of return.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

My Opinions & Trades:

- Sold AMZN at 236.09 from $231.34 for a 2.1% gain.

- Remain long AGU at $106.23.

- Shorted MCP at $10.34

- Shorted ESRX at 61.51

- Track my portfolio RealTime here.

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.